Market Analysis and Insights:

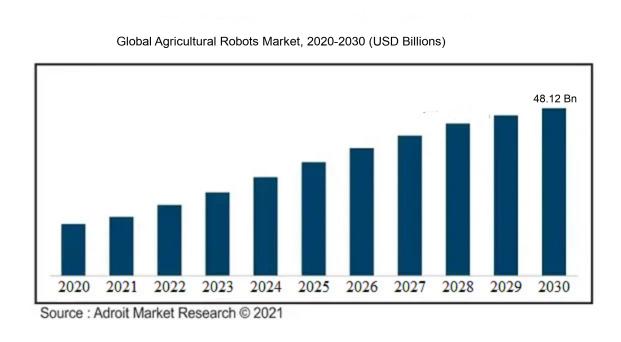

The market for Global Agricultural Robots was estimated to be worth USD 11.51 billion in 2022, and from 2023 to 2030, it is anticipated to grow at a CAGR of 20.56%, with an expected value of USD 48.12 billion in 2030.

The market for agricultural robots is witnessing robust growth propelled by several key factors. Increased global population and escalating food requirements are compelling farmers to enhance their operational efficiency and productivity. Agricultural robots play a crucial role in meeting this challenge by automating key tasks like planting, harvesting, irrigation, and weed management, thereby boosting agricultural yields. Moreover, the scarcity of labor in the agriculture sector, particularly in developed nations, is prompting the adoption of robots to supplement manual labor. These robots excel at performing repetitive tasks accurately, reducing dependency on human labor and bolstering operational effectiveness.

Agricultural Robots Market Scope:

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2030 |

| Study Period | 2018-2030 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2030 | USD 48.12 billion |

| Growth Rate | CAGR of 20.56% during 2023-2030 |

| Segment Covered | By Application, By Type, By Region. |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Deere & Company, Trimble Inc., AGCO Corporation, AG Leader Technology, BouMatic Robotics BV, Topcon Positioning Systems Inc., Yamaha Motor Corporation, GEA Group AG, Lely Holding S.A.R.L., and CNH Industrial N.V. |

Market Definition

Agrarian automatons, commonly referred to as agribots, are sophisticated devices created to aid in a multitude of agricultural activities such as seeding, reaping crops, overseeing livestock, and enhancing farming methodologies. Their primary objective is to automate arduous tasks and enhance productivity within the agricultural industry.

Agricultural robots are essential components of modern farming techniques, providing significant benefits such as enhanced efficiency, productivity, and sustainability. These robotic systems are designed to automate labor-intensive activities like planting, harvesting, and monitoring crop health, minimizing the need for manual labor and enhancing operational efficiency. Utilizing cutting-edge technologies like GPS and sensors, agricultural robots can precisely administer fertilizers and pesticides, resulting in decreased chemical consumption and reduced environmental impact of agricultural activities.

Moreover, these robots can operate continuously throughout the day and night, ensuring timely tasks execution and optimizing crop yields. They also enable farmers to gather detailed information on soil conditions, crop growth trends, and weather patterns, empowering them to make informed decisions and efficiently allocate resources. Additionally, agricultural robots play a crucial role in addressing the labor scarcity encountered by numerous farming communities, ultimately leading to improved profitability and sustainability in the agricultural sector.

Key Market Segmentation:

Insights On Key Application

Monitoring & Surveillance

Monitoring & Surveillance is expected to dominate the Global Agricultural Robots Market. This part plays a crucial role in ensuring the efficient and effective management of agricultural operations. With the advancements in technology, farmers are increasingly relying on automated systems for monitoring and surveillance tasks. Agricultural robots equipped with sensors and cameras enable real-time monitoring of crops, livestock, and farm equipment. This helps in detecting pests, diseases, or any anomalies in the field, allowing farmers to take immediate actions for pest control, disease prevention, and efficient resource management. The demand for monitoring & surveillance robots is driven by the need for precision farming, improving crop quality and yield, minimizing environmental impacts, and reducing labor costs.

