Aluminum Alloy Market Analysis and Insights:

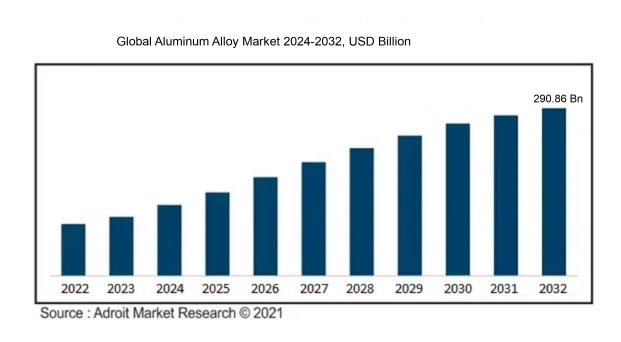

At a compound annual growth rate (CAGR) of 9.42%, the aluminum alloy market is expected to rise from USD 167.2 billion in 2024 to USD 290.86 billion by 2032, from its 2023 valuation of USD 1523.11 billion.

The aluminum alloy sector is significantly affected by various pivotal factors. A primary driver is the escalating requirement for lightweight materials in the automotive and aerospace industries, as manufacturers strive to boost fuel efficiency and minimize emissions. Additionally, the growth of the construction industry—especially in the realm of energy-efficient buildings—has spurred the need for aluminum alloys, valued for their strength and recyclability. Advances in alloy manufacturing technologies also play a crucial role in enhancing performance attributes, such as resistance to corrosion and increased strength. Moreover, the rising application of aluminum alloys in electrical fields, notably in consumer electronics and renewable energy industries, further elevates overall market demand. Additionally, governmental initiatives aimed at encouraging sustainable practices and aluminum recycling serve as vital motivators, fostering a conducive atmosphere for market growth. As sectors continue to emphasize both performance and eco-friendliness, the aluminum alloy market is well-positioned for significant expansion.

Aluminum Alloy Market Definition

An aluminum alloy comprises aluminum combined with different elements to improve its mechanical attributes and corrosion resistance. These alloys are widely utilized across multiple sectors due to their advantageous lightweight and robust qualities.

Aluminum alloys play a vital role in various applications owing to their remarkable attributes, which encompass a lightweight profile, impressive strength, and outstanding resistance to corrosion. As a result, these alloys are widely utilized in numerous sectors, including aerospace, automotive, construction, and packaging, as they can endure challenging conditions while preserving their structural reliability. The adaptability of aluminum alloys enables the fabrication of intricate shapes and components, promoting creative design solutions and enhancing fuel efficiency in transportation. In addition, their capacity for recycling supports environmentally sustainable practices, establishing aluminum alloys as a key material in modern manufacturing and engineering endeavors.

Aluminum Alloy Market Segmental Analysis:

Insights On Product

Wrought Alloy

Based on current research and market trends, wrought alloys are expected to dominate the Global Aluminum Alloy Market. This is primarily attributed to their versatility and extensive applications across various industries, such as automotive, aerospace, and construction. Wrought alloys boast superior mechanical properties, better formability, and enhanced corrosion resistance, making them a preferred choice for manufacturers seeking high-performance materials. The increasing demand for lightweight, durable components in the transportation sector further fuels the growth of wrought alloys, particularly as industries shift towards more sustainable practices. Additionally, technological advancements in alloy production and processing will likely strengthen the position of wrought alloys in the market over the coming years.

Cast Alloy

Cast alloys hold a significant position within the Global Aluminum Alloy Market, largely due to their cost-effectiveness and suitability for complex shapes. They are commonly used in applications where intricate designs are essential, such as in automotive engine blocks and various industrial parts. While they may not have the same level of mechanical properties as wrought alloys, their ease of production and ability to be molded into various forms makes them an attractive option for manufacturers. Furthermore, the growth of the automotive and machinery industries continues to support the use of cast alloys as companies seek reliable and efficient materials for their operations.

Insights On Sensitivity Type

Heat Treatable Alloys

Heat Treatable Alloys are expected to dominate the Global Aluminum Alloy Market due to their high strength-to-weight ratio and superior mechanical properties. These alloys are extensively utilized in aerospace, automotive, and construction applications where structural integrity and lightweight components are crucial. The increasing demand for lightweight materials that enhance fuel efficiency in vehicles and aircraft significantly drives the growth of this category. Additionally, advancements in technology and manufacturing processes allow for the development of new heat treatable alloys that offer improved performance and durability. Consequently, this is poised for robust growth, overshadowing its counterpart.

