Alternative Protein Market Analysis and Insights:

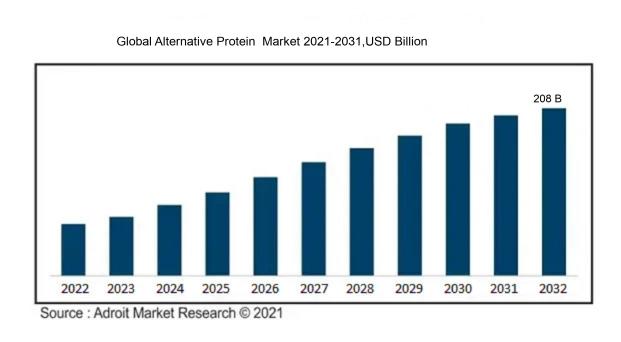

In 2023, the size of the worldwide Alternative Protein market was US$ 79.3 billion. Adroit Market Research projects that the market will increase at a compound annual growth rate (CAGR) of 10.9% from 2024 to 2032, reaching US$ 208 billion.

The Alternative Protein Market is significantly influenced by an increasing awareness of health among consumers, ened understanding of the ecological consequences of conventional livestock agriculture, and a growing thirst for sustainable food sources. As more individuals turn to plant-centric diets for both health benefits and ethical considerations, there has been a notable rise in the popularity of protein alternatives, including legumes, grains, and plant-derived meat substitutes. Furthermore, challenges surrounding food security and the inefficiencies tied to traditional protein sourcing have stirred interest in pioneering options like lab-cultured and insect-derived proteins. The rapid expansion of vegan and vegetarian offerings, fueled by a surge in startups and investments in the food tech sector, further propels market advancement. Additionally, regulatory backing and shifting consumer desires for clean labels and allergen-free products enhance the appeal of alternative proteins. Collectively, these dynamics are transforming the protein supply landscape, providing consumers with a variety of nutritious options while tackling essential global sustainability issues.

Alternative Protein Market Definition

Alternative protein encompasses non-traditional sources of protein that do not originate from conventional livestock agriculture. This includes proteins derived from plants, insects, and lab-cultivated meat. These options are designed to offer sustainable and ethical solutions to address the increasing global demand for protein.

Alternative proteins play a vital role in tackling increasing worries related to food security, environmental sustainability, and public health. With the global population on the rise and conventional livestock farming under pressure, alternatives such as plant-based, lab-cultivated, and insect-based proteins present eco-friendly options that lower greenhouse gas emissions, conserve land, and minimize water usage. These alternatives also meet the needs of vegan and flexitarian diets, supporting a variety of nutritional requirements. By broadening the range of protein sources available, alternative proteins can alleviate the consequences of climate change, strengthen food system resilience, and secure a sustainable food supply for future generations.

Alternative Protein Market Segmental Analysis:

Insights On Key Protein Source

Plant-Based Protein

Plant-based protein is poised to dominate the Global Alternative Protein Market due to increasing consumer awareness regarding health, sustainability, and ethical considerations. The surge in plant-based diets, including vegetarian and vegan lifestyles, reflects a growing preference for alternative protein sources that not only offer nutritional benefits but also align with environmental sustainability goals. Major players in the food industry are investing heavily in developing diverse and innovative plant-based protein products, catering to a wide range of consumers. Furthermore, the versatility in applications, from meat substitutes to snacks and beverages, positions plant-based proteins as a favorable option in a market driven by flexibility and dietary preferences.

Animal Derived Proteins

Animal-derived proteins still hold a significant market share, primarily due to their established presence in traditional diets and culinary applications. Consumers who prefer meat products often seek high-quality, nutrient-dense options that include protein derived from livestock. Despite the rise of plant-based alternatives, animal-derived proteins meet the demands of populations with cultural and dietary ties to these sources. Nonetheless, the growing concern over sustainability and animal welfare may challenge the long-term growth of this category, yet it remains a dominant option for many consumers seeking familiar taste and texture in their diets.

Mycoprotein

Mycoprotein is carving out a niche within the alternative protein landscape, appealing to flexitarians and health-conscious consumers. This fungus-based protein, popularized by brands like Quorn, offers a meat-like texture and an excellent amino acid profile, attracting those looking for alternatives that closely mimic the sensory experience of eating meat. Mycoprotein is also gaining traction due to its lower environmental impact compared to traditional animal farming. However, market penetration remains limited compared to more popular options such as plant-based proteins, and consumer awareness is still growing, which could enhance its prominence in the coming years.