Planting & Seeding Management

Planting & Seeding Management is another important application of the Global Agricultural Robots Market. This part focuses on the automation of planting and seeding processes, which are essential for crop production. Agricultural robots equipped with precision mechanisms and intelligent algorithms can accurately plant and seed crops, ensuring optimal spacing, depth, and seed placement. This helps in increasing crop yield, reducing seed wastage, and improving overall farm productivity. The adoption of planting & seeding management robots is driven by the need for efficient utilization of seeds, reducing manual labor, and achieving consistent crop establishment.

Spraying Management

Spraying Management is a significant application in the Global Agricultural Robots Market. This part deals with the automation of spraying operations, including herbicides, pesticides, and fertilizers. Agricultural robots equipped with precision spraying mechanisms and sensor-based technologies enable targeted and controlled spray applications. This helps in reducing chemical usage, minimizing environmental pollution, and optimizing crop protection. The demand for spraying management robots is driven by the increasing focus on sustainable agriculture, minimizing chemical inputs, and improving spray accuracy.

Milking

Milking is a niche application in the Global Agricultural Robots Market. This part focuses on the automation of milking processes in dairy farming. Robotic milking systems utilize advanced sensors and milking technology to automatically milk cows, ensuring hygiene, efficiency, and minimal stress on the animals. The adoption of robotic milking solutions is driven by factors such as labor shortage, increased milk production, improved milk quality, and enhanced animal welfare.

Harvest Management

Harvest Management is another application in the Global Agricultural Robots Market. This part involves the automation of harvesting operations, such as picking fruits, vegetables, or grains. Agricultural robots equipped with vision systems, robotic arms, and intelligent algorithms can accurately identify and harvest crops, reducing labor-intensive manual harvesting. The adoption of harvest management robots is driven by factors like labor shortage, increasing labor costs, improving harvesting efficiency, and reducing food waste.

Livestock Monitoring

Livestock Monitoring is a niche application in the Global Agricultural Robots Market. This part focuses on automated systems for monitoring the health, behavior, and productivity of livestock. Agricultural robots equipped with sensors and data analytics technology can continuously monitor the vital signs, activity levels, and feeding patterns of livestock, providing real-time insights for better management and early disease detection. The adoption of livestock monitoring robots is driven by the need for precision livestock farming, enhancing animal welfare, and improving overall livestock productivity.

Others

The Others category includes various applications that do not fall under the dominantly mentioned parts. This part may comprise novel or emerging applications in the agricultural sector, such as soil analysis robots, weed identification robots, or climate monitoring robots. The growth and dominance of this part are yet to be determined, depending on the adoption and market demand for these innovative applications.

Insights On Key Type

Driverless Tractors

Driverless tractors are expected to dominate the Global Agricultural Robots Market. With advancements in technology, the adoption of autonomous farming solutions has been increasing. Driverless tractors offer numerous benefits such as improved precision, increased productivity, reduced labor costs, and better efficiency. These autonomous vehicles can perform tasks such as plowing, planting, and harvesting without human intervention. The ability of driverless tractors to operate continuously for extended periods and cover large areas of land makes them a highly attractive option for farmers. Thus, driverless tractors are expected to be the dominating part in the Global Agricultural Robots Market.

Unmanned Aerial Vehicles

Unmanned aerial vehicles (UAVs) also hold significant potential in the Global Agricultural Robots Market. These drones can be equipped with advanced imaging sensors and cameras to monitor crop health, detect diseases, and assess the need for irrigation. They provide farmers with valuable information regarding field conditions, enabling precise decision-making and effective resource allocation. Despite their potential, however, UAVs are not expected to dominate the market as their usage is more limited in comparison to driverless tractors.

Dairy Robots

Dairy robots have gained traction in the agricultural industry, particularly for tasks such as milking cows and monitoring animal health. These robots automate tedious and repetitive tasks involved in dairy farming, leading to increased efficiency and reduced labor costs. While dairy robots offer valuable benefits, they are expected to have a smaller market share compared to driverless tractors. The scope of their application is limited to dairy farms and may not be as extensively adopted as other parts.