Non Heat-Treatable Alloys

Non Heat-Treatable Alloys have unique characteristics such as excellent corrosion resistance and good workability, making them suitable for varied applications. Though they may not reach the tensile strengths of heat treatable alloys, they are favored in industries like packaging, electrical, and architectural applications. The reliance on formability and ease of fabrication often drives demand for these alloys. As the need for corrosion-resistant materials persists across various sectors, nonheat treatable alloys maintain a steady presence in the market, appealing to specific applications where their performance characteristics are advantageous.

Insights On Design Type

6000 Series

The 6000 Series is expected to dominate the Global Aluminum Alloy market due to its impressive combination of strength, corrosion resistance, and workability. This series is primarily composed of magnesium and silicon, making it highly versatile for various applications such as construction, automotive, and aerospace. Moreover, its excellent weldability and machinability allow it to cater to both structural and architectural needs. As the demand for lightweight yet strong materials grows in multiple industries, especially in transportation and building construction, the 6000 Series is well-positioned to capture a significant market share. Its increasing use in green building initiatives and lightweight structures further solidifies its leading role.

2000 Series

The 2000 Series alloys are primarily composed of copper and are known for their high strength and excellent machinability. These properties make them ideal for aerospace applications, where weight savings and performance are critical factors. However, since these alloys are less resistant to corrosion compared to other types, their usage is often limited to specialized applications. Their unique capabilities ensure a steady demand, particularly in high-performance industries, but they remain niche players in the broader market.

3000 Series

The 3000 Series alloys contain manganese as the principal alloying element and are recognized for their good corrosion resistance and formability. They are commonly used in the manufacturing of beverage cans, cooking utensils, and chemical equipment. Although they provide adequate strength for many applications, they don't compare to the stronger 6000 or 7000 Series. As a result, this series primarily serves the consumer products sector, where weight and strength requirements are less stringent.

4000 Series

The 4000 Series is primarily characterized by its low melting point due to the addition of silicon, making these alloys highly suitable for welding and brazing applications. Their use is frequently seen in automotive and manufacturing sectors, where parts require durability but not excessive strength. While they play an important role in specific applications requiring alloying and welding advantages, their market presence is limited compared to higher-strength alternatives.

5000 Series

The 5000 Series alloys feature magnesium as the main alloying element, which imparts excellent corrosion resistance and weldability. These properties make them highly desirable for marine applications, as well as architectural panels and pressure vessels. Although they provide good strength, particularly in marine environments, their performance is often overshadowed by the more versatile 6000 Series. Consequently, they have a strong but somewhat niche market presence, focusing on regions and applications where corrosion resistance is paramount.

7000 Series

The 7000 Series alloys are largely alloyed with zinc and are known for their exceptional strength, making them popular in the aerospace and sporting equipment industries. However, their low weldability and tough machining requirements limit their applications. They are instrumental in high-performance contexts where weight-to-strength ratios are critical. While they hold a unique position in the market, broader applications are sometimes challenged by their niche characteristics, which can favor stronger or more workable materials in certain scenarios.

Others

The “Others” category consists of various specialty alloys that do not fit neatly into the aforementioned groups. These can include alloys tailored for specific applications, such as those with unique properties like enhanced wear resistance or tailored heat treatment capabilities. While they may not dominate the market, they play crucial roles in specialized sectors, offering custom solutions that cater to distinctive engineering challenges. Their market presence is generally more limited, focusing on bespoke needs rather than widespread applications.

Insights On Strength Type

Ultra-High Strength

The Ultra-High Strength category is expected to dominate the Global Aluminum Alloy Market due to its increasing applications in industries such as aerospace, automotive, and defense. The demand for lightweight yet durable materials to improve fuel efficiency and performance in aircraft and high-performance vehicles is driving this trend. Manufacturers are increasingly focusing on developing alloys that meet rigorous standards for strength and weight reduction. Additionally, technological advancements in alloy production processes are enhancing the performance characteristics of Ultra-High Strength materials, making them more appealing for high-stress applications. This alignment with industry needs positions Ultra-High Strength as the prevailing choice in the market.

