Alcohol Packaging Market Analysis and Insights:

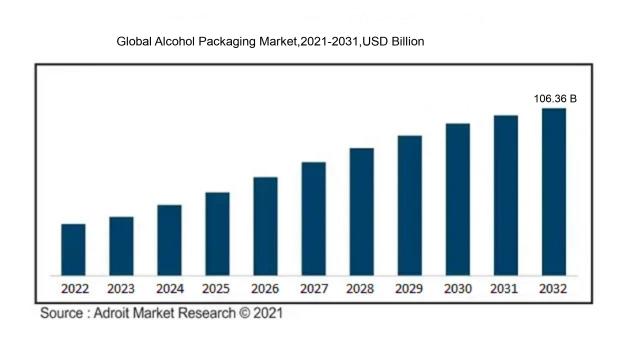

In 2023, the size of the worldwide Alcohol Packaging market was US$ 60.13 billion. Adroit Market Research projects that the market will increase at a compound annual growth rate (CAGR) of 5.42% from 2024 to 2032, reaching US$ 106.36 billion.

The Alcohol Packaging Market is propelled by a variety of significant influences. Primarily, the ened interest in alcoholic products, particularly among younger generations such as millennials and Gen Z, is driving advancements in packaging aesthetics and materials. The shift towards sustainability is becoming increasingly important, leading brands to implement environmentally friendly packaging options that resonate with eco-aware consumers. Additionally, the expansion of the e-commerce realm necessitates robust packaging solutions to guarantee the safe transit of products. The emergence of craft breweries and small-scale distilleries is further pushing for distinctive, premium packaging as a means of standing out in a crowded marketplace. Furthermore, evolving regulations and an emphasis on compliance with labeling and packaging standards are spurring innovation and adjustments across the industry. Collectively, these elements are shaping the ever-changing landscape of alcohol packaging.

Alcohol Packaging Market Definition

Alcohol packaging involves the materials and design elements utilized to encase, safeguard, and display alcoholic drinks for retail and consumption purposes. This includes a variety of containers such as bottles and cans, along with labels and closures, all designed to comply with regulatory requirements while also enhancing the brand's visual appeal.

The packaging of alcoholic beverages is integral to maintaining safety, quality, and brand presence. Well-designed packaging shields against contamination and deterioration, ensuring the product remains untainted. Additionally, it functions as an important means of communication, offering crucial details such as alcohol percentage, health advisories, and serving recommendations. Attractive designs draw the attention of potential buyers and communicate the brand's ethos, impacting their purchasing choices. Moreover, adherence to regulations necessitates appropriate labeling and packaging to deter underage consumption. In summary, carefully considered alcohol packaging not only protects the product but also cultivates brand loyalty and improves the overall consumer experience.

Alcohol Packaging Market Segmental Analysis:

Insights On Material

Glass

Glass is expected to dominate the Global Alcohol Packaging Market due to its premium appeal and sustainability. Consumers increasingly prefer glass packaging for alcoholic beverages as it preserves the flavor and quality of the liquor more effectively than other materials. Additionally, glass is non-reactive, making it ideal for packaging various alcoholic drinks, including wine, spirits, and beers. The growing trend towards environmentally friendly packaging is also bolstering glass's popularity since it is highly recyclable and maintains its quality after multiple reuses. As a result, manufacturers are investing more in glass packaging solutions, thereby driving its market share upward.

Metal

Metal is a significant player in the alcohol packaging landscape, especially for beer and some spirits. The primary advantage of metal packaging, such as aluminum cans, is its lightweight nature and convenience, which appeals to on-the-go consumers. Metal also offers excellent protection from light and oxygen, both of which can negatively impact the quality of the beverage. However, while metal is favored for short-term consumption, it generally lacks the premium feel associated with glass packaging, limiting its appeal for high-end spirits and wines.