Material Management

Material management robots encompass various automation solutions aimed at optimizing the handling and transportation of agricultural materials, such as seeds, fertilizers, and harvested produce. These robots can enhance the logistics and operational efficiency of agricultural processes. However, material management robots are likely to have a smaller market share compared to driverless tractors. The demand for autonomous material handling may not be as high as the need for autonomous field operations, resulting in their limited dominance in the Global Agricultural Robots Market.

Insights On Key Offering

Hardware

Hardware is expected to dominate the Global Agricultural Robots Market. This is because agricultural robots primarily rely on physical components and machinery to perform their tasks. The demand for robotic devices and equipment such as autonomous tractors, drones, sensors, and robotic arms is steadily increasing in the agricultural sector. Farmers are adopting these technologies to automate various processes, including planting, harvesting, spraying pesticides, and monitoring crop health. The advancements in robotics technology have led to improved productivity, efficiency, and accuracy in farming operations. As a result, the hardware part is projected to be the dominant part of the By Offering category in the Global Agricultural Robots Market.

Software

Software plays a crucial role in enhancing the capabilities and functionalities of agricultural robots. With the integration of artificial intelligence and machine learning algorithms, software solutions provide the ability to collect, analyze, and interpret data captured by the robotic devices. This information helps farmers make informed decisions related to crop management, yield optimization, and resource allocation. While software is an essential component for efficient operation of agricultural robots, it is not expected to dominate the market as hardware holds a greater significance in this industry. Therefore, the software part is likely to have a significant presence, but it may not dominate the Global Agricultural Robots Market.

Services

Services encompass a range of activities that support the implementation, maintenance, and utilization of agricultural robots. These services include installation, training, repair and maintenance, technical support, and data analysis. While services are vital for ensuring the effective functioning and longevity of agricultural robots, they are not expected to dominate the Global Agricultural Robots Market. The hardware part holds greater importance as it constitutes the physical components required for automation in agriculture. Nonetheless, the services part will play an auxiliary role in facilitating the adoption and ongoing support of agricultural robotics technologies.

Insights On Key Farming environment

Outdoor

Outdoor farming environment is expected to dominate the Global Agricultural Robots Market. This can be attributed to several factors. Firstly, outdoor farming covers a wide range of crops and agricultural activities, including large-scale crop cultivation, livestock management, and field monitoring. Agricultural robots designed for outdoor environments are well-suited for these tasks, offering capabilities such as planting, harvesting, and irrigation. Moreover, outdoor farming typically involves extensive land areas, making it more feasible for robots to operate efficiently and autonomously. The demand for increased productivity and precision in agricultural operations further drives the adoption of outdoor agricultural robots. With advancements in technology and the need to optimize resources, outdoor farming is poised to be the dominant part in the Global Agricultural Robots Market.

Indoor

While the outdoor farming environment is expected to dominate the Global Agricultural Robots Market, the indoor part holds its own significance. Indoor farming, also known as vertical farming or controlled environment agriculture, is gaining popularity due to its ability to overcome challenges such as limited arable land and environmental constraints. Agricultural robots designed for indoor environments offer precise and automated solutions to tasks like seeding, monitoring plant growth, and managing climate conditions. This part caters to the demand for high-yield and sustainable farming practices in urban areas, where space is limited. Although the scale and scope of indoor farming are relatively smaller compared to outdoor farming, the need for efficient cultivation in controlled environments fuels the adoption of agricultural robots in this part.

Insights on Regional Analysis:

Europe

Europe is expected to dominate the Global Agricultural Robots market. This region has a well-developed agricultural sector and a strong emphasis on technology adoption in farming practices. European countries such as Germany, France, and the Netherlands have been at the forefront of implementing advanced agriculture technologies, including agricultural robots. The increasing demand for automation and precision in agricultural processes, coupled with supportive government initiatives and investment in research and development, has stimulated the growth of the agricultural robot market in Europe. Furthermore, the presence of key market players and a well-established distribution network contribute to the dominance of Europe in this market .

