Market Analysis and Insights:

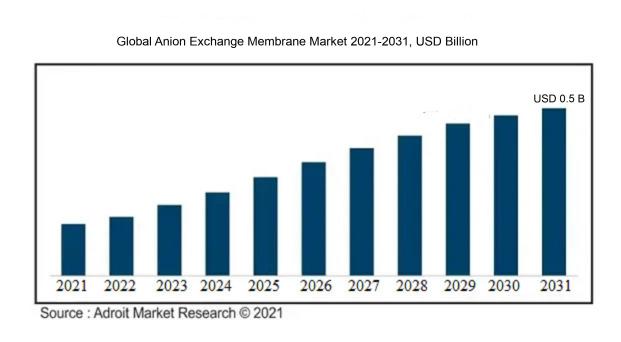

The market for Anion Exchange Membrane was estimated to be worth USD 0.3 billion in 2024, and from 2024 to 2031, it is anticipated to grow at a CAGR of 10% with an expected value of USD 0.5 billion in 2031.

The market for Anion Exchange Membranes (AEM) is largely fueled by the escalating need for eco-friendly energy alternatives, especially in areas such as fuel cell applications and hydrogen generation through electrolysis. This transition toward sustainable energy, along with governmental support for green initiatives, significantly drives market expansion. Furthermore, innovations in membrane technology, focused on improving performance and lowering expenses, facilitate broader implementation in diverse sectors, including water treatment and chemical manufacturing. The increasing focus on enhancing energy storage solutions to maximize the use of renewable resources also boosts the demand for AEMs. Additionally, a ened awareness of sustainable options and the urgent need to minimize carbon footprints are prompting industries to research and invest in Anion Exchange Membranes. Altogether, these elements create a positive forecast for the AEM market, as major players pursue advancements in technology and sustainability.

Anion Exchange Membrane Market Scope :

| Metrics | Details |

| Base Year | 2024 |

| Historic Data | 2020-2023 |

| Forecast Period | 2024-2031 |

| Study Period | 2023-2031 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2031 | USD 0.5 billion |

| Growth Rate | CAGR of 10% during 2024-2031 |

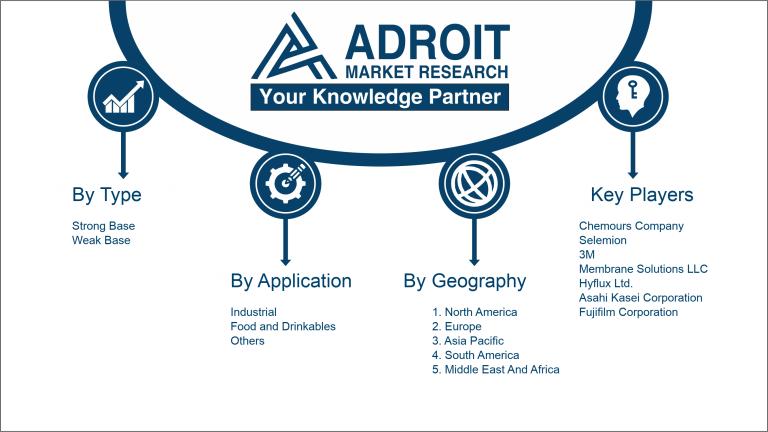

| Segment Covered | By Type, By Application, Regions |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Chemours Company, Selemion, and 3M, alongside Membrane Solutions LLC, Hyflux Ltd., Asahi Kasei Corporation, Fujifilm Corporation, and Parker Hannifin Corporation. Other notable contributors are Fumatech BWT GmbH and Ningbo Dingsheng Chemical Technology Co., Ltd. Furthermore, Giner Inc., A. Schulman, Inc. (now a division of LyondellBasell), DuPont de Nemours, Inc., Toyobo Co., Ltd., and GRAETZ GmbH |

Market Definition

An anion exchange membrane is a distinct type of membrane designed to permit the flow of anions while preventing the movement of cations. This membrane is frequently utilized in various electrochemical applications, including fuel cell technology and water purification, to promote the transport of negatively charged ions.

Anion exchange membranes (AEMs) are essential components in a range of electrochemical technologies, such as fuel cells, electrolyzers, and water purification systems. They enable the targeted movement of anions, which boosts ion conductivity and the efficiency of the entire system. By allowing alkaline fuel cells to function effectively, AEMs can lower expenses compared to traditional proton exchange membranes, thereby enhancing energy conversion and storage. Their resilience in challenging chemical conditions broadens their use, facilitating progress in green energy initiatives and eco-friendly water treatment solutions. This positions AEMs as critical elements in the pursuit of environmental sustainability and energy efficiency.

Key Market Segmentation:

Insights On Key Type

Strong Base

The Strong Base is predicted to dominate the Global Anion Exchange Membrane Market due to its high ion-exchange capacity and superior performance in various applications. This is extensively employed in industries like water purification, fuel cells, and electrochemical processes where robust performance is essential. Strong bases provide greater ionic conductivity and stability, making them a preferred choice for many manufacturers. Furthermore, increasing demands for effective separation technologies and advancements in membrane technology are bolstering the market growth of Strong Bases. As industries focus on efficiency and sustainability, the preference for Strong Base anion exchange membranes is set to rise sharply, reinforcing its dominant position in the market.