High Strength

The High Strength category remains significant in the Global Aluminum Alloy Market, catering to industries like construction and transportation where structural integrity and durability are crucial. High Strength alloys offer a balanced combination of weight saving and mechanical properties, making them suitable for various applications such as buildings, bridges, and automotive components. As manufacturers look for cost-effective solutions without compromising on quality, High Strength materials continue to maintain a strong presence. Their versatility and adaptability further enable manufacturers to meet specific requirements across multiple sectors, thus sustaining their relevance in the market.

Insights On Key Application

Transportation

Transportation is expected to dominate the Global Aluminum Alloy market due to the significant growth in the aerospace and automotive sectors, where weight reduction and fuel efficiency are paramount. The shift towards lightweight materials is pushing manufacturers to adopt aluminum alloys, which provide high strength-to-weight ratios. Furthermore, government regulations and consumer preferences for fuel-efficient vehicles are driving demand. The transportation sector benefits from the versatility of aluminum alloys, being employed in various applications, including aircraft, railroads, and ships. The continuous advancements in alloy technologies further enhance their performance capabilities, making them more attractive for manufacturers aiming to meet sustainability goals.

Automotive

The automotive industry plays a crucial role in the aluminum alloy market, driven by the increasing need for fuel efficiency and lower emissions. Automakers are increasingly using aluminum alloys in vehicle construction to reduce weight without compromising safety. Innovations in automotive design and manufacturing techniques, such as modular architecture, further accelerate the usage of aluminum. This alignment with consumer demand for more efficient vehicles ensures that aluminum alloys remain a key component in automotive design, contributing to the industry's overall growth.

Building and Construction

The building and construction sector also demonstrates a significant demand for aluminum alloys, owing to their corrosion resistance, aesthetic appeal, and lightweight nature. These alloys are widely used in facades, windows, roofing, and structural components, enhancing the durability and aesthetic aspects of buildings. The ongoing trends toward sustainable and energy-efficient constructions further support the adoption of aluminum alloys, making them an essential material in modern construction projects.

Packaging

In the packaging industry, aluminum alloys are favored for their lightweight properties, recyclability, and barrier protection capabilities. They are commonly used in food and beverage packaging and are becoming increasingly popular in pharmaceutical applications. The demand for convenient, eco-friendly packaging solutions drives the use of aluminum alloys, especially as companies seek to reduce plastic waste and improve product preservation.

Machinery

The machinery sector utilizes aluminum alloys for their strength and lightweight characteristics, which allow for operational efficiencies and reduced energy consumption. Industries employing aluminum machinery components benefit from the material's mechanical properties, improving performance and extending equipment lifespan. The demand for sophisticated machinery, particularly in manufacturing and processing, continues to propel the utilization of aluminum alloys in this industry.

Electrical

In the electrical sector, aluminum alloys are gaining traction due to their excellent conductivity and lightweight properties. They are increasingly used in transmission lines, transformers, and electrical connectors, enhancing the overall efficiency of electrical systems. With the growing focus on renewable energy solutions and smart grid technologies, the demand for efficient materials like aluminum alloys in electrical applications is expected to continue its upward trajectory.

Marine

The marine industry benefits from the unique properties of aluminum alloys, such as corrosion resistance and a high strength-to-weight ratio. These characteristics make them ideal for constructing ships, boats, and marine infrastructure. As environmental regulations become stricter, lightweight and fuel-efficient designs are essential, driving the adoption of aluminum alloys in the marine sector.

Consumer Durables

Consumer durables encompass a wide range of products, including appliances and electronics, where aluminum alloys are utilized for their appealing finish and lightweight properties. Products like laptops, TVs, and refrigerators benefit from the use of aluminum, improving performance and aesthetics. The trend toward lightweight, modern designs in consumer goods ensures that aluminum alloys maintain a strong presence in this market.

Aerospace

In the aerospace sector, the use of aluminum alloys is prominent due to their high strength-to-weight ratio and excellent corrosion resistance. They are crucial materials in aircraft fuselage, wings, and other structural components, contributing to improved fuel efficiency and payload capacity. Continuous innovations in aerospace technology push the demand for advanced aluminum alloys, fostering growth within this specialized.

