Agriculture Supply Chain Management Market Analysis and Insights:

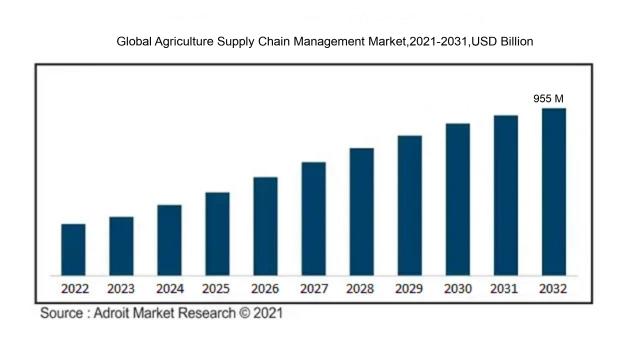

In 2023, the size of the worldwide Agriculture Supply Chain Management market was US$ 400 million. Adroit Market Research projects that the market will increase at a compound annual growth rate (CAGR) of 10% from 2024 to 2032, reaching US$ 955 million.

The Agriculture Supply Chain Management (SCM) sector is shaped by a variety of critical elements that contribute to its advancement and optimization. Innovations in technology, including precision agriculture and the Internet of Things (IoT), are pivotal in boosting efficiency and strategic decision-making, leading to superior resource management. The rising food demand prompted by expanding global populations necessitates enhanced supply chain strategies to maintain food security. Furthermore, the growing emphasis on sustainability is encouraging agricultural participants to implement environmentally friendly methods, thus impacting supply chain processes. The application of data analytics facilitates improved forecasting, effective risk management, and streamlined logistics, which help minimize waste and maximize profitability. Moreover, supportive government policies and initiatives aimed at agricultural growth and infrastructure development significantly improve supply chain functionality. As consumers increasingly prioritize the quality and source of their food, the need for transparency and traceability within the supply chain has intensified, driving investments in innovative strategies that meet consumer desires and regulatory requirements. Collectively, these dynamics foster the ongoing transformation of Agriculture SCM in the contemporary marketplace.

Agriculture Supply Chain Management Market Definition

Agricultural supply chain management encompasses the organized oversight of the stages involved in the production, processing, distribution, and consumption of food products. The main objective is to improve operational efficiency, minimize expenses, and elevate the quality of food distribution from the farm to the consumer.

Agricultural Supply Chain Management (SCM) plays a vital role in guaranteeing the seamless transition of products from producers to consumers, boosting efficiency and minimizing waste. By refining logistics, inventory control, and distribution systems, SCM ensures that fresh agricultural items are readily available while keeping costs low. It encourages cooperation among various stakeholders such as farmers, suppliers, and retailers, leading to improved decision-making and resource distribution. A well-implemented SCM strategy can enhance food security, increase responsiveness to market variations, and strengthen resilience against interruptions, ultimately fostering sustainable farming practices and improving the financial outcomes for everyone involved in the supply chain.

Agriculture Supply Chain Management Market Segmental Analysis:

Insights On Component

Services

The services component in the Global Agriculture Supply Chain Management Market is expected to dominate since it is primarily focused on support and consulting, which are crucial for the effective implementation of solutions. These services include system integration, training, and ongoing support that help businesses adapt to changing technologies. While this sector is important, it tends to follow the advancements in solutions; as technology evolves, so does the demand for tailored services that optimize the use of these solutions in different agricultural scenarios. Though crucial for the sector, this area is more reactive compared to the proactive nature of the solutions.

Solution

The solution aspect of the Global Agriculture Supply Chain Management Market is growing primarily due to the increasing demand for advanced technologies that enhance efficiencies in agricultural operations. These solutions encompass software and applications that offer real-time data analytics, tracking, and automation capabilities. The rising need for precision farming, efficiency in resource utilization, and compliance with sustainability regulations significantly drives this demand. Moreover, with the digital transformation underway in agriculture, businesses are more inclined to invest in technological solutions that not only streamline processes but also minimize waste and improve yield, thereby solidifying the dominance of this component.