Weak Base

The Weak Base, while not currently the leading choice, remains significant within the anion exchange membrane market. This category is particularly attractive for specific applications such as wastewater treatment and selective ion removal processes. Weak bases function effectively in low-concentration environments and are less sensitive to pH variations, allowing for broader application flexibility. Additionally, their lower operating costs have drawn interest from sectors that prioritize budget efficiency in their operations. As environmental regulations become more stringent, there may be an increased interest in Weak Bases for their performance in particular niche applications.

Insights On Key Application

Food and Drinkables

The Food and Drinkables category is expected to dominate the Global Anion Exchange Membrane Market primarily due to the increasing demand for purified water and high-quality food processing. This sector utilizes anion exchange membranes for various applications, including water treatment and beverage production, which are critical for maintaining safety and quality standards. The growing health consciousness among consumers is also pushing manufacturers to invest more in advanced filtration systems that ensure the removal of unwanted ions, contributing significantly to the overall demand. Additionally, tighter regulations surrounding food safety and water quality are likely to fuel growth in this area.

Industrial

The Industrial application is poised for substantial growth, driven by the need for efficient waste management and recycling processes. Industries are increasingly adopting anion exchange membranes for the treatment of process streams and wastewater, helping to recover valuable materials and reduce environmental impact. This shift is supported by the stringent regulations on waste discharge and resource conservation. As industries continue to face pressure to enhance sustainability, the demand for effective separation technologies, including anion exchange, is likely to rise.

Others

The Others category encompasses various niche applications such as water purification, battery technology, and specific industrial processes. While it represents a smaller market share compared to Food and Drinkables and Industrial, there is potential for growth driven by technological advancements and increased adoption in innovative applications. The rise in energy-efficient technologies and eco-friendly practices can further stimulate interest in this, as stakeholders look for solutions that minimize environmental footprint while maintaining operational efficiency. However, it remains a secondary focus relative to the other two main sectors.

Insights on Regional Analysis:

Asia Pacific

The Asia Pacific region is anticipated to dominate the Global Anion Exchange Membrane market due to a combination of factors including rapid industrialization, growing demand for water purification systems, and advancements in fuel cell technology. Countries like China, Japan, and India are increasingly investing in research and development, which is visible in the rising use of anion exchange membranes in various applications, especially in energy conversion and storage. The region's robust manufacturing capabilities and significant government initiatives towards renewable energy sources further bolster its position. Furthermore, the increasing awareness about environmental sustainability is driving the demand for efficient waste treatment solutions, making Asia Pacific the frontrunner in this market.

North America

In North America, the anion exchange membrane market is characterized by its well-established technological infrastructure and strong investment in clean energy solutions. The presence of numerous key players and manufacturers, alongside supportive government policies favoring renewable energy adoption, propels market growth. Additionally, the increasing focus on energy efficiency and sustainable practices among industries enhances the uptake of anion exchange membranes in various sectors.

Latin America

Latin America presents a growing market for anion exchange membranes, although it currently lags behind in terms of market size compared to other regions. The increasing industrial activities and governmental initiatives aimed at improving water treatment facilities create opportunities for growth. However, challenges such as economic instability and limited technological advancements might restrain rapid expansion in this.

Europe

Europe showcases a significant demand for anion exchange membranes, primarily driven by stringent environmental regulations and a strong push for green technologies. The region's ongoing pursuit of renewable energy sources and efficient waste management systems highlights its focus on sustainability. Although Europe is proactive in adopting advanced technologies, the region faces stiff competition from the rapidly evolving Asia Pacific market.

Middle East & Africa

In the Middle East & Africa, the market for anion exchange membranes is relatively smaller but gradually expanding due to increasing awareness about water scarcity issues and the necessity of advanced water purification techniques. Although investments in infrastructure are improving, the market growth is hindered by economic challenges and varying levels of technological adoption across different countries in the region.

Company Profiles:

Major participants in the global anion exchange membrane sector are involved in the creation and distribution of cutting-edge membranes used in diverse applications such as fuel cells and water purification. These companies prioritize innovation, enhance quality, and pursue strategic alliances to meet rising demand and strengthen their competitive standing in the market.

Prominent entities in the Anion Exchange Membrane Market include Chemours Company, Selemion, and 3M, alongside Membrane Solutions LLC, Hyflux Ltd., Asahi Kasei Corporation, Fujifilm Corporation, and Parker Hannifin Corporation. Other notable contributors are Fumatech BWT GmbH and Ningbo Dingsheng Chemical Technology Co., Ltd. Furthermore, Giner Inc., A. Schulman, Inc. (now a division of LyondellBasell), DuPont de Nemours, Inc., Toyobo Co., Ltd., and GRAETZ GmbH significantly impact the market landscape. These companies are integral to advancing and delivering anion exchange membranes utilized across diverse fields, including fuel cells, water purification, and various electrochemical applications.

