Market Analysis and Insights:

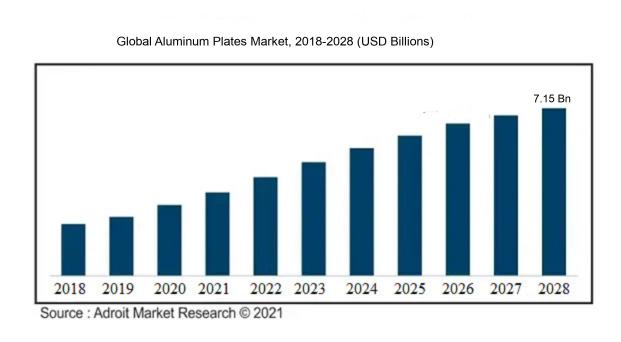

The market for Aluminum Plates was estimated to be worth USD 4.28 billion in 2020, and from 2020 to 2028, it is anticipated to grow at a CAGR of 5.39%, with an expected value of USD 7.15 billion in 2028.

The global market for aluminum plates is being shaped by various key factors. One significant driver is the surging need for lightweight and sturdy materials in industries like automotive, aerospace, and construction. Aluminum plates are favored in these sectors due to their high strength-to-weight ratio and exceptional resistance to corrosion, making them a popular choice for manufacturing various components. Additionally, the construction sector's growth, particularly in developing nations, is expected to contribute to the demand for aluminum plates for infrastructure and architectural purposes. The adoption of aluminum plates in food and beverage packaging is also on the rise, further boosting market expansion. Furthermore, the increasing popularity of electric vehicles is set to increase the demand for aluminum plates in automotive manufacturing due to their fuel efficiency and contribution to reducing vehicle weight. Moreover, the recyclable and sustainable nature of aluminum plates is attracting manufacturers and users alike, positively influencing market growth. In essence, the driving forces behind the aluminum plates market include the need for lightweight materials, the growth of the construction industry, expanding packaging applications, the rise of electric vehicles, and the focus on sustainability.

Aluminum Plates Market Scope:

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2028 |

| Study Period | 2018-2028 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2028 | USD 7.15 billion |

| Growth Rate | CAGR of 5.39% during 2020-2028 |

| Segment Covered | By Type, By Application, By Region. |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Aluminum Corporation of China Limited, Norsk Hydro ASA, Novelis Inc., Hindalco Industries Limited, Constellium SE, Kobe Steel, Ltd., Aleris Corporation, Alcoa Corporation, Arconic Inc., and China Hongqiao Group Limited. |

Market Definition

Aluminum plates are flat sheets of metal crafted from the lightweight and corrosion-resistant material aluminum. Widely utilized in various industries like construction and manufacturing due to their adaptability and robustness, these plates offer a resilient and flexible option boasting superb thermal and electrical conductivity attributes.

Aluminum plates are essential components in various industries due to their distinctive features and qualities. The lightweight yet robust nature of aluminum makes it an ideal choice in sectors like automotive and aerospace, where reducing weight is crucial. Additionally, aluminum plates offer superior corrosion resistance, ensuring their longevity and durability even in harsh conditions. Furthermore, the malleability of aluminum allows it to be easily molded into different shapes, enhancing flexibility in manufacturing processes. Moreover, aluminum's exceptional thermal and electrical conductivity make it suitable for applications like heat exchangers and electrical wiring. Lastly, the recyclability of aluminum plates promotes sustainability and helps in reducing environmental impact. In summary, the strength, corrosion resistance, versatility, and recyclability of aluminum plates make them indispensable in a wide range of industries.

Key Market Segmentation:

Insights On Key Type

6XXX

The 6XXX type is expected to dominate the Global Aluminum Plates Market. The 6XXX series of aluminum alloys are known for their exceptional strength, weldability, and corrosion resistance properties. They are widely used in various industries such as aerospace, automotive, and construction. The high strength-to-weight ratio of 6XXX aluminum plates makes them suitable for applications that require lightweight yet strong materials, such as aircraft components, structural parts, and automotive body panels. The increasing demand for lightweight materials in these industries is likely to drive the dominance of the 6XXX part in the global aluminum plates market.

7XXX

The 7XXX type of aluminum plates is expected to hold a significant share in the Global Aluminum Plates Market. The 7XXX series alloys are known for their high strength properties, specifically when heat-treated. They offer excellent corrosion resistance and are commonly used in applications that require structural strength, such as the aerospace industry. The 7XXX aluminum plates find extensive usage in aircraft fuselage, wings, and other structural components. With the growing demand for aircraft and the need for lightweight, durable materials, the 7XXX part is likely to play a significant role in dominating the global aluminum plates market.