Plastic

Plastic packaging is gaining traction in the alcohol sector due to its versatility, lightweight nature, and cost-effectiveness. It's primarily used in convenience-focused s, like ready-to-drink cocktails and certain beer products. The ability to mold plastic into various shapes allows for innovative designs and branding opportunities. Nevertheless, plastic struggles with perceptions around quality and environmental sustainability, which can deter consumers looking for a more premium packaging option. Additionally, newer regulations around recycling and sustainability are placing pressure on the growth of plastic in this market.

Paper and Paperboard

Paper and paperboard serve a niche role in the alcohol packaging market, primarily used for labeling and secondary packaging. They are often seen in gift packaging and specialized alcoholic beverages that prioritize sustainability and eco-friendliness. They offer aesthetic value and can be recycled, which appeals to environmentally conscious consumers. However, their use is limited for primary packaging due to their susceptibility to moisture and lack of durability compared to glass or metal. Thus, while they have an important role, their market share remains limited relative to other materials.

Others

The "Others" category in alcohol packaging can include diverse materials such as composite materials or biodegradable packaging solutions. While this may not account for a major portion of the market, it is growing as brands seek to differentiate themselves and promote sustainable options. Innovative packaging designs, such as eco-friendly pouches and hybrid containers, are gaining popularity, especially among newer brands aiming to attract environmentally aware consumers. However, their market impact is still minimal when compared to the established preferences for glass, metal, and plastic.

Insights On Product Type

Cans

Cans are expected to dominate the Global Alcohol Packaging Market due to their lightweight nature, ease of transportation, and recycling capabilities. As consumer preferences shift towards convenience and portability, aluminum cans are increasingly favored for their ability to chill drinks more quickly and efficiently, making them popular for outdoor events and social gatherings. Additionally, the growing trend of craft beverages has stimulated innovation in can designs and sizes, appealing to a younger demographic focused on environmentally friendly packaging. The sustainability initiatives around aluminum also bolster its position, resulting in a projection of continued growth and dominance over other packaging types.

Bottles

Bottles remain a significant product type in the Alcohol Packaging Market, particularly for premium spirits and wines. They are attributed to their aesthetic appeal and ability to retain beverage integrity and flavor over time. Glass bottles convey a sense of quality and luxury, encouraging consumer confidence in purchasing. The traditional nature associated with bottled beverages continues to hold sway among manufacturers seeking to cultivate a brand identity rooted in heritage and authenticity. Though bottles are heavier and less eco-friendly compared to cans, their longstanding market presence ensures they remain a vital component within the broader packaging landscape.

Bag-in-box

Bag-in-box packaging has gained traction, particularly for wine and certain branded spirits. This packaging format offers convenience and a longer shelf life once opened, appealing to consumers who wish to enjoy their beverages over an extended period without compromising taste. The ease of storage and service in various settings, such as parties and events, adds to its popularity. Furthermore, manufacturers benefit from reduced packaging costs, allowing for competitive pricing in the market. Although the approach is still niche compared to bottles and cans, it captures a specific audience looking for functional and practical solutions.

Brick Carton

Brick cartons have made some inroads into the Alcohol Packaging Market, primarily for wines and some lower-alcohol beverages. Their lightweight and easy-to-shape nature makes them cost-effective for distribution while also providing a barrier to light and air exposure. While not as premium as other packaging types, brick cartons appeal to environmentally conscious consumers thanks to their recyclable materials. They are especially popular for bulk purchases or in markets where price sensitivity is a crucial factor. Though their market share remains limited in comparison to bottles and cans, they present a valuable option for specific consumer s.

Others

The "Others" category encompasses a variety of unique packaging formats, such as kegs and pouches. These alternatives often cater to niche markets or specific types of beverages, such as draft beers or flavored alcoholic drinks. Kegs, for instance, are crucial for on-trade sales (bars and restaurants) and are typically used for larger volumes at social events. Pouches present a fun and casual option, appealing particularly to younger consumers. While this category may not dominate the market, its diversity allows brands to innovate and offer distinctive experiences that could capture the interest of evolving consumer trends.