COVID-19 Impact and Market Status:

The Covid-19 pandemic caused significant disruptions in global supply chains and led to a decline in demand, which adversely affected the Anion Exchange Membrane market by obstructing production and postponing projects in multiple sectors.

The COVID-19 pandemic profoundly influenced the anion exchange membrane market by disrupting supply chains, which resulted in production and distribution delays. Temporary halts in manufacturing and shortages of labor significantly reduced the availability of crucial materials needed for membrane fabrication. Additionally, the economic instability led to a decline in investments, especially in sectors that depend on advanced membranes for energy and water treatment technologies. On the other hand, the pandemic increased awareness of the importance of efficient water purification and health solutions, subsequently boosting the demand for anion exchange membranes in the pharmaceutical and environmental industries. In response to the evolving landscape, sectors began adapting to new operational standards, allowing for a gradual recovery in the latter phases of the pandemic, alongside a rise in innovations related to membrane technology. In summary, while the pandemic presented considerable challenges, it also prompted growth opportunities in the anion exchange membrane market, particularly in areas focusing on sustainability and health applications.

Latest Trends and Innovation:

- In June 2022, Membrane Technology and Research, Inc. announced the acquisition of a significant portion of the assets of MSCA, a leading company in membrane technology for energy applications, enhancing MTR’s capabilities in anion exchange membrane technologies for various applications.

- In August 2022, BASF and Ballard Power Systems entered into a partnership to develop next-generation fuel cells using advanced anion exchange membranes, focusing on improving fuel efficiency and reducing costs, with expected deployment by mid-2023.

- In March 2023, Chemours launched a new line of advanced anion exchange membranes designed for high-performance applications in electrochemical processes, showcasing improved conductivity and stability compared to previous models.

- In April 2023, FuelCell Energy reported successful pilots using its proprietary anion exchange membrane technology, resulting in increased efficiency in its carbonate fuel cell systems, positioning the company as a leader in clean energy solutions.

- In July 2023, Solvay announced a collaboration with the University of Maryland to innovate anion exchange membranes for green hydrogen production, with a focus on sustainable materials and manufacturing practices, aiming for commercialization in 2025.

- In September 2023, Toray Industries revealed their development of a novel anion exchange membrane that shows promising results in seawater desalination processes, significantly improving the productivity and energy efficiency of the technology.

Significant Growth Factors:

The Anion Exchange Membrane Market is set to expand as a result of the rising need for water treatment technologies, innovations in fuel cell applications, and favorable governmental policies promoting sustainable energy initiatives.

The Anion Exchange Membrane (AEM) sector is witnessing substantial expansion due to several pivotal influences. Firstly, the surging demand for sustainable energy alternatives—especially in the realms of fuel cells and electrolyzers—is catalyzing advancements in AEM technology, which boasts enhanced efficiency and reduced costs relative to conventional proton exchange membranes. Furthermore, regulatory initiatives aimed at curbing greenhouse gas emissions are encouraging investments in AEM applications within hydrogen generation and energy storage. The escalating popularity of electric vehicles (EVs) is also driving the need for anion exchange membranes, as manufacturers strive to improve battery performance and durability. In addition, progress in materials science is fostering the creation of more resilient and efficient membranes, thereby expanding their use in water purification and industrial applications. A ened awareness of sustainable practices and the principles of the circular economy is further promoting the adoption of AEMs, as various sectors seek greener technological solutions. Finally, partnerships among key players, including academic and industrial entities, are propelling innovation and enhancing market presence. Collectively, these dynamics are shaping a dynamic and growing market for anion exchange membranes in the foreseeable future.

Restraining Factors:

Critical challenges in the Anion Exchange Membrane Market involve elevated production expenses and a shortage of accessible materials.

The Anion Exchange Membrane (AEM) sector is confronted with numerous challenges that could hinder its progression. A major obstacle is the substantial expenses tied to the production of advanced membranes, which can escalate operational costs for businesses utilizing AEM technologies. Furthermore, the restricted availability of high-performing ion exchange materials may impede the creation of new and improved membranes, while the absence of universally accepted testing protocols could affect the verification of performance across different applications. Concerns about the chemical resilience, longevity, and functionality of AEMs under stringent operating conditions also add complexity to market growth. In addition, competition from alternative solutions, such as Proton Exchange Membranes (PEMs) and conventional ion exchange systems, might redirect funding and research endeavors away from AEM developments. The industry must also contend with regulatory and environmental challenges, as companies comply with rigorous standards concerning chemical usage and waste management. Nevertheless, ongoing research and advancements in material science offer potential pathways to mitigate these issues. As industry stakeholders engage in innovation and collaboration to improve the efficacy and cost-effectiveness of AEMs, the prospects for broader application in areas such as energy storage, water purification, and fuel cells indicate a promising future for the Anion Exchange Membrane market.

Key Segments of the Anion Exchange Membrane Market

By Type

• Strong Base

• Weak Base

By Application

• Industrial

• Food and Drinkables

• Others

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America