North America

North America is a significant player in the Global Agricultural Robots market. The region has a highly developed agricultural sector and a substantial focus on technological advancements in farming practices. The United States and Canada are major contributors to the growth of this market in North America. Factors such as the increasing need for labor-saving technologies, growing adoption of precision agriculture techniques, and the presence of leading agricultural robot manufacturers in this region drive market dominance in North America. Additionally, government support and initiatives aimed at boosting the adoption of agricultural robots further contribute to the region's market dominance.

Asia Pacific

Asia Pacific is witnessing significant growth in the Global Agricultural Robots market. The region has a large population and extensive agricultural activities, making it a vital market for agricultural robots. Countries like China, India, and Japan are actively adopting agricultural automation technologies to improve productivity and efficiency in farming practices. The rising demand for crop yield enhancement, coupled with the need for labor shortage solutions, drives the growth of the agricultural robot market in the Asia Pacific region. Moreover, government initiatives to promote advanced farming techniques and advancements in technology infrastructure are further fueling market dominance in Asia Pacific.

Latin America

Latin America is emerging as a growing market for agricultural robots. Countries such as Brazil, Argentina, and Mexico have substantial agricultural sectors and are witnessing increasing adoption of technology-driven farming practices. Factors such as the need for increasing agricultural productivity, improving the quality of produce, and addressing labor scarcity issues contribute to the demand for agricultural robots in Latin America. Additionally, government support and initiatives aimed at improving farming practices and reducing environmental impact are driving market growth in this region.

Middle East & Africa

The Middle East & Africa region is also witnessing growth in the agricultural robot market. Countries like Israel, Saudi Arabia, and South Africa are actively adopting advanced agricultural technologies to tackle challenges such as water scarcity and arid climatic conditions. The use of agricultural robots in these regions helps optimize resource utilization, improve efficiency, and increase crop yield. Additionally, government initiatives to promote sustainable agriculture and the growing awareness of the benefits of agricultural automation contribute to the growth of the agricultural robot market in the Middle East & Africa.

Company Profiles:

The primary stakeholders in the worldwide Agricultural Robots industry are accountable for the creation and production of cutting-edge robotic systems and remedies designed for a range of agricultural activities, including seeding, harvesting, and crop supervision. They are pivotal in spearheading advancements and mechanization within the agricultural domain.

Prominent companies in the Agricultural Robots Market encompass Deere & Company, Trimble Inc., AGCO Corporation, AG Leader Technology, BouMatic Robotics BV, Topcon Positioning Systems Inc., Yamaha Motor Corporation, GEA Group AG, Lely Holding S.A.R.L., and CNH Industrial N.V. Engaged in advancing, manufacturing, and dispersing agricultural robots and associated solutions to elevate farming processes and amplify efficiency, these entities prioritize innovation, partnerships, and product introductions to secure a leading position in the industry.

COVID-19 Impact and Market Status:

The global market for agricultural robots has experienced notable changes as a result of the Covid-19 pandemic, with a rise in adoption rates and rapid advancements in technology.

The agricultural robots market has been significantly impacted by the COVID-19 pandemic. As a result of social distancing measures and labor shortages in the agricultural sector, there has been a growing demand for automation and robotics in farming operations. These robots are now utilized for various tasks such as seeding, harvesting, weeding, and crop monitoring, aiming to reduce reliance on human labor and minimize the risk of virus transmission.

Nonetheless, the market has faced challenges during the pandemic, including supply chain disruptions, travel limitations, and economic uncertainty, all contributing to delays in the production and deployment of agricultural robots. Moreover, reduced investments and financial constraints across industries have impeded the adoption of these technologies. Despite these hurdles, the market has demonstrated resilience in the face of adversity. As recovery efforts progress, the demand for agricultural robots is projected to recover. Looking ahead, the market's long-term outlook appears optimistic, driven by the ongoing need for efficiency, precision, and sustainability in the agricultural sector, leading to increased adoption of robotics and automation technologies.