2XXX

The 2XXX type of aluminum plates is anticipated to have a notable presence in the Global Aluminum Plates Market. The 2XXX series alloys are primarily alloyed with copper, which imparts high strength and excellent machinability to these plates. They are commonly used in applications that require good weldability and resistance to stress cracking, such as structural components in the automotive, marine, and defense industries. The 2XXX aluminum plates find applications in military vehicles, boats, and structural parts. The demand for these plates is expected to be driven by the increasing need for strong, weldable materials in various industries.

5XXX

The 5XXX type of aluminum plates is expected to maintain a substantial share in the Global Aluminum Plates Market. The 5XXX series alloys are known for their excellent corrosion resistance, especially in marine environments. They are widely used in various industries, including transportation, construction, and electrical. The 5XXX aluminum plates find applications in shipbuilding, offshore structures, storage tanks, and electrical enclosures. The growing concern for environmental sustainability and the need for durable, corrosion-resistant materials are likely to contribute to the dominance of the 5XXX part in the global aluminum plates market.

8XXX

The 8XXX type of aluminum plates is expected to have a limited presence in the Global Aluminum Plates Market. The 8XXX series alloys are primarily alloyed with lithium, which imparts excellent strength and low density to these plates. They are used in specific applications that require high strength and stiffness, such as aerospace and defense. The lightweight and high-strength properties of the 8XXX aluminum plates make them suitable for aerospace structural components, missiles, and defense equipment. However, the demand for these plates is relatively niche compared to other parts in the global aluminum plates market.

Others

The Others category of aluminum plates consists of alloys that do not fall into the defined categories of 2XXX, 5XXX, 6XXX, 7XXX, or 8XXX series. This part is expected to hold a moderate share in the Global Aluminum Plates Market. The "Others" part includes various aluminum alloys that are used for specific applications depending on their unique properties. These plates find usage in industries such as automotive, packaging, and consumer goods. While the demand for the "Others" part is diverse, it is not expected to overshadow the dominance of the 6XXX, 7XXX, or other major parts in the global aluminum plates market.

Insights On Key Application

Automobile

The Automobile application is expected to dominate the Global Aluminum Plates Market. This is primarily due to the growing demand for lightweight and fuel-efficient vehicles. Aluminum plates offer superior strength-to-weight ratio, corrosion resistance, and flexibility in design, making them ideal for use in automobile manufacturing. As the automotive industry continues to focus on reducing emissions and improving fuel economy, the adoption of aluminum plates is expected to increase significantly. Furthermore, the increasing production of electric vehicles, which rely on lightweight materials for extended battery range, is expected to drive the demand for aluminum plates in the automobile sector.

Aerospace & Defense

The Aerospace & Defense application holds significant potential in the Global Aluminum Plates Market. Aluminum plates are widely used in the aerospace industry due to their strength, light weight, and resistance to extreme temperatures. As the global demand for commercial and military aircrafts continues to rise, the use of aluminum plates in the manufacturing of aircrafts, spacecrafts, and defense equipment is expected to increase. With advancements in technology and the need to enhance fuel efficiency, the aerospace and defense sector will continue to be a key driver for the aluminum plates market.

Rail and Ship

In the Rail and Ship application of the Global Aluminum Plates Market, there is a growing demand for lightweight materials that offer durability and corrosion resistance. Aluminum plates are increasingly used in the construction of rail and ship structures to lower weight and improve fuel efficiency. The use of aluminum plates in rail and ship manufacturing provides advantages such as reduced energy consumption, increased payload capacity, and improved structural performance. As the transportation sector emphasizes the need for sustainable practices and enhanced efficiency, the demand for aluminum plates in the rail and ship industry is expected to witness steady growth.

Mechanical Engineering or Moulding

The Mechanical Engineering or Moulding application in the Global Aluminum Plates Market is an important sector where aluminum plates find diverse applications. Aluminum plates are widely used in mechanical engineering for the fabrication of equipment, machineries, and components due to their strength, formability, and durability. The use of aluminum plates in moulding processes, such as casting and extrusion, provides excellent dimensional stability and heat transfer properties. As the mechanical engineering industry continues to expand, driven by industrial growth and technological advancements, the demand for aluminum plates in this part is expected to grow.

Others

The Others category within the Application category of the Global Aluminum Plates Market comprises various niche s that do not fall under the dominant categories mentioned above. This part may include applications such as construction, packaging, and electrical industries, where aluminum plates find specific uses. While the specific parts under "Others" may vary, the demand for aluminum plates in these industries is expected to be moderate compared to the dominant s. The growth in these niche sectors will depend on factors such as economic development, technological advancements, and specific industry requirements.

