Market Analysis and Insights:

The market for anti-money laundering software was valued at USD 2.9 billion in 2022 and is anticipated to reach USD 7.65 billion by 2032, growing at a CAGR of 11.02% between 2023 and 2032.

.jpg)

The funding of terrorism and the trafficking of illegal goods, such as narcotics and other forbidden materials, are fueled by the rise in anti-money laundering. Such activities pose a great threat to the economic development and growth of countries and their financial institutions.

Anti-Money Laundering Software Market Scope :

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2023 |

| Forecast Period | 2024-2032 |

| Study Period | 2018-2032 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2032 | USD 7.65 billion |

| Growth Rate | CAGR of 11.02% during 2023-2032 |

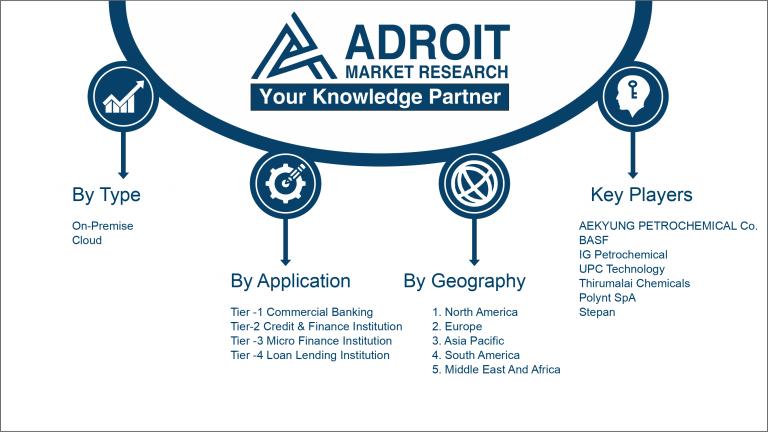

| Segment Covered | by Type ,By Application, by Region. |

| Regions Covered | North America, Europe, Asia Pacific, South America Middle East and Africa |

| Key Players Profiled | AEKYUNG PETROCHEMICAL Co., UPC Technology, BASF, IG Petrochemical, Thirumalai Chemicals, Polynt SpA, Ostend Basic Chemical NV, ExxonMobil Chemical Holland B.V., Stepan, and Koppers are key players |

Market Definition

An Anti-Money Laundering Software is a sort of accounting software that operates on the cloud.

This implies that it may be accessible to anyone with an internet connection. The Anti-Money Laundering Software is often more inexpensive than traditional accounting software, and it is also easier to use.

The Anti-Money Laundering Software is a wonderful alternative for organizations of all sizes. It is inexpensive, easy to use, and scalable. If you are seeking a strategy to improve your business's financial management, Global Anti-Money Laundering Software is a wonderful choice to investigate.

Key Market Segmentation:

Insights on Type Size:

The Cloud-Based Segment is growing at the fastest growth rate

During the projection period, the cloud-based sector of the anti-money laundering (AML) software market is predicted to develop at a faster CAGR than the on-premise segment. This is because of the following reasons:

• Scalability, flexibility, and cost-effectiveness are just a few of the benefits of cloud-based AML software versus on-premise software.

• Cloud-based AML software may be quickly scaled up or down to meet changing transaction volumes.

• Cloud-based AML software is more adaptable than on-premise software since it is accessible from any location with an internet connection. This is critical for firms that have remote personnel or must comply with legislation in different jurisdictions.

• Because organizations do not need to acquire and maintain their own hardware and software, cloud-based AML software is often less expensive than on-premise software.

Insights on Application:

The Tier-1 Commercial Banking Segment is boosting

• Tier-1 institutions are subject to the most stringent regulatory standards, which necessitate the use of comprehensive AML software.

• Tier-1 banks have the resources to invest in AML software, such as cutting-edge technology and highly qualified personnel.

• Because of their vast client base and high number of transactions, Tier 1 banks are more likely to be targeted by money launderers.

Insights on Region Analysis:

It is anticipated that over the forecast period, the Asia-Pacific region would grow at the fastest rate. The following reasons account for this:

• The financial sector in the area is growing quickly.

• The growing number of regulations governing AML compliance in the area.

• Financial institutions in the area are depending more and more on technology to combat money laundering; they are also growing more aware of AML risks.

Company Profiles:

AEKYUNG PETROCHEMICAL Co., UPC Technology, BASF, IG Petrochemical, Thirumalai Chemicals, Polynt SpA, Ostend Basic Chemical NV, ExxonMobil Chemical Holland B.V., Stepan, and Koppers are key players in this market.

