The global market for the Agricultural Fumigants is anticipated to develop at a compound annual growth rate (CAGR) of 2.8% throughout the course of the forecast, to reach US$ 1.4 Bn by 2032.

.jpg)

In 2019, the global agricultural fumigants market size was valued at >1,600 million. Increased use of improved methods for agricultural practices to protect nematodes, agricultural production, rodents, soil from pests, moles, and soil insects over the past few years has increased popularity of agricultural fumigants. The use of agricultural fumigants is both pre-harvest and post-harvest. Fumigants are introduced into the soil to destroy fungi or insects in seeds, grains, etc. during pre-harvest. It is used in post-harvest to reduce any damage from bugs, insects, termites to harvested crops by filling the space with toxic gases.

Increasing awareness among farmers of contamination-gluten free food has resulted in increasing product adoption, which over the projected period is likely to have a positive effect on the demand for agricultural fumigants. Improved cold storage technology by virtue of increasing concerns about the saving of post-harvest crops will make an effective contribution to the market size of agricultural fumigants in the coming years. However, strict government regulations against the consumption of the product use as it contains toxic gases that can cause serious harm to humans are expected to hinder the demand for agricultural fumigants over the forecast period.

Agricultural Fumigants Market Scope

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2032 |

| Forecast Period | 2024-2032 |

| Study Period | 2018-2032 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2032 | US$ 1.4 Bn |

| Growth Rate | CAGR of 2.8% during 2022-2032 |

| Segment Covered | By Type, By Form, Regions |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Arkema Group (France), Solvay group (Belgium), Eastman Chemical Company (U.S.), DEGESCH America, Inc. (U.S.), Reddick Fumigants, LLC (U.S.), Vietnam Fumigation J.S Company (Vietnam) |

Key Segments of the Global Agricultural Fumigants Market

Form Overview, (USD Billion)

- Solid

- Liquid

- Ga

Product Overview, (USD Billion)

- Chloropicrin

- Dimethyl disulfide

- Methyl bromide

- Metam sodium

- 1,3-Dichloropropene

- Others

Regional Overview, (USD Billion)

North America

- U.S.

- Canad

Europe

- UK

- Germany

- France

- Rest of Europ

Asia Pacific

- China

- Japan

- India

- Rest of Asia-Pacifi

Middle East and Africa

- UAE

- South Africa

- Rest of Middle East and Afric

South America

- Brazil

- Rest of South America

Reasons for the study

- The purpose of the study is to give an exhaustive outlook of the global agricultural fumigants market. Benchmark yourself against the rest of the market.

- Ensure you remain competitive as innovations by existing key players to boost the market.

What does the report include?

- The study on the global agricultural fumigants market includes qualitative factors such as drivers, restraints, and opportunities

- The study covers the competitive landscape of existing/prospective players in the agricultural fumigants industry and their strategic initiatives for the product development

- The study covers a qualitative and quantitative analysis of the market segmented based on form and product. Moreover, the study provides similar information for the key geographies.

- Actual market sizes and forecasts have been provided for all the above-mentioned segments.

Who should buy this report?

- This study is suitable for industry participants and stakeholders in the global agricultural fumigants market. The report will benefit: Every stakeholder involved in the agricultural fumigants market.

- Managers within the agricultural fumigants industry looking to publish recent and forecasted statistics about the global agricultural fumigants market.

- Government organizations, regulatory authorities, policymakers, and organizations looking for investments in trends of global agricultural fumigants market.

- Analysts, researchers, educators, strategy managers, and academic institutions looking for insights into the market to determine future strategies.

Frequently Asked Questions (FAQ) :

Increasing penetration of agricultural fumigants for storage and production of cereals, rising concern on reducing post-harvest losses, technological advancement in storage and farming practices and methods, and rising insects due to climate changes are expected to open new opportunities for agricultural fumigants industry over the forecast period. Increasing global population followed by increasing government support for strengthening agricultural production in Asia Pacific region is expected to open new avenues for agricultural fumigants industry over the coming years. Rapid research & development and investment over the past few years has developed many efficient and less toxic products and the trend is expected to continue over the coming years. Increasing population, rising consumer inclination towards agricultural output and advanced storage technologies are expected to increase market reach. For instance, according to Food and Agriculture Organization (FAO), the global agricultural output is expected to see tremendous growth by 2050.

Form Segment

In terms of the form, the market is segmented into solid, liquid, and gas form. Solid form for agriculture fumigants includes tablets, pellets, and powder form. Solid form is expected to dominate agriculture fumigants market over the forecast period by virtue of ease of sprinkling and safer for environment as compared to gas and liquid form. Soluble materials used to remove moulds, insects, and rodents, among others, are part of the liquid form. Using traditional sprayers, they are normally sprayed over the desired land area. When it is done in either enclosed chambers or fully open outdoor areas, this method of fumigation is typically considered the safest.

Product Segment

In terms of the product, the market is segmented into chloropicrin, dimethyl disulfide, methyl bromide, metam sodium, 1,3-dichloropropene, and others. Chloropicrin product accounted for nearly 20% of the overall agriculture fumigants market in 2019. Chloropicrin is increasingly used as an alternative to methyl bromide. Additionally, it is combined with 1,3-dichloropropene for better results. 1,3-dichloropropene product is expected to show promising future in coming years by virtue of its high level of sorption coefficient, low vapor pressure, and high degradation rates.

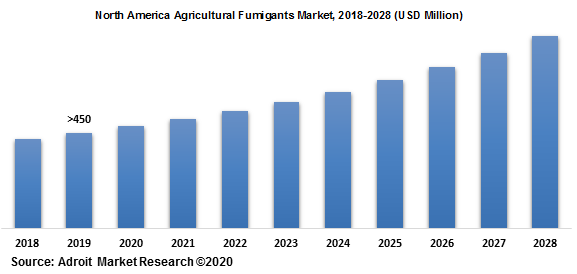

The North America region dominated the overall market in 2019 and it is projected to keep its position during the forecast years 2018-2028. The market growth in this region is mostly ascribed to presence of well-established agrochemical manufacturers such as Agrium, Yara International ASA, Potash Corporation, Monsanto, Bayer Crop Science, Dow Agro Sciences, and BASF SE. Increasing government regulations to protect farming in U.S. and Canada followed by technological enhancement in the area of agricultural practices is further expected to drive the market over the coming years.

Leading companies engaged in agricultural fumigants market are Rentokil, Degesch America, The DOW Chemical Company, UPL, Arkema, BASF, Nufarm, Nippon Chemical Industrial Co., Ltd, Syngenta, AMVAC, FMC Corporation, and Adama. Key companies present in the market are adopting new product development, technological advancement, research & development, investment, merger & acquisition, and partnerships to form strategies in order to stay competitive in the industry and strengthen their distribution network in order to increase their customer base.