Insights On Solution type

Inventory Management Solutions

The dominating part expected to lead the Global Agriculture Supply Chain Management Market is inventory management solutions. This is primarily due to the fact that efficient inventory management plays a crucial role in optimizing the agricultural supply chain, reducing waste, and improving profitability. With advancements in technology, farmers and suppliers are increasingly adopting solutions that enable real-time tracking of stock levels, automate reorder processes, and enhance visibility across the supply chain. This shift toward data-driven decision-making is not only raising operational efficiency but is also essential in managing seasonal variations and demand fluctuations prevalent in the agricultural sector.

Fleet Management Solutions

Fleet management solutions are becoming increasingly relevant in the agricultural landscape, particularly with the rising emphasis on logistics efficiency. By monitoring vehicle performance and optimizing routes, these solutions help in reducing transportation costs. Furthermore, they contribute to timely deliveries which are critical for perishable goods. With growing investments in technology, innovations such as GPS tracking and telematics are elevating the standard of fleet management, thus enhancing productivity and reducing resource wastage across agricultural operations.

Supplier Management

Supplier management is essential in ensuring that agricultural producers can effectively coordinate with multiple suppliers to source quality inputs like seeds and fertilizers. This involves evaluating supplier performance, managing contracts, and ensuring compliance with quality standards. As the agriculture sector faces pressure to maintain high productivity, effective supplier management can significantly influence the consistency and quality of the supply chain. Furthermore, this is vital for establishing strong partnerships and negotiating better terms, thereby enhancing the overall performance of the agricultural supply chain.

Market Intelligence

Market intelligence serves as an indispensable tool for agricultural businesses, enabling them to gather insights into market trends, pricing strategies, and competitive dynamics. This data-driven approach assists stakeholders in making informed decisions about crop selection, pricing, and risk management. As volatility in agricultural markets continues to grow, businesses that leverage market intelligence can better position themselves to seize opportunities and mitigate risks, thus enhancing their competitive advantage and driving long-term sustainability in operations.

Food Safety & Compliance

Food safety and compliance solutions are critical in today’s agricultural landscape, driven by increasing regulatory requirements and consumer expectations for safe, high-quality food. These solutions monitor and ensure adherence to food safety standards throughout the supply chain, from farm to table. By implementing these compliance mechanisms, businesses can not only mitigate risks related to contamination and recalls but also build consumer trust and brand reputation. As companies aim to meet stringent regulations while maintaining quality, food safety and compliance measures are becoming integral to operational strategies in agriculture.

Others

The “others” category encompasses various alternative solutions that may address specific needs within the agricultural supply chain management framework. This includes specialized software and tools tailored for niche markets or practices, such as precision agriculture technologies or analytics-based decision-making platforms. While this may not have the market presence of the others mentioned, it is nonetheless gaining traction as agricultural stakeholders seek tailored solutions to optimize unique aspects of their operations. As agriculture continues to evolve with technological advancements, this category might witness growth as new challenges and requirements arise.

Insights On Deployment model

On-premise

The On-premise is expected to dominate the Global Agriculture Supply Chain Management Market. This model has traditionally been used by many organizations due to its perceived control and security benefits. Companies opting for this model appreciate the ability to keep sensitive data in-house, avoiding potential vulnerabilities associated with cloud storage. However, the high initial investment and maintenance costs can be drawbacks, particularly for smaller agricultural enterprises. While still relevant, this model's appeal is diminishing as more companies recognize the advantages of cloud computing and the benefits of reducing the burden of IT management while searching for ways to optimize their supply chain operations.

On-demand/cloud-based

The On-demand/cloud-based approach is increasingly filling the gaps in agriculture, but it still faces limitations. Dependence on internet connectivity is a significant challenge in rural areas where many agricultural operations are located. Additionally, concerns regarding data privacy and ownership are notable, causing hesitation among organizations that are cautious about shifting their data to third-party providers. Although these issues persist, many agribusinesses are gradually recognizing that the benefits of flexibility and enhanced communication offered by cloud solutions can outweigh these concerns, leading to growing adoption potential in the sector.

Global Agriculture Supply Chain Management Market Regional Insights:

Asia Pacific

The Asia Pacific region is expected to dominate the Global Agriculture Supply Chain Management market due to its vast agricultural landscape, significant population, and rapid economic growth. Countries like China and India are major agricultural producers, accounting for a large percentage of the world's agricultural output. The increasing demand for more efficient supply chains, fueled by a rising middle class and urbanization, drives investment in technology and infrastructure improvements. Furthermore, government initiatives supporting modern farming practices and sustainability measures are propelling innovation in supply chain management practices, making the Asia Pacific a central hub for agricultural advancements.