Insect Based Protein

Insect-based protein is an emerging category, recognized for its high nutritional value and low environmental footprint. Though still niche in many markets, this source of protein offers a sustainable alternative with minimal resource requirements for production. Insects are rich in protein, vitamins, and minerals, capturing attention in the quest for efficient protein sources. However, cultural and sensory barriers remain significant hurdles to wider adoption. Acceptance is gradually increasing, particularly in regions with culinary traditions that embrace entomophagy, but the overall market share is still small compared to plant-based and animal-derived proteins at this stage.

Insights On Key Formulation Type

Whole Food

Whole food options are expected to dominate as they comprise of natural plant-based protein sources like legumes, grains, nuts, and seeds, focus on delivering nutrients in their unrefined form. While they appeal to health-conscious consumers and those favoring organic products, their growth is somewhat limited by convenience and preparation time. Consumers increasingly seek ready-to-eat or easy-to-prepare foods, leading to a dip in whole food consumption compared to more processed alternatives. Nevertheless, this still garners a loyal following, particularly among purists who prioritize clean eating and the nutritional benefits of minimally processed foods.

Processed Protein Products

Processed Protein Products are expected to dominate the Global Alternative Protein Market due to their versatility, convenience, and widespread acceptance among consumers. These products, which include items such as meat substitutes, dairy alternatives, and ready-to-eat protein snacks, appeal to a broader audience actively seeking protein-rich diets without compromising on taste and texture. Moreover, the increasing trend toward plant-based lifestyles, driven by health, environmental, and ethical considerations, has led manufacturers to enhance the quality and variety of processed protein offerings. As a result, processed protein products are gaining traction, attracting both health-conscious consumers and flexitarians, establishing themselves as the preferred choice in the market.

Protein Supplements

Protein supplements, including powders, bars, and ready-to-drink shakes, have gained significant popularity, particularly among fitness enthusiasts and athletes. However, despite their strong presence in the market, they often face competition from processed protein products, which tend to be perceived as more versatile and appealing for everyday consumption. Furthermore, the rise of meal replacements and vegan protein options on the market has diversified choices for consumers, challenging the traditional appeal of straight protein supplements. This growth potential in adjacent categories may inhibit the sheer dominance of protein supplements in the alternative protein landscape as consumer preferences shift towards more diverse and flavorful options.

Insights On Key Application

Food and Beverages

The Food and Beverages category is expected to dominate the Global Alternative Protein market due to the increasing consumer demand for plant-based diets and meat alternatives. With awareness about health benefits, environmental concerns, and ethical considerations regarding animal welfare on the rise, more individuals are opting for alternative protein sources in their everyday meals. Furthermore, mainstream food manufacturers are incorporating innovative protein products which cater to shifting consumer preferences. With an expansive range of offerings from ready-to-eat meals, snacks, beverages to culinary condiments, this continues to innovate and attract a larger customer base, positioning it as the leading area within the market.

Neutraceuticals

The Neutraceuticals category is gaining traction due to the growing consumer consciousness surrounding health and wellness. Individuals are increasingly seeking dietary supplements that offer additional health benefits, which alternative proteins can provide. Products rich in alternative proteins are being marketed for their potential to boost immune health, enhance muscle recovery, and promote overall wellness. This growing trend is further fueled by the aging population that values preventive health measures, thereby enhancing the attractiveness of the nutraceutical market.

Animal Feed

The Animal Feed category is another important as the demand for sustainable livestock production rises. With growing concerns about the environmental impact of traditional feed sources, alternative proteins are being utilized to offer a more sustainable solution. Livestock producers are increasingly incorporating these proteins to improve the nutritional profile of animal feed while reducing dependency on conventional protein sources such as soy and fish meal. This increasing shift towards sustainable farming practices is expected to bolster this significantly in the coming years.

Insights On Key End User

Flexitarians

Flexitarians are expected to dominate the Global Alternative Protein Market due to their increasing adoption of plant-based diets while still incorporating some meat products. This reflects a significant lifestyle change aimed at reducing meat consumption, primarily for health and environmental reasons. Flexitarians appeal to a broad audience who are not strictly vegetarian or vegan, allowing for greater market accessibility and acceptance. Their flexibility makes them a compelling market target, as they seek high-quality alternative protein options that satisfy both taste and nutritional requirements. This growing trend indicates a shift in consumer behavior towards more sustainable protein sources while still providing room for traditional meat consumption.

