The global Aesthetic Medicine market size is expected to reach close to US$ 64.4bn by 2029 with an annualized growth rate of 10.3% through the projected period.

.jpg)

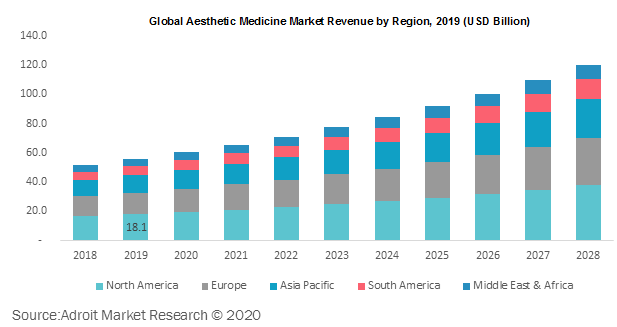

The global aesthetic medicine market was valued at USD 55.8 billion in 2019 and is expected to grow at a CAGR of 9% over the forecast period. The aesthetic market will be improved by rising aesthetic understanding and a variety of non-invasive aesthetic procedures. In addition, the technical insulation developments across the sector will increase its worldwide adoption rate. Another major factor driving growth in industry is the increasing image recognition among individuals of their appearance.

The global aesthetic medicine market is categorized based on invasive procedures, and non-invasive procedures. Region wise, North America was the largest market in 2018; however, Asia Pacific is expected to be the fastest growing region by 2028, with a CAGR of 9.7%.

Key players serving the global aesthetic medicine market include Cynosure (Hologic, Inc.), Johnson & Johnson, Alma Lasers, Galderma S.A., Allergan, Inc., Solta Medical, Syneron Candela, Lumenis, Valeant International, Zeltiq Aesthetic among other prominent players.

Aesthetic Medicine Market Scope

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2029 |

| Study Period | 2018-2029 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2029 | US$ 64.4bn |

| Growth Rate | CAGR of 10.3% during 2019-2029 |

| Segment Covered | By Procedure Type, Regions |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Allergan, Galderma Laboratories, Merz Pharmaceuticals, Alma Lasers, Johnson & Johnson, Galderma, Lumenis, Cynosure, Cutera |

Key Segment Of The Aesthetic Medicine Market

By Procedure Type

o Invasive Procedures

• Breast augmentation

• Liposuction

• Nose reshaping

• Eyelid surgery

• Tummy tuck

• Other invasive procedures

o Non-Invasive Procedures

• Botox injections

• Soft tissue fillers

• Chemical peel

• Laser hair removal

• microdermabrasion

Regional Overview

North America

• US

• Canada

Europe

• Germany

• France

• UK

• Rest of Europe

Asia Pacific

• China

• India

• Japan

• Rest of Asia Pacific

South America

• Mexico

• Brazil

• Rest of South America

Middle East and South Africa

Frequently Asked Questions (FAQ) :

The number of target customers with signs of ageing, such as wrinkles, loss of skin elasticity and dark spots is expected to fuel population growth between 30 and 65 years. According to the CIA, for example, about 39.9 per cent of the German population was between 25 and 54 years old, and about 15.0 per cent of the population was between 55 and 65 years old in 2019. This aspect is expected to drive the country 's demand for aesthetic medicine in the coming years.

In addition, the need to develop aesthetics in the increasingly growing population of the working class is likely to increase the use of aesthetic medicines over this projected period. The market is anticipated to experience lucrative progress over the projection period with the improvement of jobs, especially in emerging economies. However, the adverse effects of aesthetic procedures can continue to adversely affect the consumer preference index.

The global aesthetic medicine market has been bifurcated into invasive procedures & non-invasive procedures. In the year 2019, non-invasive segment dominated the global aesthetic medicine market and is projected to witness the highest CAGR through-out the forecast period. In 2019, over 17 million minimally invasive cosmetic procedures were performed in the United States. The botox injection is considered to be the top minimally invasive cosmetic treatment according to the Plastic Surgery Statistics Study with over 7.7 million procedures carried out in the U.S. in 2019. This has resulted in strong demand for procedures that are minimally invasive and thus projected to fuel market growth further.

Based on regions, the global aesthetic medicine market is segmented into North America, Europe, Asia Pacific, South America and Middle East & Africa. In 2019, North America was the largest market globally. Some of the key factors contributing to growth are: well developed healthcare facilities, acceptance of cosmetic procedures, increased prevalence of skin disorders, and the presence of qualified and professional cosmetic surgeons across the region.