Market Analysis and Insights:

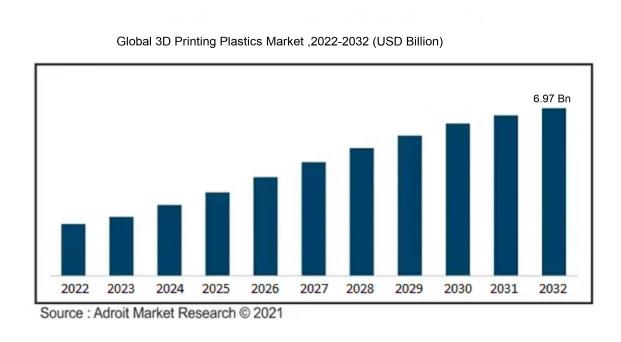

The market for Global 3D Printing Plastics was estimated to be worth USD 1.41 billion in 2023, and from 2024 to 2032, it is anticipated to grow at a CAGR of 20.62%, with an expected value of USD 6.97 billion in 2032.

The market for 3D printing plastics is influenced by a variety of factors. One key driver is the constant advancement of technology and innovation within the 3D printing sector, which significantly impacts market growth. The ongoing improvements in both techniques and materials have broadened the scope of applications for 3D printing plastics, resulting in a rise in market demand. Additionally, the increasing utilization of 3D printing technology across multiple industries such as automotive, aerospace, healthcare, and consumer goods is contributing to the surge in demand for 3D printing plastics. This is mainly attributed to the unique benefits offered by 3D printing, including customized solutions, rapid prototyping, and cost-efficient production processes. Furthermore, there is a growing emphasis on sustainable and environmentally friendly manufacturing practices, leading to a rise in demand for biodegradable and recycled 3D printing plastics. As companies seek to reduce their environmental impact, the adoption of biodegradable and recyclable materials in 3D printing is gaining traction. Lastly, government initiatives and investments in the development of 3D printing technologies are also playing a significant role in propelling market growth. These initiatives aim to incentivize the adoption of 3D printing across different sectors, fostering innovation and further research in the realm of 3D printing plastics.

3D Printing Plastics Market Scope:

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2032 |

| Study Period | 2018-2032 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2032 | USD 6.97 billion |

| Growth Rate | CAGR of 20.62% during 2024-2032 |

| Segment Covered | By Type, By Form, By Application, By End-Use, By Region. |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Stratasys Ltd., 3D Systems Corporation, The ExOne Company, EOS GmbH Electro Optical Systems, Materialise NV, SLM Solutions Group AG, EnvisionTEC Inc., Arcam AB, voxeljet AG, and Protolabs. |

Market Definition

3D printing polymers encompass a variety of materials suitable for additive manufacturing to produce three-dimensional objects. These polymers are uniquely developed to melt and conform through a layer-by-layer printing method, allowing for the creation of detailed and flexible designs. 3D printing plastics are essential in the realm of additive manufacturing given their wide-ranging advantages and applications. These materials provide versatility, longevity, and a diverse set of mechanical characteristics, rendering them appropriate for a variety of sectors including aerospace, automotive, healthcare, and consumer products. The capability to fabricate intricate and tailored forms at a modest expense using 3D printing plastics has transformed the production process, enabling swift prototyping, waste reduction, and enhanced productivity. Additionally, these resources are eco-conscious since they can be repurposed and regenerated, promoting sustainable methodologies. In essence, the significance of 3D printing plastics is rooted in their capacity to introduce innovation, cost-efficiency, and environmental sustainability across a spectrum of industries.

Key Market Segmentation:

Insights On Key Type

Photopolymers

Among the different of 3D Printing Plastics, photopolymers will dominate the global marketAmong the different of 3D Printing Plastics,. Photopolymers are a type of 3D printing material that solidifies when exposed to light, making them ideal for creating detailed and intricate objects. This type of plastic offers high resolution and accuracy, allowing for the production of intricate designs with fine details. Moreover, photopolymers are widely used in industries such as healthcare, automotive, and aerospace due to their excellent mechanical properties and biocompatibility. The increasing demand for complex and customized products, coupled with the need for high-performance materials, is expected to drive the dominance of photopolymers in the global 3D printing plastics market.