Vegans

The vegan, while smaller in comparison to flexitarians, has gained considerable traction in recent years. Driven by ethical considerations and health concerns, veganism represents an unwavering commitment to plant-based diets limited to no animal products. This group is enthusiastic about the variety of alternative protein sources available on the market today, from legumes to innovative lab-grown meat products. The economic potential of this audience is noteworthy, as they are willing to spend more on premium, ethically-sourced products that align with their values, thereby creating substantial growth opportunities in the alternative protein sector.

Vegetarians

The vegetarian category has consistently maintained a strong presence within the alternative protein market. Like vegans, vegetarians avoid meat, but their diet may still include eggs and dairy products. This flexibility can result in a wider acceptance of alternative protein products compared to strict plant-based diets. As health trends continue to rise, many consumers find themselves gravitating towards vegetarianism for its perceived health benefits and as a bridge between meat-eating and a fully plant-based lifestyle. This demographic showcases ample growth potential, particularly as food innovation continues to enhance the palatability and nutritional value of vegetarian options.

Meat Eaters

Meat eaters represent a that is perhaps the most challenging for the alternative protein market to penetrate. However, there is a growing awareness among this group regarding health issues and environmental impacts related to excessive meat consumption. Many meat eaters are beginning to explore alternative protein sources, seeking to reduce their meat intake without completely giving it up. This gradual transition towards including more plant-based proteins showcases an emerging opportunity for alternative protein brands to create products that appeal to the tastes and preferences of traditional meat consumers. Thus, while not the primary focus, this holds potential for growth as awareness and product development progresses.

Insights On Key Distribution Channel

Online Retail

The online retail sector is expected to dominate the Global Alternative Protein Market due to the rise of e-commerce and changing consumer shopping behaviors. As consumers increasingly prefer the convenience of online shopping, the category has witnessed significant growth, particularly driven by younger demographics seeking easy access to diverse product offerings. Online platforms allow for better price comparisons and access to a wider selection of alternative protein products, facilitating informed purchasing decisions. Additionally, the impact of global health crises has accelerated the shift toward online shopping, further entrenching this channel's dominant position in the market as consumers embrace the convenience and safety of home delivery services.

Hypermarkets/Supermarkets

Hypermarkets and supermarkets hold a significant share in the Global Alternative Protein Market, mainly due to their extensive reach and ability to attract a diverse customer base. These large retail stores provide a one-stop shopping experience, making them a popular choice among consumers. The appeal lies in their ability to offer a variety of alternative protein products under one roof, which caters to the increasing health-conscious population. Furthermore, the prevalence of promotional activities and discounts in these stores influences customer purchases, ensuring a steady flow of consumers seeking meat alternatives and plant-based options.

Health Food Stores

Health food stores play a niche role in the Global Alternative Protein Market, attracting a specialized customer base that prioritizes health and wellness. These retail outlets often emphasize organic and natural products, appealing particularly to consumers who are more conscious of nutritional content and sourcing. Furthermore, the knowledgeable staff and curated selections can enhance the shopping experience, fostering customer loyalty. Although this channel does not dominate overall sales, it continues to grow steadily as more health-focused consumers seek out specific product recommendations and unique offerings not typically found in larger retail environments.

Global Alternative Protein Market Regional Insights:

Asia Pacific

The Asia Pacific region is expected to dominate the Global Alternative Protein market due to its rapidly growing population, increasing demand for sustainable food sources, and significant investments in plant-based and cellular agriculture technologies. Countries like China and India are witnessing a rise in health consciousness and vegetarianism, driving the demand for alternative protein products. Furthermore, local companies are innovating to create culturally relevant products that appeal to consumers in the region. In addition, government support for sustainable food initiatives and a growing middle-class population are further propelling the alternative protein market forward, contributing to its anticipated dominance.

North America

North America is a key player in the Global Alternative Protein market, driven primarily by consumer trends shifting towards plant-based diets and increasing health awareness. Major brands in the United States and Canada are heavily investing in R&D for alternative protein solutions, including plant-based meats and dairy alternatives. The region's established supply chain and strong retail infrastructure also facilitate the accessibility of alternative protein products, making it a vital market. Furthermore, there is significant public interest and demand for sustainable and ethical food choices, which continues to stimulate innovation and growth in the industry.