Latest Trends and Innovation:

- John Deere announced the acquisition of Blue River Technology on September 6, 2017.

- Clearpath Robotics acquired Harvest Automation on October 3, 2018.

- AgEagle Aerial Systems acquired Agribotix on January 10, 2019.

- DeLaval, a division of Tetra Laval Group, launched the Voluntary Milking System VMS V300 on February 20, 2018.

- Autonomous Solutions Inc. (ASI) collaborated with CNH Industrial to develop autonomous tractors in December 2017.

- Trimble Inc. acquired Müller-Elektronik on April 3, 2017.

- PrecisionHawk acquired HAZON Solutions on October 2, 2019.

- Naio Technologies raised €14 million in a series B funding round on June 3, 2020.

- Kubota Corporation launched its M7 tractor series featuring autonomous functions on October 23, 2018.

- Yamaha Motor Company introduced the agricultural drone YMR-01 on November 6, 2017.

Significant Growth Factors:

The expansion drivers of the Agricultural Robotics industry encompass the burgeoning need for precision agriculture and the growing acceptance of automation in agricultural activities.

The growth of the agricultural robots industry is being fueled by various factors. One significant driver is the escalating global population, which has resulted in an increased demand for food. This demand necessitates the implementation of effective and high-yielding agricultural techniques. Agricultural robots play a crucial role in facilitating precision farming practices, which aid in the efficient utilization of resources like water, fertilizers, and pesticides. This, in turn, leads to enhanced crop yields and a decreased environmental footprint. Furthermore, the shortage of labor in the agriculture sector, particularly in more developed regions, is prompting the integration of robots for various tasks such as planting, harvesting, and sorting of crops.

These robots offer improved productivity and cost-effectiveness as they can operate continuously without experiencing fatigue or requiring breaks. Additionally, agricultural robots are equipped with cutting-edge technologies including artificial intelligence, machine learning, and sensors. These features enable farmers to collect real-time data regarding crop health, soil conditions, and weather patterns. By leveraging this data-driven approach, farmers are empowered to make informed decisions and efficiently manage their crops, resulting in enhanced yields and decreased losses.

Restraining Factors:

The agricultural robotics industry faces challenges in widespread adoption primarily due to the significant upfront costs and the lack of familiarity with advanced technologies.

The market for agricultural robots has experienced rapid growth in recent years; however, there are various factors that impede its optimal development. One significant challenge is the high cost associated with agriculture robots, which poses a barrier to adoption for farmers, particularly those operating on a smaller scale with limited financial resources. The substantial initial investment and ongoing maintenance expenses can be prohibitive, making it challenging for many farmers to embrace this technology. Furthermore, there is a lack of awareness and comprehension regarding the advantages and capabilities of agricultural robots among farmers. The perceived value and benefits of this technology can be met with skepticism and reluctance to invest without proven outcomes. The complexity of these robots presents an additional hurdle, as farmers may lack the necessary technical expertise and understanding to effectively operate and maintain these advanced machines. In addition, regulatory constraints and legal issues may hinder the implementation of agricultural robots, such as limitations on automation usage in specific farming practices and concerns about safety and liability. Despite these obstacles, efforts are underway to mitigate these challenges. Enhanced government support and incentivization for farmers to adopt agricultural robots, coupled with technological advancements that may lower costs and enhance user-friendliness, can help address these issues. Collaborative initiatives among manufacturers, governments, and farmers to enhance awareness, provide training and assistance, and establish appropriate regulations can create a conducive environment for the expansion of the agricultural robots market.

Key Segments of the Agricultural Robots Market

Application Overview

• Planting & Seeding Management

• Spraying Management

• Milking

• Monitoring & Surveillance

• Harvest Management

• Livestock Monitoring

• Others

Type Overview

• Driverless Tractors

• Unmanned Aerial Vehicles

• Dairy Robots

• Material Management

Offering Overview

• Hardware

• Software

• Services

Farming Environment Overview

• Indoor

• Outdoor

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• UK

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America