Insights On Application

Beer

The beer category is expected to dominate the Global Alcohol Packaging Market due to its massive and continually growing consumer base across various demographics. The increasing popularity of craft beers and local breweries has significantly boosted demand for diverse packaging solutions. Additionally, the rise of premium and artisanal beers has led to higher investments in sustainable and innovative packaging materials, emphasizing branding and consumer appeal. Convenience packaging, such as cans and eco-friendly options, aligns with current consumer trends towards sustainability. The combination of these factors ensures that beer packaging will lead the market as breweries strive to differentiate themselves in an increasingly competitive landscape.

Wine

Wine packaging is experiencing substantial growth, driven by a resurgence in wine consumption worldwide, particularly among younger consumers. The trend towards premium and organic wines has elevated packaging designs that emphasize quality and sustainability. Moreover, advancements in wine packaging such as bag-in-box and wine pouches cater to convenience-seeking consumers, further expanding market potential. The vibrant sector of wine also leverages creative packaging for product differentiation at retail, enhancing visual appeal. This innovation aligns with consumer preferences for personalized and unique products, supporting a thriving wine packaging market.

Spirits

The spirits market has seen significant growth, propelled by the popularity of cocktails and the revival of classic spirits such as whis and gin. This benefits from distinguished packaging designs that reflect brand heritage and innovative craftsmanship. Additionally, premiumization in the spirits category encourages unique and luxurious packaging, attracting high-end consumers looking for distinctive offerings. However, this market remains highly competitive, with stringent regulations on labeling and packaging materials, which brands must navigate to ensure market success. While robust, the spirits faces challenges in overtaking the beer packaging market.

Others

The "Others" category, which encompasses various alcoholic beverages like ready-to-drink (RTD) cocktails and flavored spirits, is witnessing a gradual uptick in market demand. The growth of RTD drinks is particularly notable, driven by consumer preference for convenience and innovation in flavors. As manufacturers aim to capture the attention of younger audiences, packaging plays a crucial role, facilitating travel-friendly options and vibrant designs. However, this remains smaller compared to beer, wine, and spirits, relying on niche markets and creative branding strategies to drive consumer interest.

Global Alcohol Packaging Market Regional Insights:

Asia Pacific

The Asia Pacific region is expected to dominate the Global Alcohol Packaging market due to a combination of rapid urbanization, changing consumer behaviors, and increasing disposable income levels, which have led to a surge in alcohol consumption, particularly among younger demographics. Countries like China and India are experiencing significant growth in their alcoholic beverage sectors, supported by a broader acceptance of alcoholic beverages and a growing middle class. Additionally, the region’s vibrant manufacturing capabilities facilitate cost-effective packaging solutions, enhancing competitiveness. The expansion of international brands and the rise of craft beverages also drive demand for innovative and sustainable packaging options, positioning Asia Pacific as the leading region in this market.

North America

North America holds a substantial share of the Global Alcohol Packaging market, driven primarily by the United States, which is one of the largest consumers of alcohol globally. The region is characterized by a strong market for premium and craft beverages, leading to a rising demand for attractive and sustainable packaging options. Furthermore, consumers are increasingly seeking convenience through ready-to-drink beverages, contributing to innovation within packaging design. Regulatory frameworks in the region also support environmentally friendly packaging, aligning with consumer preferences for sustainability.

Europe

Europe remains a significant player in the Global Alcohol Packaging market, buoyed by the popularity of traditional alcoholic beverages such as beer and wine. The region's rich history of alcohol production leads to high consumption levels, fostering a demand for diverse packaging formats ranging from glass bottles to eco-friendly alternatives. Additionally, stringent regulations on materials and waste management in several European countries drive a focus on sustainability in packaging solutions. The presence of established brands alongside emerging craft distilleries also contributes to a dynamic packaging landscape.