North America

North America, particularly the United States and Canada, boasts a highly developed agricultural sector with advanced supply chain technologies. The region benefits from significant capital investment and innovation, leading to efficient logistics and distribution. Moreover, strong consumer demand for sustainable and organic products is driving improvements in supply chain processes. However, while it is a player, North America may not surpass the growth potential seen in the Asia Pacific region due to market saturation and limited expansion opportunities.

Europe

Europe is well-known for its agricultural practices and high-quality products, with countries like France, Germany, and the Netherlands leading in both production and sustainability. The region has stringent regulations on food safety and sustainability, influencing supply chain practices to adopt transparency and eco-friendly processes. However, the overall market growth may be stifled by regulatory constraints and a slower population growth rate compared to Asia Pacific, limiting its dominant position.

Latin America

Latin America has a rich agricultural heritage and is a major exporter of commodities like coffee, soybeans, and sugar. The region is increasingly focusing on technology adoption within its agricultural supply chains to improve efficiency and traceability, but challenges such as infrastructure deficits, political instability, and varying regulations often hinder growth. These factors contribute to Latin America's potential but prevent it from dominating the global market like Asia Pacific.

Middle East & Africa

The Middle East & Africa region presents unique opportunities in agriculture due to its diverse climatic conditions and growing demand for food security. Investments in agricultural technology and practices are on the rise, especially in water-scarce areas. Nevertheless, the sector faces significant barriers, including outdated infrastructure and limited access to modern farming techniques, which restrict growth and overall market share in comparison to the leading Asia Pacific region.

Agriculture Supply Chain Management Market Competitive Landscape:

Central figures in the worldwide Agricultural Supply Chain Management sector encompass producers, distributors, and logistics firms that collaborate to refine the movement of goods from agricultural operations to end-users. Their primary objectives include improving efficiency, minimizing expenses, and maintaining product quality across the entire supply chain.

Prominent participants in the Agriculture Supply Chain Management sector encompass Cargill, Archer Daniels Midland Company (ADM), Bayer AG, BASF SE, John Deere, Syngenta AG, and DuPont de Nemours, Inc., now referred to as Corteva Agriscience. Other noteworthy contributors include Trimble Inc., AG Leader Technology, Taranis, TELUS Agriculture, AgriWebb, FarmLogs, and Agroop. Additionally, firms such as Raven Industries, Nutrien Ltd., Farmers Edge, Cropio, and IBM play a significant role in delivering diverse solutions and technologies aimed at optimizing agriculture supply chain processes on a global scale.

Global Agriculture Supply Chain Management Market COVID-19 Impact and Market Status:

The Covid-19 pandemic had a profound impact on the global agricultural supply chain management, leading to a scarcity of labor, delays in logistics, and ened compliance expenses, which collectively disrupted food production and distribution.

The COVID-19 pandemic brought substantial upheaval to the agricultural supply chain management sector, creating numerous obstacles in areas such as production, distribution, and logistics. The implementation of lockdowns and restrictions led to a decrease in available labor, which in turn contributed to diminished agricultural productivity and postponed harvests. Constraints on transportation hindered the movement of goods, resulting in supply shortages and escalated costs for producers and consumers alike. At the same time, evolving consumer preferences—particularly the spike in online grocery shopping—necessitated a rapid adjustment within supply chains to accommodate these new buying patterns. The crisis catalyzed the adoption of technological solutions, with many participants in the industry leveraging digital tools for enhanced inventory oversight and demand forecasting. Moreover, the pandemic highlighted existing weaknesses in global supply networks, prompting a reassessment of sourcing strategies aimed at bolstering resilience. In summary, while the agricultural supply chain management market encountered immediate disruptions, it also promoted innovation and adaptation that may influence its future development.

Latest Trends and Innovation in The Global Agriculture Supply Chain Management Market:

- In July 2023, Bayer AG announced its acquisition of Biologics, a startup specializing in biological crop protection products, aimed at enhancing sustainable farming practices and diversifying Bayer’s product portfolio in the agriculture sector.

- In August 2023, Cargill partnered with Farmers Business Network (FBN) to provide farmers with improved data analytics tools for crop management, enhancing decision-making processes and strengthening the agricultural supply chain.