Global Aluminum Alloy Market Regional Insights:

Asia Pacific

The Asia Pacific region is expected to dominate the Global Aluminum Alloy market due to a combination of rapid industrialization, increasing automotive production, and a growing construction sector. Countries such as China and India are leading this trend, where demand for aluminum alloys in transportation, aerospace, and construction applications is surging. The region benefits from abundant raw materials and a competitive manufacturing base, with several key players investing heavily in innovation and production capacity to meet growing domestic and international demand. Furthermore, initiatives aimed at reducing carbon emissions are propelling the use of lightweight aluminum alloys across various industries, thus enhancing their market presence in this region.

North America

In North America, the aluminum alloy market is characterized by strong demand from the aerospace and automotive sectors, which focus on lightweight materials to enhance fuel efficiency. The U.S., in particular, is home to several leading manufacturers of aluminum products who are continuously innovating to produce high-performance alloys. While the market is growing, it faces challenges from rising raw material costs and increased competition from imports. However, the investment in recycling and sustainable practices is expected to bolster the market, providing opportunities for growth in niche s.

Europe

Europe is a significant player in the Global Aluminum Alloy market, driven by strict environmental regulations and a robust automotive industry that emphasizes lightweight solutions. Countries like Germany and Italy are leading in the production and utilization of aluminum alloys for various industry applications, including transportation and packaging. The region’s focus on sustainability is prompting increased usage of recycled aluminum alloys, enhancing the industry's environmental footprint. However, sluggish economic growth in some areas may hinder fast-paced expansion in comparison to the Asia Pacific region.

Latin America

Latin America's aluminum alloy market is evolving, with Brazil and Mexico as the primary drivers of demand. The construction and automotive sectors are seeing a gradual shift towards the use of aluminum alloys for their lightweight and corrosion-resistant properties. Nevertheless, the market contends with economic instability and infrastructural challenges that may hamper growth. As investments in infrastructure projects increase, particularly ahead of significant events, the region could see a boost in aluminum alloy applications.

Middle East & Africa

The Middle East & Africa region is characterized by growing demand for aluminum alloys spurred by rapid urbanization and infrastructure development. The construction sector is a key driver, particularly in Gulf Cooperation Council (GCC) countries, where major projects are underway. However, political instability and economic fluctuations in some parts of Africa may impede growth. Efforts to diversify economies away from oil dependence could further stimulate the market for aluminum alloys, especially in construction applications, but substantial hurdles remain to overcome for larger scale expansion.

Aluminum Alloy Competitive Landscape:

Leading entities in the worldwide aluminum alloy sector propel innovations and enhance production effectiveness, impacting pricing structures and supply chain dynamics. Additionally, they play a vital role in promoting sustainable methods and technological progress, thereby influencing the competitive environment and adapting to changing consumer demands.

Prominent participants in the Aluminum Alloy sector consist of Alcoa Corporation, Rio Tinto Group, Norsk Hydro ASA, Aleris Corporation (currently integrated into Novelis), Novelis Inc., Constellium SE, Kaiser Aluminum Corporation, Hindalco Industries Limited, Emirates Global Aluminium, South32 Limited, Zhongwang International Group, UACJ Corporation, Sumitomo Light Metal Industries, and Yamato Kogyosho Co., Ltd.

Global Aluminum Alloy COVID-19 Impact and Market Status:

The Covid-19 pandemic caused major upheavals in the worldwide aluminum alloy market, resulting in supply chain challenges and a reduction in demand from crucial industries, including automotive and aerospace.

The aluminum alloy industry experienced considerable disruptions due to the COVID-19 pandemic, which affected supply chains, lowered production capabilities, and diminished demand in vital sectors such as automotive, aerospace, and construction. The implementation of lockdowns and various restrictions resulted in the temporary closure of manufacturing plants, leading to a scarcity of raw materials and postponements of project deadlines. As economies started to heal, there was a rising need for lightweight materials essential for electric vehicles and renewable energy solutions, contributing to a gradual recovery of the market. Furthermore, the pandemic underscored the necessity for local sourcing and a reduced reliance on global supply networks, which encouraged businesses to rethink their operational strategies. Although the initial stages of the pandemic brought about a decline in the sector, the future prognosis for the aluminum alloy market looks promising, driven by technological advancements, sustainability efforts, and an increased emphasis on infrastructure projects, which are likely to foster growth as industries adjust to the evolving market landscape.

