Market Analysis and Insights:

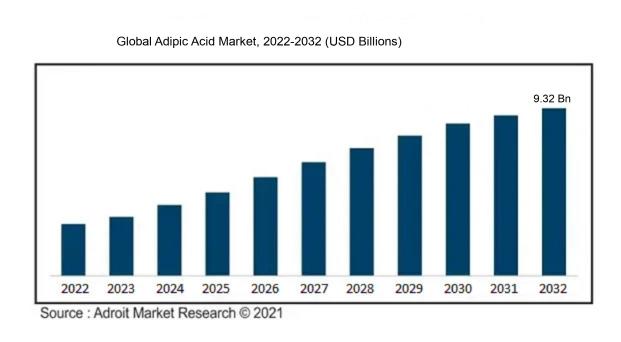

The market for Adipic Acid was estimated to be worth USD 5.24 billion in 2022, and from 2022 to 2032, it is anticipated to grow at a CAGR of 4.68%, with an expected value of USD 9.32 billion in 2032.

The driving forces behind the Adipic Acid Market are diverse and encompass various elements such as the increasing demand from critical end-user sectors, the expansion of the automotive and textiles industries, and the escalating emphasis on sustainability and environmental considerations. One significant aspect contributing to the growth of adipic acid is its crucial role as a primary ingredient in the manufacturing process of nylon 6,6, which serves a wide range of applications in industries like automotive, textiles, and consumer goods. This upsurge is reinforced by the continuous expansion of the global automotive sector and the rising need for energy-efficient vehicles, thereby escalating the requirement for adipic acid for the creation of durable and lightweight materials. Moreover, the burgeoning environmental awareness has led to a shift towards sustainable and environmentally-friendly products, propelling the demand for adipic acid due to its essential role in the production of eco-friendly nylon. Additionally, the expansion of the textiles industry, particularly in developing countries, has significantly boosted the demand for adipic acid, given its utilization in the production of polyester fibers. These influential factors collectively contribute to the advancement of the Adipic Acid Market.

Adipic Acid Market Scope:

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2032 |

| Study Period | 2018-2032 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2032 | USD 9.32 billion |

| Growth Rate | CAGR of 4.68% during 2022-2032 |

| Segment Covered | By Application, By End-User, By Raw Material, By Region. |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Asahi Kasei Corporation, BASF SE, Invista, Lanxess AG, Shandong Haili Chemical Industry Co. Ltd., Ascend Performance Materials, PetroChina Liaoyang Petrochemical, Radici Group, Solvay S.A., and Ascend Performance Materials Operations LLC. |

Market Definition

Adipic acid, an organic compound found in nature, serves as a crucial raw material in the manufacturing of nylon and various polymers. This dicarboxylic acid, denoted by the chemical formula C6H10O4, is renowned for its capacity to bolster the resilience and robustness of diverse substances.Adipic acid is a pivotal chemical compound that plays a crucial role in diverse industrial sectors. Primarily utilized in the manufacture of nylon—a remarkably durable and versatile material—adipic acid serves as a vital element in the synthesis of nylon polymers.

These polymers find extensive applications in the production of textiles, carpets, and various industrial goods. Furthermore, adipic acid is a key ingredient in the production of polyurethane, a commonly used material in creating items such as furniture, insulation, and automotive components. Its capacity to improve the performance and characteristics of these materials renders it indispensable across a range of industries. Additionally, adipic acid serves as a food additive, imparting tartness and flavor to specific food and beverage items. Its role as a corrosion inhibitor also makes it an essential component in antifreeze solutions. In essence, the significance of adipic acid is underscored by its contributions to the manufacturing processes of nylon, polyurethane, food products, and antifreeze, confirming its essential nature in multiple industrial domains.

Key Market Segmentation:

Insights On Key Application

Nylon 6,6 Fiber

Nylon 6,6 Fiber is expected to dominate the Global Adipic Acid Market. Nylon 6,6 fiber is widely used in various industries such as textile, automotive, aerospace, and electronics due to its excellent properties like high tensile strength, excellent heat resistance, and dimensional stability. The demand for nylon 6,6 fiber is increasing as it finds extensive applications in manufacturing products such as textiles, carpets, tire cords, and industrial fabrics. The growing demand for durable and lightweight materials in various end-use industries is driving the dominance of nylon 6,6 fiber in the Global Adipic Acid Market.