Europe

Europe is witnessing a rapid adoption of alternative protein sources, fueled by a growing awareness of environmental sustainability and health concerns. The European Union supports many initiatives aimed at reducing carbon footprints, leading to favorable regulations for plant-based food products. Countries like Germany and the UK are at the forefront of this trend, with burgeoning markets for meat substitutes and dairy alternatives. Furthermore, there is a strong emphasis on local production and clean labeling, encouraging the growth of startups focused on alternative proteins, thereby amplifying market potential in the region.

Latin America

Latin America is gradually emerging in the alternative protein space, with countries like Brazil and Argentina showing promise in plant-based products. The region has a rich agricultural base that provides raw materials for plant protein, making it an advantageous locale for production. However, growth is still relatively nascent, primarily focusing on local consumption and less on export. The economic shifts toward sustainable practices and changing dietary patterns among younger populations herald new opportunities; nonetheless, market penetration remains limited compared to more developed regions.

Middle East & Africa

The Middle East and Africa are at a fundamental stage in the alternative protein market. Awareness of plant-based alternatives is increasing, driven by health trends and the quest for food security. However, challenges include limited infrastructure, regulatory hurdles, and higher prices for alternative protein products. While the market has potential due to increasing urbanization and a younger population, significant investment in production and distribution is needed for growth. Local startups are beginning to explore alternatives, yet the current dominance of meat-based diets presents substantial hurdles for widespread adoption in the region.

Alternative Protein Market Competitive Landscape:

Major participants in the worldwide alternative protein sector, encompassing both food tech firms and conventional meat manufacturers, play a vital role in the innovation, development, and expansion of plant-based, cultured, and fermentation-derived protein solutions to satisfy the increasing consumer appetite for sustainable protein sources. Their partnerships throughout the supply chain promote progress in product variety and enhance market reach.

The alternative protein sector is prominently represented by several major companies, including Beyond Meat, Impossible Foods, Oatly, Pea Protein Ltd., Memphis Meats, Mosa Meat, Eat Just, Inc., Perfect Day, MycoTechnology, Nutritional Holdings, Protix, NORI, Ginkgo BioWorks, Tyson Foods, and Bayer AG. Other influential players in this industry encompass ADM (Archer Daniels Midland Company), Cargill, DuPont, BASF, the Bill & Melinda Gates Foundation, the World Wildlife Fund (WWF), AgriProtein, and Blue Horizon. Furthermore, companies such as Greenleaf Foods, The Protein Brewery, Green Protein, and Synlogic play vital roles in advancing this field.

Global Alternative Protein Market COVID-19 Impact and Market Status:

The Covid-19 pandemic markedly expedited the expansion of the worldwide alternative protein market, driven by a rising consumer demand for sustainable and health-oriented food choices.

The COVID-19 pandemic has profoundly influenced the alternative protein industry, accelerating shifts in consumer behaviors toward plant-centered diets and protein substitutes. With an increase in health awareness during this period, many individuals began prioritizing nutritious and sustainable food options, resulting in a surge in demand for plant-based meats, dairy substitutes, and other protein sources. While the initial disruptions to supply chains impacted both production and distribution, innovative startups navigated these challenges by diversifying their distribution methods, particularly by enhancing online sales. Additionally, the pandemic compelled food companies to channel more resources into the research and development of alternative protein offerings to cater to the growing consumer interest. The ened public awareness of environmental sustainability during this time further amplified the attractiveness of plant-based diets, driving market expansion. This trend is reflected in increased investments and collaborative efforts within the industry, alongside a broader variety of alternative protein products being introduced to the market, all of which align with changing consumer preferences and expectations.

Latest Trends and Innovation in The Global Alternative Protein Market:

- In March 2021, Beyond Meat announced a partnership with McDonald’s to develop a new line of plant-based menu options, further solidifying its position in the fast-food sector.

- In June 2021, Oatly went public with an initial public offering (IPO) that raised nearly $1.4 billion, highlighting the increasing consumer interest in plant-based dairy alternatives.

- In August 2021, Swiss startup Eat Just, known for its egg substitute product, secured $200 million in funding to expand its capabilities in the alternative protein sector, specifically focusing on cultured meat.

- In September 2021, Tyson Foods announced its acquisition of the alternative protein company Planterra Foods, which focuses on creating plant-based protein items under the Ozo brand, indicating larger meat producers' interest in diversifying their portfolios.