Latest Trends and Innovation in The Global Aluminum Alloy Market:

- In July 2023, Alcoa Corporation announced the acquisition of a controlling interest in the mining and refining operations of the Sierra Leone-based bauxite producer, enhancing its raw material supply for aluminum production.

- In August 2023, Norsk Hydro ASA launched its new range of low-carbon aluminum alloys, aimed at meeting growing demand for sustainable materials in key industries such as automotive and construction.

- In September 2023, Kaiser Aluminum Corporation completed the merger with General Cable, which strengthened its portfolio of aluminum products, particularly in electrical wire and cable systems.

- In October 2023, Constellium SE introduced a new line of advanced aluminum alloys designed for 3D printing applications, targeting the aerospace and automotive sectors.

- In November 2023, Arconic Corporation announced a significant investment in new production technology at its manufacturing facilities in Tennessee, aimed at increasing efficiency and output of high-strength aluminum alloys.

- In December 2023, Novelis Inc. expanded its recycling operations with a new facility in Alabama, reinforcing its commitment to sustainability and increasing the supply of recycled aluminum alloy for its products.

Aluminum Alloy Market Growth Factors:

The expansion of the aluminum alloy market is propelled by the escalating requirement from the automotive and aerospace sectors for lightweight, robust materials, alongside a rise in investments directed towards infrastructure projects.

The Aluminum Alloy Market is set for substantial growth, driven by a variety of influential factors. To begin with, the rising need for lightweight and resilient materials in the automotive and aerospace industries is boosting the utilization of aluminum alloys, which enhance both fuel efficiency and overall performance. Furthermore, the construction sector's emphasis on sustainable materials accelerates the adoption of aluminum alloys, noted for their recyclability and minimal environmental footprint.

Technological innovations, such as the creation of high-strength alloys, are also facilitating market growth by enabling broader applications across multiple industries. In addition, governmental policies that advocate for lighter materials in vehicles to lower emissions are further increasing demand. The advancement of emerging economies, characterized by ened industrialization and infrastructure projects, positively impacts the market as well.

The surge in consumer electronics and the transition toward electric vehicles underscore the importance of lightweight aluminum alloys, resulting in ened production levels. Finally, advancements in alloy design and processing methods are catering to a wide range of consumer requirements, thereby propelling market growth. Together, these elements foster a dynamic landscape for the Aluminum Alloy Market, underscoring its potential for future development across diverse sectors.

Aluminum Alloy Market Restaining Factors:

The primary inhibiting factors in the Aluminum Alloy Market encompass variations in raw material costs and increasing rivalry from substitute materials.

The aluminum alloy industry is currently grappling with several inhibiting factors that could influence its development in the near future. A major obstacle is the fluctuation in raw material prices, which can elevate production costs and, in turn, affect overall pricing strategies. Environmental concerns associated with the extraction and processing of aluminum also bring about regulatory challenges that may hinder growth in various areas. Furthermore, competition from alternative materials like carbon fiber and high-strength steel presents a risk, as industries pursue lighter, more resilient, and cost-efficient solutions. The pace of technological progress in competing materials may also surpass advancements in aluminum alloys, diminishing their market significance. Supply chain interruptions, intensified by geopolitical conflicts or global health crises, could further complicate access to crucial raw materials. Nonetheless, there is reason for optimism in the aluminum alloy sector, as the surging demand for lightweight and high-performance materials across industries such as automotive, aerospace, and construction continues to fuel innovation. In addition, breakthroughs in recycling technologies and a growing commitment to sustainability create avenues for market expansion, bolstering aluminum's role as a critical material in the shift towards more environmentally friendly alternatives.

Key Segments of the Aluminum Alloy Market

By Product:

- Wrought Alloy

- Cast Alloy

By Sensitivity Type:

- Heat Treatable Alloys

- Non Heat-Treatable Alloys

By Design Type:

- 2000 Series

- 3000 Series

- 4000 Series

- 5000 Series

- 6000 Series

- 7000 Series

- Others

By Strength Type:

- High Strength

- Ultra-High Strength

By Application:

- Transportation

- Automotive

- Building and Construction

- Packaging

- Machinery

- Electrical

- Marine

- Consumer Durables

- Aerospace

- Others

Regional Overview

North America

- US

- Canada

- Mexico

Europe

- Germany

- France

- U.K

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

Middle East and Africa

- Saudi Arabia

- UAE

- Rest of Middle East and Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America