Latin America

Latin America is witnessing growth in the Global Alcohol Packaging market, influenced by an increase in disposable income and a burgeoning middle class that is adopting alcohol consumption as part of lifestyle changes. The region’s rich cultural heritage in beverage production, particularly in countries like Brazil and Argentina, propels demand for unique and culturally relevant packaging solutions. The craft beverage movement is gaining traction, encouraging innovation in packaging to differentiate products in a competitive market. However, economic challenges and varying regulations can impact growth trajectories within this.

Middle East & Africa

The Middle East & Africa region is emerging in the Global Alcohol Packaging market, albeit with challenges stemming from cultural and regulatory constraints surrounding alcohol consumption. Nevertheless, increasing urbanization and economic growth are fostering a burgeoning market for alcoholic beverages in select countries. The rise in tourism in regions like Africa creates opportunities for premium packaging offerings, especially in the wine and spirits sectors. As consumer preferences evolve and the market matures, demand for sustainable and innovative packaging solutions is likely to increase, although growth may remain slower compared to other regions.

Alcohol Packaging Market Competitive Landscape:

Prominent actors in the worldwide alcohol packaging industry significantly contribute to the development of sustainable packaging alternatives while improving product visibility and adhering to regulatory requirements. Their initiatives promote market expansion by addressing consumer demands for convenience and environmentally-friendly options.

The Alcohol Packaging Market features several prominent companies, including Amcor plc, Owens-Illinois, Inc., Ball Corporation, Crown Holdings, Inc., Ardagh Group, and Smurfit Kappa Group. Other notable players are Bericap GmbH & Co. KG, CKS Packaging, Inc., Constellation Brands, Inc., Nampak Limited, RPC Group Plc, Nüdur, Diageo plc, and Allied Glass Containers Ltd. Furthermore, enterprises such as Greiner Packaging International GmbH, HUBER Packaging Group GmbH, Verallia, and Stölzle-Oberglas GmbH also significantly impact this sector. These organizations are essential in producing a wide array of packaging solutions tailored for alcoholic beverages, addressing the diverse needs and s within the industry.

Global Alcohol Packaging Market COVID-19 Impact and Market Status:

The Covid-19 pandemic greatly intensified the need for eco-friendly and e-commerce-compatible packaging solutions for alcoholic beverages, as consumers increasingly opted for online shopping and demonstrated a preference for sustainability.

The COVID-19 pandemic has had a profound impact on the alcohol packaging sector, primarily due to alterations in consumer behavior and manufacturing methods. As lockdowns and social distancing protocols were implemented, there was a significant rise in off-premise alcohol consumption, which greatly increased the demand for packaged alcoholic drinks. Consumers began favoring products that prioritized convenience and safety, leading to a greater emphasis on single-serve and ready-to-drink packaging formats. Furthermore, disruptions in the supply chain caused shortages in raw materials and delays in production schedules, compelling manufacturers to refine their operations and investigate sustainable packaging solutions. The rapid growth of e-commerce and home delivery options also prompted shifts in packaging design, focusing on durability and transport efficiency. While the pandemic created various challenges, it simultaneously spurred innovation within the alcohol packaging industry, potentially resulting in enduring shifts in consumer trends and market practices.

Latest Trends and Innovation in The Global Alcohol Packaging Market:

- In April 2023, Ball Corporation announced the acquisition of the metal beverage can manufacturing operations from Crown Holdings, significantly expanding its production capacity in North America to meet the growing demand for sustainable packaging solutions.

- In November 2022, Amcor plc introduced its new recyclable paper-based bottle for spirits, marking a significant advancement in sustainable alcohol packaging. This innovation utilizes a proprietary design that is fully recyclable, supporting a circular economy.

- In July 2023, Constellation Brands partnered with the sustainable packaging company, Eco-Box Solutions, to launch a new line of environmentally friendly wine packaging that reduces carbon footprint and improves recyclability.

- In March 2023, Diageo announced the rollout of its 'Green Bottle' initiative, featuring lightweight glass bottles that reduce carbon emissions in the production process. This initiative is part of their broader strategy to achieve net-zero carbon emissions across their direct operations by 2030.