- In December 2021, Impossible Foods launched its new "Impossible Sausage" product, expanding its offerings into breakfast items and targeting a growing market for plant-based breakfast alternatives.

- In February 2022, a collaboration between the American company Aleph Farms and the Japanese firm Mitsubishi resulted in the development of cultivated meat products aimed at the Asian market, showcasing cross-border innovation in alternative proteins.

- In May 2022, the vegan cheese brand Violife entered into a strategic partnership with the Canadian company, Plant Pure, focusing on the distribution of environmentally friendly cheese alternatives in North America.

- In November 2022, the food tech startup Nutrafol announced the acquisition of the alternative protein company Plant Nutrition in a move to integrate plant-based ingredients into their products for improved health and wellness offerings.

- In April 2023, BYND Foods, a subsidiary of Beyond Meat, launched a collaboration with popular sports nutrition brand Muscle Milk to develop plant-based protein bars, tapping into the fitness market.

- In October 2023, Eat Just obtained regulatory approval for its cultivated chicken product in Singapore, marking a significant milestone in the commercialization of lab-grown meat in Asia.

- In November 2023, Cargill announced a partnership with The Good Food Institute to invest in and develop sustainable plant-based protein options, indicating a commitment of traditional food companies towards innovation in the alternative protein arena.

Alternative Protein Market Growth Factors:

The market for alternative proteins is expanding, spurred by ened consumer interest in sustainable food choices, technological innovations, and a growing understanding of the health and environmental advantages associated with these products.

The alternative protein sector is undergoing remarkable expansion, driven by a variety of interrelated elements. Firstly, an increasing awareness among consumers about health and wellness is boosting the interest in plant-based protein sources, which are often linked to a reduced risk of chronic illnesses. Furthermore, ened concerns regarding environmental sustainability and the ethical treatment of animals are prompting individuals to explore non-animal protein options, thereby lessening their environmental impact. Advances in food technology, particularly in enhancing the flavor and texture of plant-based proteins, also contribute to their attractiveness, allowing these alternatives to compete more effectively with conventional meat products.

Moreover, the rising prevalence of food allergies and lactose intolerance is further fueling the need for alternative protein sources, as individuals seek safe and appropriate dietary choices. Supportive government policies and investments in sustainable food production are also playing a crucial role in fostering growth in this market by encouraging research and innovation. The increasing popularity of vegan and flexitarian lifestyles among diverse groups is acting as a significant driver for major food companies to broaden their alternative protein portfolios. Additionally, the COVID-19 pandemic has intensified focus on food supply chain resilience, emphasizing the importance of diverse food systems and thereby accelerating the acceptance of alternative proteins. Together, these dynamics are setting the stage for substantial growth in the alternative protein market in the years ahead.

Alternative Protein Market Restaining Factors:

Significant barriers in the alternative protein sector encompass consumer reluctance stemming from taste inclinations, regulatory hurdles, and rivalry from conventional meat options.

The alternative protein sector is experiencing rapid growth, yet it encounters several challenges that could hinder its advancement. One major issue is consumer skepticism surrounding the taste, texture, and general perception of both plant-based and lab-cultured proteins when compared to conventional meat options. Furthermore, the elevated production costs linked to cutting-edge protein technologies like fermentation and cellular agriculture can restrict competitive pricing, complicating efforts to penetrate mainstream markets. Regulatory obstacles present another significant impediment, as the complexities of food safety and labeling regulations may slow down product introductions. Additionally, the limited supply of raw materials and reliance on particular agricultural practices can intensify supply chain difficulties. Cultural preferences and established dietary habits, often tied to traditional cuisines, also pose barriers to the widespread acceptance of alternative proteins. However, growing awareness about sustainability and health advantages is fuelling consumer interest, indicating that persistent innovation and education could help address these challenges. This suggests a positive trajectory for the alternative protein industry, as it evolves to meet the shifting preferences of consumers.

Key Segments of the Alternative Protein Market

By Protein Source

• Plant Based Protein

• Animal Derived Proteins

• Mycoprotein

• Insect Based Protein

By Formulation Type

• Whole Food

• Processed Protein Products

• Protein Supplements

By Application

• Food and Beverages

• Neutraceuticals

• Animal Feed

By End User

• Vegans

• Vegetarians

• Flexitarians

• Meat Eaters

By Distribution Channel

• Online Retail

• Hypermarkets/Supermarkets

• Health Food Stores

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America