Polyurethane

Polyurethane is another significant application in the Global Adipic Acid Market. Polyurethane is widely used in the production of foams, coatings, adhesives, and sealants. The increasing demand for polyurethane foams in the construction and automotive sectors is driving the growth of this part. Polyurethane foams offer excellent insulation properties, high strength, and resistance to wear and tear. Additionally, the expanding furniture and bedding industry further contributes to the dominance of the polyurethane part in the Global Adipic Acid Market.

Nylon 6,6 Resin

Nylon 6,6 resin is also a prominent application in the Global Adipic Acid Market. This resin is extensively used in the manufacturing of engineering plastics, electrical connectors, and automotive parts. With the rising need for lightweight and high-performance materials in various industries, there is an increased demand for nylon 6,6 resin. Its properties such as high strength, chemical resistance, and excellent thermal stability make it suitable for applications in diverse sectors, including automotive, electrical, and industrial.

Adipate Esters

Adipate esters are another application in the Global Adipic Acid Market. Adipate esters find applications in various products such as plasticizers, lubricants, and cosmetics. These esters offer excellent compatibility with polymers, low volatility, and good lubrication properties. The increasing demand for plasticizers in the production of PVC-based products and the growing cosmetics industry fuels the dominance of the adipate esters part in the Global Adipic Acid Market.

Others

The Others category includes various minor applications of adipic acid that do not significantly dominate the Global Adipic Acid Market. These applications may include niche industries where adipic acid is used in smaller quantities or for specialized uses. While these applications are important, they do not hold a dominating position compared to the previously mentioned parts.

Insights On Key End-Use

Automotive

The automotive industry is expected to dominate the global adipic acid market. Adipic acid is widely used in the production of nylon, which is extensively used in the automotive sector for manufacturing various components such as fuel lines, airbags, engine covers, and upholstery. The demand for lightweight materials in the automotive industry to improve fuel efficiency and reduce emissions has led to an increased use of nylon, thereby driving the demand for adipic acid. Additionally, the growing adoption of electric vehicles, where adipic acid is used in the production of lithium-ion batteries, further contributes to the dominance of the automotive part in the global market.

Electrical & Electronics

The electrical & electronics end-use is another significant player of the global adipic acid market. Adipic acid is utilized in the manufacturing of various electronic components such as connectors, circuit boards, and capacitors. The increasing demand for electronic devices, including smartphones, tablets, laptops, and other consumer electronics, drives the need for adipic acid. Moreover, the rising adoption of renewable energy sources and the subsequent growth in the solar and wind power sectors further drive the demand for adipic acid in the production of photovoltaic cells and wind turbine blades.

Packaging & Consumer Goods

The packaging & consumer goods end-use also holds a significant share in the global adipic acid market. Adipic acid is used in the production of packaging materials, including food packaging films, coatings, and laminates, due to its excellent barrier properties and durability. The increasing demand for packaged food and beverages, particularly in emerging economies, contributes to the dominance of this part. Additionally, adipic acid is utilized in the production of various consumer goods such as footwear, luggage, and sporting goods, further fueling its demand in this part.

Building & Construction

In the building & construction end-use, adipic acid finds applications in the production of coatings, adhesives, sealants, and composite materials. These materials are widely used in the construction industry for architectural coatings, flooring, insulation, and structural components. The growth in the construction sector, driven by urbanization, infrastructure development, and increased construction activities, positively impacts the demand for adipic acid. However, compared to the dominant parts, the building & construction part holds a relatively smaller share in the global market.

Textile

The textile end-use of the global adipic acid market is expected to have a moderate share. Adipic acid is used in the production of nylon 6,6 fibers and yarns, which find applications in textiles, carpets, and apparel. The demand for nylon textiles, driven by the fashion industry and the increasing popularity of athleisurewear, contributes to the demand for adipic acid in this part. However, the dominance of the textile part is limited compared to the automotive, electrical & electronics, and packaging & consumer goods parts.

Others

The Others category represents various smaller players and applications of adipic acid that do not fall under the major categories mentioned above. This part includes uses such as personal care products, pharmaceuticals, and industrial applications. While these applications may contribute to the overall demand for adipic acid, their individual shares are relatively small compared to the dominant parts. Hence, the "Others" part is not expected to dominate the global adipic acid market.

Insights On Key Raw Material

Cyclohexanone

Cyclohexanone is expected to dominate the Global Adipic Acid Market. Cyclohexanone is a key raw material in the production of adipic acid and is widely used in the industry. It is primarily utilized in the production of nylon-6,6, which is a popular synthetic polymer used in various applications such as textiles, automotive, and consumer goods. The demand for nylon-6,6 is growing due to its excellent properties, including high strength and resistance to chemicals and heat. As a result, the demand for cyclohexanone as a raw material for adipic acid production is expected to be significant, leading to its dominance in the global market.