- In August 2023, Ardagh Group initiated a merger with Crescendo Equity Partners, which aims to enhance their capabilities in sustainable glass production and expand their portfolio in the alcoholic beverage sector, leveraging innovative technologies in manufacturing.

- In February 2023, O-I Glass, Inc. highlighted its investment in a new furnace that uses hybrid technology, which is expected to reduce energy consumption by up to 40% in the production of glass bottles used for beverages, including alcohol.

- In December 2022, Canpack Group unveiled its state-of-the-art facility in the United States focused exclusively on producing aluminum beverage cans, thus responding to the growing demand for canned alcohol products, especially ready-to-drink cocktails.

- In September 2023, Molson Coors Beverage Company announced a collaboration with the start-up company, Paper Bottle Company, to pilot eco-friendly paper bottles designed for its beer products, marking a significant step towards reducing plastic usage in packaging.

Alcohol Packaging Market Growth Factors:

The expansion of the alcohol packaging sector is fueled by increasing consumer interest in high-quality drinks, creative packaging solutions, and efforts towards sustainability.

The Alcohol Packaging Market is witnessing remarkable expansion, attributed to several pivotal factors. Primarily, the global increase in alcohol consumption, especially within developing nations, is driving the demand for novel packaging solutions that boost product attractiveness and ease of use. The focus on sustainability is reshaping packaging preferences, as both consumers and manufacturers lean towards eco-conscious materials, resulting in a notable rise in the use of recyclable and biodegradable options. Moreover, the premiumization trend within the alcohol industry is fostering the adoption of luxurious packaging that reflects quality and craftsmanship. The surge of e-commerce has also altered distribution methods, creating a need for packaging that safeguards products during shipping while aligning with consumers' online shopping habits. Additionally, in a fiercely competitive landscape, brands are prioritizing unique and visually appealing designs to stand out and capture consumer interest. Innovations in packaging technology, such as smart packaging solutions, are enhancing the user experience and providing valuable product information, further stimulating market growth. In summary, the interplay of evolving consumer preferences, sustainability initiatives, and advancements in packaging technology are crucial drivers of the Alcohol Packaging Market's growth trajectory.

Alcohol Packaging Market Restraining Factors:

Crucial constraints affecting the alcohol packaging sector involve rigid regulations surrounding labeling and packaging materials, which can pose significant challenges for manufacturers in terms of compliance.

The Alcohol Packaging Market encounters several challenges that could impede its expansion. Stringent regulatory frameworks and labeling mandates introduce obstacles for producers, complicating the packaging workflow. Furthermore, the growing consumer consciousness surrounding the health dangers linked to alcohol consumption might decrease demand, thereby affecting the packaging sector. Significant variations in the costs of raw materials such as glass, metal, and plastic can put pressure on the profit margins of packaging firms. Additionally, the push for sustainable packaging poses difficulties, as the industry must transition to environmentally-friendly materials and methods while maintaining cost-effectiveness and performance. The rise of non-alcoholic beverages also adds competitive pressure on the alcoholic beverage market and its packaging solutions. Lastly, supply chain interruptions, intensified by global challenges like the COVID-19 pandemic, can disrupt the supply and production of packaging resources. Nevertheless, the Alcohol Packaging Market also holds growth potential, particularly as innovations in sustainable packaging and improved designs resonate with environmentally-conscious consumers. As brands place greater emphasis on enhancing packaging appeal and functionality, a revival in demand appears likely, suggesting a potentially bright outlook for the future.

Segments of the Alcohol Packaging Market

Segmentation by Material:

- Glass

- Metal

- Plastic

- Paper and Paperboard

- Others

Segmentation by Product Type:

- Bottles

- Cans

- Bag-in-box

- Brick Carton

- Others

Segmentation by Application:

- Beer

- Wine

- Spirits

- Others

Regional Overview

North America

- US

- Canada

- Mexico

Europe

- Germany

- France

- U.K

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

Middle East and Africa

- Saudi Arabia

- UAE

- Rest of Middle East and Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America