- In September 2023, Truterra, the sustainability business of Land O'Lakes, launched its new digital platform focused on sustainable farming practices, enabling farmers to track their sustainability metrics and improve soil health while optimizing yield and reducing costs.

- In October 2023, AG Leader Technology introduced a new precision agriculture software suite to help farmers better manage their operations, utilizing real-time data to make informed decisions on planting, fertilizing, and harvesting.

- In June 2023, John Deere expanded its investment in autonomous tractor technology through the acquisition of a controlling stake in a robotics startup, aiming to integrate advanced AI and robotics into its farming equipment.

- In July 2023, Syngenta launched a new precision irrigation technology designed to help farmers optimize water use and increase crop yields while reducing operational costs, further streamlining the agricultural supply chain.

- In August 2023, Trimble announced the release of its new connected farming solutions that combine IoT technology with data analytics, aiming to enhance visibility and operational efficiency across the agricultural supply chain.

- In September 2023, Olam Agribusiness and Microsoft entered into a strategic partnership to leverage cloud computing and AI technologies for improving supply chain transparency and efficiency in the food and agriculture sector.

Agriculture Supply Chain Management Market Growth Factors:

The Agriculture Supply Chain Management sector is experiencing growth driven by technological innovations, a ened focus on food security, and the emerging emphasis on sustainable practices.

The market for Agriculture Supply Chain Management (SCM) is witnessing remarkable expansion driven by a variety of interconnected factors. First and foremost, the surge in the global population and the corresponding rise in food requirements call for effective supply chain strategies to guarantee food security. Innovations in technology, particularly in areas such as the Internet of Things (IoT), big data, and blockchain, are improving visibility, traceability, and efficiency within the supply chain infrastructure. Farmers are progressively implementing precision agriculture techniques, which demand comprehensive supply chain management systems to optimize resource distribution and maximize crop yields.

Moreover, there is a growing focus on sustainability and environmentally friendly practices, prompting all stakeholders to embrace smarter supply chain approaches that reduce waste and lessen ecological footprints. Additionally, governmental initiatives and funding aimed at upgrading agricultural infrastructure are further enhancing market growth by facilitating improved logistics and connectivity between producers and consumers. The COVID-19 pandemic has also revealed significant weaknesses in traditional supply chains, leading to a ened emphasis on resilience and adaptability.

As a result, the current landscape is ripe for innovation in supply chain management technologies, leading to increased demand for digital solutions. All these elements are collectively transforming the Agriculture SCM market, driving investments and developments that adapt to the changing agricultural environment and positioning the sector for ongoing growth in the foreseeable future.

Agriculture Supply Chain Management Market Restaining Factors:

The agricultural supply chain management sector faces significant challenges such as insufficient infrastructure, volatile prices for commodities, and limited technological uptake by farmers.

The Agriculture Supply Chain Management sector encounters various constraints that could impede its expansion. A principal hurdle is the insufficient infrastructure in many developing areas, which negatively influences logistical operations and transportation efficiency. Furthermore, limited access to contemporary technologies and digital resources can obstruct effective data handling and communication throughout the supply chain. Variability in market prices coupled with erratic weather patterns adds complexity to planning and inventory control, while regulatory challenges and compliance concerns may slow down goods processing. Additionally, the decentralized nature of supply chains, often involving numerous small-scale farmers, can result in inefficiencies and elevated costs. Labor shortages, exacerbated by shifting demographics and trends of migration from rural to urban areas, also significantly challenge productivity and operational stability. Nevertheless, amidst these obstacles, there is a growing acknowledgment of the necessity for sustainable practices and the adoption of cutting-edge technologies like blockchain and IoT, which have the potential to improve transparency and bolster resilience within the supply chain. As stakeholders increasingly focus on collaboration and investing in essential infrastructure, the Agriculture Supply Chain Management sector may transform, enhancing efficiency and sustainability in the realms of food production and distribution.

Segments of the Agriculture Supply Chain Management Market

By Component

- Solution

- Services

By Solution Type

- Inventory Management Solutions

- Fleet Management Solutions

- Supplier Management

- Market Intelligence

- Food Safety & Compliance

- Others

By Deployment Model

- On-premise

- On-demand/Cloud-based

Regional Overview

North America

- US

- Canada

- Mexico

Europe

- Germany

- France

- U.K

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

Middle East and Africa

- Saudi Arabia

- UAE

- Rest of Middle East and Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America