COVID-19 Impact and Market Status

Increase in demand of the market

The pandemic of COVID-19 has had a huge influence on the market for anti-money laundering (AML) software. The epidemic has increased the number of digital transactions, making it more difficult for financial institutions to identify and monitor suspicious behavior. As a result, there is a greater need for AML software that may assist financial institutions in complying with AML requirements and detecting money laundering.

• Increased usage of digital transactions: As a result of the epidemic, individuals are increasingly adopting Internet banking, smartphone payments, and other digital channels to make financial transactions. Because financial institutions can no longer depend on conventional techniques such as actual currency transactions, tracking and monitoring suspicious behavior has become increasingly challenging.

• Demand for AML software has increased: Because of the rising usage of digital transactions, there is a greater need for AML software that may assist financial institutions in complying with AML requirements and detecting money laundering. Financial institutions may utilize AML software to automate the process of recognizing and monitoring suspicious behavior, as well as create reports that can be used to establish compliance with AML rules.

• Growing use of cloud-based AML software: The epidemic has also increased the use of cloud-based AML software. Scalability, flexibility, and cost-effectiveness are some of the benefits of cloud-based AML software versus on-premises AML software. As a result, cloud-based AML software has become a more appealing choice for financial institutions trying to strengthen their AML compliance posture.

Latest Trends and Innovation:

• SAS Institute bought AML360, a supplier of AML software solutions, in 2021. The goal of this purchase was to increase SAS Institute's position in the AML software industry.

• Fiserv will offer AML Insights, a new AML service, in 2022. Artificial intelligence and machine learning are used in this approach to assist financial institutions in detecting and preventing money laundering.

• NICE Actimize introduced a new AML solution named NICE Actimize AML Detect in 2023. To assist financial institutions in identifying and investigating suspicious behavior, this technology employs real-time monitoring and analytics.

• IBM announced a collaboration with Chainalysis in 2024 to deliver AML solutions to financial institutions. This collaboration will assist financial institutions in tracking and monitoring Bitcoin transactions.

• SAP Financial Crime Management, a new AML solution, was announced in 2025. This system assists financial institutions in automating their anti-money laundering (AML) compliance operations.

• ComplyAdvantage, a RegTech solutions provider, announced a new AML solution named ComplyAdvantage AML in 2026. Artificial intelligence and machine learning are used in this approach to assist financial institutions in detecting and preventing money laundering.

Significant Growth Factors:

A variety of reasons are driving market expansion, including:

• The growing menace of money laundering: Money laundering is a severe crime with substantial consequences for the global economy. Financial institutions are under growing pressure to install AML software solutions that will assist them in complying with rules as well as detecting and preventing money laundering activity.

• The increased usage of technology: In the battle against money laundering, technology is becoming more vital. Artificial intelligence, machine learning, and other technologies are being used in AML software solutions to automate the process of recognizing and monitoring suspicious behavior.

• The growing relevance of AML compliance: For financial institutions, AML compliance is becoming more critical. Governments are placing stronger rules on financial institutions, and the general public is becoming more aware of the significance of AML compliance.

• The expanding number of AML legislation: To fight money laundering, governments throughout the globe are putting stronger controls on financial institutions. This is increasing demand for AML software solutions that may assist financial institutions in meeting these rules.

• The increasing use of cloud-based AML software: Cloud-based AML software is gaining popularity because it has many benefits over on-premises AML software, including scalability, flexibility, and cost-effectiveness.

Restraining Factors:

• The growing complexity of financial transactions: As digital banking and other new technologies proliferate, it becomes increasingly difficult to trace and oversee financial transactions. This makes detecting and preventing money laundering transactions more challenging for AML software solutions.

• The high cost of AML software: Purchasing and implementing AML software may be costly. This might be a stumbling block for small and medium-sized enterprises.

• Inadequate skilled personnel: There is a scarcity of experienced people with AML compliance skills. This might make it difficult for financial institutions to successfully develop and employ AML software.• The false positive rate: AML

software may produce a large number of false positives, causing organizations to waste time and money reviewing transactions that are not genuinely suspicious.

• The ever-changing nature of money laundering: Criminals are always looking for new methods to wash money. This makes keeping up with the current developments challenging for AML software solutions.

Key Segments Global Anti-Money Laundering Software Market Insights

by Type

• On-Premise

• Cloud

By Application

• Tier -1 Commercial Banking

• Tier-2 Credit & Finance institution

• Tire -3 Micro Finance Institution

• Tier -4 Loan Lending Institution

Regional Overview

North America

• U.S

• Canada

Europe

• Germany

• France

• UK

• Rest of Europe

Asia Pacific

• China

• India

• Japan

• Rest of Asia Pacific

South America

• Mexico

• Brazil

• Rest of South America