Insights on Regional Analysis:

Asia Pacific

Asia Pacific is expected to dominate the Global Aluminum Plates market. The region holds the largest share in the global market due to the presence of major markets such as China, Japan, and India. The rapid industrialization and urbanization in these countries have led to a significant increase in the demand for aluminum plates across various sectors, including automotive, construction, and packaging. Moreover, the growing population and rising disposable income in the region are driving the demand for consumer goods, further fueling the demand for aluminum plates. Furthermore, the region benefits from the availability of abundant raw materials and low labor costs, making it a favorable destination for aluminum plate manufacturers. Overall, the Asia Pacific region is expected to dominate the Global Aluminum Plates market due to its strong economic growth and increasing industrial activities.

North America

North America is a significant market for aluminum plates, but it is likely to be overshadowed by Asia Pacific in terms of dominance. The region is driven by the presence of key industries such as aerospace, automotive, and construction, which are major consumers of aluminum plates. However, factors such as mature markets and slower economic growth compared to Asia Pacific limit the region's potential for dominating the global market. Despite these limitations, North America still holds a considerable market share and offers growth opportunities due to technological advancements and the focus on lightweight materials in various industries.

Latin America

Latin America has a growing demand for aluminum plates, particularly in the construction sector. The region is experiencing urbanization and infrastructure development, which drives the need for aluminum plates for applications such as roofing, panels, and facades. However, the market size and growth potential of Latin America are relatively smaller compared to other regions. Factors such as political and economic uncertainties, environmental regulations, and limited access to technological advancements can hinder the region's ability to dominate the global market. Nonetheless, Latin America still contributes to the global aluminum plates market with its specific demand drivers and opportunities.

Europe

Europe has a robust industrial sector and is a significant market for aluminum plates. The region is driven by the automotive and transportation industries, which have high demand for aluminum plates due to their lightweight and durable properties. Additionally, the construction and packaging sectors also contribute to the demand for aluminum plates in Europe. However, factors such as market maturity, slow economic growth, and environmental regulations pose challenges to the region's dominance in the global market. Europe still holds a decent market share and continues to innovate and invest in the development of advanced aluminum plate technologies.

Middle East & Africa

The Middle East & Africa region has a growing demand for aluminum plates due to the increasing infrastructure development and construction activities. The region is witnessing rapid urbanization and investments in sectors such as energy, construction, and transportation, which are key consumers of aluminum plates. However, the market size and growth potential of the Middle East & Africa region in the global market are relatively smaller compared to other regions. Factors such as political instability, economic uncertainties, and limited access to technological advancements can hinder the region's ability to dominate the global market. Nevertheless, the Middle East & Africa region contributes to the global aluminum plates market with its specific demand drivers and opportunities.

Company Profiles:

Prominent figures in the international aluminum plates industry play a vital part in producing and distributing aluminum plates for a variety of sectors including automotive, aerospace, and construction. They engage in extensive research and development endeavors to improve the quality of their products and broaden their market reach on a worldwide scale.

Prominent companies operating in the Aluminum Plates Market encompass Aluminum Corporation of China Limited, Norsk Hydro ASA, Novelis Inc., Hindalco Industries Limited, Constellium SE, Kobe Steel, Ltd., Aleris Corporation, Alcoa Corporation, Arconic Inc., and China Hongqiao Group Limited.

COVID-19 Impact and Market Status:

The global market for aluminum plates has experienced a notable downturn as a result of the far-reaching effects of the Covid-19 pandemic. This downturn has been characterized by a reduction in both demand and production levels, stemming from disruptions across multiple industries and supply chains.

The aluminum plates market has been significantly influenced by the COVID-19 pandemic, with global lockdown measures and supply chain disruptions leading to decreased demand and production across various industrial sectors such as construction, automotive, aerospace, and packaging. Due to social distancing guidelines causing construction projects to be delayed or cancelled, the need for aluminum plates utilized in building facades, roofs, and structural components has diminished. Moreover, the automotive industry, a key consumer of aluminum plates for vehicle parts, has seen a sharp decline in sales, resulting in lower demand for these materials. Similarly, the aviation sector has been greatly impacted by travel restrictions, leading to reduced demand for aluminum plates used in aircraft production. Additionally, disruptions in the packaging industry due to restricted operations and a shift towards online shopping have also impacted the demand for aluminum plates in packaging materials. While the current outlook presents short-term challenges for the aluminum plates market, there may be prospects for recovery as economic activities gradually resume.