Cyclohexanol

Cyclohexanol, on the other hand, is not expected to dominate the Global Adipic Acid Market. Although it is also a raw material used in the production of adipic acid, its demand is relatively lower compared to cyclohexanone. Cyclohexanol finds application in various industries, including pharmaceuticals, solvents, and polymer production, but its usage in adipic acid production is limited. The dominance of cyclohexanone can be attributed to its higher demand and widespread usage in the production of nylon-6,6.

Insights on Regional Analysis:

Europe

Europe is expected to dominate the global Adipic Acid market. The region has a well-established chemical industry and a high demand for adipic acid, which is widely used in various applications such as nylon production, manufacturing of fibers, and production of automotive parts. Additionally, Europe has stringent regulations in place regarding environmental sustainability, and adipic acid is commonly used as a bio-based substitute for petrochemical-based products. The region also benefits from a strong infrastructure, advanced technology, and a skilled workforce, making it a major player in the global adipic acid market.

North America

North America is one of the prominent markets for adipic acid due to the presence of a robust automotive and textile industry. The region has a high demand for adipic acid in the manufacturing of nylon fibers, which are extensively used in automotive interiors and upholstery. Furthermore, growing concerns about environmental sustainability have led to an increased demand for bio-based adipic acid, which is expected to further drive the market growth in North America. The region also benefits from technological advancements, research and development activities, and a large consumer base.

Asia Pacific

Asia Pacific is witnessing significant growth in the adipic acid market due to the rapid industrialization and urbanization in countries like China and India. The region has a high demand for adipic acid in the production of polyamides, which find applications in various sectors, such as automotive, electrical, and packaging. The rising disposable income, changing lifestyle patterns, and increasing population of the middle class in the region have also contributed to the growth of end-use industries, leading to a higher demand for adipic acid. Additionally, low labor costs, favorable government policies, and easy availability of raw materials are further driving the market growth in Asia Pacific.

Latin America

Latin America is expected to witness moderate growth in the adipic acid market. The region's textile industry is a major consumer of adipic acid for the production of nylon fibers. However, the market growth in Latin America is hindered by factors such as economic instability, political uncertainties, and lack of infrastructure. Despite these challenges, the region's growing automotive sector and increasing investments in industrial development are likely to create opportunities for the adipic acid market. Additionally, the rising awareness about environmental sustainability and the demand for bio-based adipic acid are driving the market growth in Latin America.

Middle East & Africa

The adipic acid market in the Middle East & Africa is expected to witness steady growth. Although the region accounts for a small share in the global market, it has favorable factors such as availability of raw materials and low production costs. The construction industry in the Middle East & Africa is growing, which is driving the demand for nylon fibers and subsequently the demand for adipic acid. Additionally, the region's focus on industrial diversification and economic development is expected to boost the market growth. However, challenges such as political instability and limited access to technology and skilled manpower may hinder the market growth in the region.

Company Profiles:

Prominent contributors in the international Adipic Acid sector significantly influence industry progression by introducing cutting-edge product lines and forging strategic alliances. Their unwavering commitment to enhancing manufacturing techniques and broadening their clientele underscores their determination to sustain a strong foothold in the market.

Prominent companies driving the Adipic Acid Market are Asahi Kasei Corporation, BASF SE, Invista, Lanxess AG, Shandong Haili Chemical Industry Co. Ltd., Ascend Performance Materials, PetroChina Liaoyang Petrochemical, Radici Group, Solvay S.A., and Ascend Performance Materials Operations LLC.

COVID-19 Impact and Market Status:

The global adipic acid market has been profoundly affected by the Covid-19 pandemic, leading to a decrease in demand as a result of industry disruptions and difficulties in the supply chain.

The outbreak of the COVID-19 pandemic has significantly impacted the market for adipic acid, a key component used in the manufacture of nylon. The demand for nylon has experienced a decline as a result of the global economic slowdown and disruptions in sectors such as automotive and apparel industries. Production facilities were forced to temporarily close or operate at reduced capacity, leading to a decrease in overall production and causing disruptions in the supply chain. Furthermore, restrictions on transportation brought about by lockdown measures in various countries further exacerbated the challenges faced by the adipic acid market. Nevertheless, as economies gradually reopen and industries resume normal operations, the market for adipic acid is expected to experience a recovery. There is also a potential increase in demand for adipic acid in the healthcare sector, especially in the manufacturing of essential medical supplies and equipment. Furthermore, continuous research and development initiatives aimed at exploring new applications for adipic acid may present fresh opportunities for market expansion in the future.