Latest Trends and Innovation:

- In February 2021, Novelis, a subsidiary of Hindalco Industries, announced its plan to acquire Aleris Corporation, a global aluminum rolled products manufacturer, for $2.8 billion.

- In November 2020, Constellium SE, a global leader in aluminum products manufacturing, announced the acquisition of Aleris Corporation for $1.1 billion.

- In October 2019, Norsk Hydro, a leading Norwegian aluminum company, announced the development of the world's first certified low-carbon aluminum products under the brand name Hydro REDUXA.

- In September 2019, Hindalco Industries, an Indian aluminum company, acquired Aleris Corporation for $2.6 billion, expanding its global presence.

- In July 2018, Alcoa Corporation, a global leader in aluminum production, announced the expansion of its aluminum rolling business with a $300 million investment in its facility in Tennessee, United States.

- In May 2018, Norsk Hydro launched a new brand in the aluminum plate business, called AluSolutions, aimed at providing tailored solutions to various industries.

- In April 2017, Alcoa Corporation announced its separation from Arconic Inc., creating two independent publicly-traded companies focused on aluminum manufacturing and high-performance materials.

- In March 2017, Constellium SE announced the expansion of its aluminum extrusion plant in Mexico, aimed at meeting the growing demand for lightweight materials in the automotive industry.

- In December 2016, Novelis announced the expansion of its automotive aluminum manufacturing capabilities with a $300 million investment in its facility in Kentucky, United States.

Significant Growth Factors:

The Aluminum Plates Market is experiencing growth due to rising demand in key industries such as automotive, aerospace, and construction driven by its exceptional strength-to-weight ratio and resistance to corrosion.

The aluminum plates industry is poised for robust growth in the upcoming years, propelled by various significant factors. One key driver is the escalating need for lightweight materials in sectors such as automotive, aerospace, construction, and packaging. Aluminum plates are particularly favored in these fields for their excellent strength-to-weight ratio, corrosion resistance, and long-lasting properties. Furthermore, the growing emphasis on sustainable and environmentally friendly alternatives is projected to further propel market expansion, given aluminum's exceptional recyclability. The burgeoning global construction sector is also anticipated to play a pivotal role in boosting demand for aluminum plates, especially for infrastructure projects, residential complexes, and commercial developments. Additionally, the increasing adoption of aluminum plates in the production of consumer electronics, electrical devices, and appliances is on the rise, driven by consumer preferences for weight-efficient and energy-saving products. The Asia Pacific region, notably countries like China and India, is expected to be a major driver of aluminum plate demand due to the rapid growth in the construction and automotive industries. To sum up, the growth trajectory of the aluminum plates market is set to be steered by the rising requirement for lightweight materials, eco-friendly solutions, infrastructural advancements, and the flourishing manufacturing .

Restraining Factors:

Constraints in the Aluminum Plates Market consist of the volatility in raw material prices and stringent environmental mandates.

The growth of the Aluminum Plates Market is being hindered by various factors. Firstly, the rising costs of raw materials like bauxite and alumina are driving up production expenses for manufacturers, subsequently increasing prices for aluminum plates and reducing affordability for customers. Moreover, mounting environmental concerns surrounding aluminum production, particularly related to energy consumption and greenhouse gas emissions, are leading to more stringent regulations and compliance standards. These regulations are adding to operational costs for manufacturers and creating additional hurdles for the market. Additionally, the increasing competition from alternative materials such as steel and composites is a growing threat to the market share of aluminum plates. These alternatives offer similar characteristics with potentially lower costs or higher strength-to-weight ratios, making them appealing substitutes for certain applications. Despite these challenges, the Aluminum Plates Market is anticipated to sustain its growth momentum. The optimistic outlook for the market is driven by the rising demand from sectors including automotive, aerospace, construction, and packaging, which rely on aluminum plates for their lightweight, durable, and corrosion-resistant attributes. Furthermore, continued advancements in aluminum production technologies and the innovation of new alloys are expected to address some of the market's obstacles and bolster the competitiveness of aluminum plates in the market.

Key Segments of the Aluminum Plates Market

Type Overview

• 2XXX

• 5XXX

• 6XXX

• 7XXX

• 8XXX

• Others

Application Overview

• Aerospace & Defense

• Automobile

• Rail and Ship

• Mechanical Engineering or Moulding

• Others

Regional Overview

North America

• United States

• Canada

• Mexico

Europe

• Germany

• France

• United Kingdom

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• United Arab Emirates

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America