Latest Trends and Innovation:

- On October 21, 2019, Asahi Kasei Corporation announced the completion of its acquisition of Sage Automotive Interiors, Inc.

- In April 2019, Solvay acquired Brussels-based Cytec Industries Inc., a global specialty chemicals and advanced materials company, to expand its position in the advanced materials sector.

- On March 12, 2018, BASF announced its plans to increase its production capacity for adipic acid by constructing a new plant in Guangdong Province, China, with an annual capacity of 60,000 tons.

- In February 2018, LANXESS, a leading specialty chemicals company, completed the acquisition of Solvay's phosphorous-based flame retardants business.

- In October 2017, Sumitomo Chemical acquired the integrated adiponitrile (ADN) and hexamethylenediamine (HMD) facilities in Singapore from Solvay to strengthen its nylon business.

- In November 2016, Ascend Performance Materials completed the purchase of Poliblend and Esseti Plast GD from D'Ottavio Group, expanding its capabilities in the compounding business.

- In December 2015, DSM announced the acquisition of Aland (Zhangjiagang) High Performance Fibers Co. Ltd. in China, a leading producer of high-performance polyamide 66 fibers which uses adipic acid as a feedstock.

- In January 2015, Invista, a subsidiary of Koch Industries, announced the completion of its acquisition of the adiponitrile (ADN) business from Solvay.

Significant Growth Factors:

Factors driving the expansion of the Adipic Acid Market comprise escalating requirements from the automotive and textile sectors, ened focus on environmental issues, and innovations in manufacturing methodologies.

The market for adipic acid is poised for substantial growth in the upcoming years due to several pivotal factors. Firstly, the increasing need for nylon 6,6, a major application of adipic acid, is anticipated to propel market expansion.

Nylon 6,6 finds extensive use in sectors like automotive, textiles, and consumer goods, with the rising demand for these goods fueling the requirement for adipic acid. Secondly, the expanding populations and urbanization in emerging economies, especially in the Asia Pacific region, are stimulating the demand for construction materials, textiles, and automobiles, consequently contributing to the growth of the adipic acid market.

Furthermore, the surge in focus on sustainable development and the uptake of bio-based adipic acid present novel growth avenues for the market. Bio-based adipic acid, offering eco-friendly advantages, is increasingly gaining acceptance in the textile and automotive sectors. Additionally, the increasing demand for polyurethane foams, which depend on adipic acid as a key component, is augmenting market expansion. Despite this positive outlook, challenges such as fluctuating raw material prices and stringent environmental regulations could impede overall market growth. Nevertheless, with the continuous increase in research and development endeavors aimed at enhancing production processes and reducing costs, the market is anticipated to experience a favorable growth trajectory in the foreseeable future.

Restraining Factors:

Constraints in the Adipic Acid Market stem primarily from the restricted supply of raw materials and rising environmental apprehensions.

The adipic acid industry is expected to experience consistent growth in the upcoming period. Yet, various factors may hinder this growth. Firstly, the fluctuating prices of essential raw materials like benzene and cyclohexane needed for adipic acid manufacturing can present obstacles for producers, impacting their financial performance. Furthermore, strict environmental standards related to the carbon footprint and waste management in adipic acid production have emerged as a significant issue. Compliance with these regulations necessitates investments in advanced technologies and sustainable methods, leading to increased operational expenses. Moreover, the presence of competing products, such as eco-friendly alternatives or bio-based substitutes, may divert demand from adipic acid, especially in regions prioritizing sustainability. Lastly, global economic uncertainties, market instabilities, and trade disruptions among countries could adversely influence the overall demand for adipic acid. Despite these challenges, there are ample opportunities for growth in the adipic acid sector, particularly through technological innovations, product enhancements, and strategic partnerships. With a rising need for nylon production and the growth of the automotive and electronics industries, the market outlook remains positive. Manufacturers can capitalize on these prospects by emphasizing sustainable manufacturing practices, expanding their product range, and ensuring cost efficiency to stay competitive in the market.

Key Segments of the Adipic Acid Market

Application Overview

• Polyurethane

• Nylon 6,6 Fiber

• Nylon 6,6 Resin

• Adipate Esters

• Others

End-Use Overview

• Automotive

• Electrical & Electronics

• Packaging & Consumer Goods

• Building & Construction

• Textile

• Others

Raw Material Overview

• Cyclohexanol

• Cyclohexanone

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America