ABS

ABS (Acrylonitrile Butadiene Styrene) is a commonly used 3D printing plastic known for its strength, durability, and impact resistance. It is widely employed in manufacturing functional prototypes, automotive s, and household items. The versatility of ABS makes it a popular choice among manufacturers and designers.

PLA

PLA (Polylactic Acid) is a biodegradable and renewable 3D printing plastic derived from plant-based sources such as cornstarch or sugarcane. It offers ease of use, low toxicity, and good environmental compatibility. PLA is often preferred for applications requiring low-cost prototypes, food packaging, and educational purposes.

Polyamide

Polyamide, also known as nylon, is another significant in the 3D printing plastics market. Its high strength, chemical resistance, and heat resistance make it suitable for producing functional s, such as gears, bearings, and automotive components.

PETG

PETG (Polyethylene Terephthalate Glycol) is a durable and easy-to-use 3D printing plastic that combines the strength of ABS with the clarity of PLA. It finds applications in manufacturing functional prototypes, medical devices, and consumer products.

Others

The "Others" category includes various other 3D printing plastics such as polycarbonate, TPU (Thermoplastic Polyurethane), and PEEK (Polyether Ether Ketone). These materials offer unique properties, such as high-temperature resistance, flexibility, and flame retardancy, making them suitable for specific applications or industries.

Insights On Key Form

Filament

Filament is expected to dominate the global 3D printing plastics market. Filament is the most commonly used form of 3D printing material due to its versatility, accessibility, and ease of use. It is widely used in various industries, including aerospace, automotive, healthcare, and consumer goods. Filament offers a wide range of material options such as ABS, PLA, PETG, and Nylon, providing different properties and allowing for diverse applications. Its popularity can be attributed to its affordability, compatibility with a wide range of 3D printers, and the availability of a large number of filament suppliers worldwide. Additionally, filament allows for high-resolution prints and offers excellent layer adhesion, making it a preferred choice for many 3D printing enthusiasts and professionals.

Powder

Powder is another important form of 3D printing plastics in the global market. Although not as dominant as filament, powder-based 3D printing is gaining traction, especially in industries requiring high precision and complex geometries, such as aerospace, medical, and dental. Powder-based printers utilize materials like nylon, polypropylene, and polycarbonate, among others, to create intricate and functional s. Powder-based 3D printing offers advantages like the ability to produce s with fine details, complex internal structures, and excellent surface finish. However, powder-based printers often require specialized equipment, process controls, and post-processing steps, making them more complex and expensive compared to filament-based systems.

Liquid

Liquid-based 3D printing plastics represent a smaller within the global market. This method, also known as stereolithography (SLA) or digital light processing (DLP), uses liquid resins that are photopolymerized layer by layer to create 3D objects. Liquid resins offer a diverse range of properties, including flexibility, transparency, and high strength. Liquid-based 3D printing is commonly utilized in industries like jewelry, prototyping, and dental applications, where high levels of detail and accuracy are crucial. However, the limitations of liquid-based systems, such as material availability, post-processing requirements, and higher costs, hinder widespread adoption in comparison to filament and powder-based options.

Insights On Key Application

Prototyping

Prototyping is expected to dominate the Global 3D Printing Plastics Market. Prototyping is the process of creating a preliminary model or prototype of a product. With 3D printing, companies can quickly and cost-effectively produce prototypes to validate designs before moving forward with full-scale manufacturing. This enables faster product development cycles and reduced time to market. Therefore, the demand for 3D printing plastics for prototyping purposes is expected to be high, making it the dominating in the global market.

Manufacturing

Manufacturing is not expected to dominate the Global 3D Printing Plastics Market. While 3D printing has gained popularity in manufacturing for its ability to create complex geometries and reduce waste, it still faces limitations in terms of production volume and material properties. Traditional manufacturing methods continue to be the preferred choice for large-scale production due to their efficiency and cost-effectiveness. Therefore, the demand for 3D printing plastics in manufacturing is likely to be significant but not dominant in the market.

Tooling

Tooling is also not expected to dominate the Global 3D Printing Plastics Market. Tooling refers to the production of molds, jigs, and fixtures used in manufacturing processes. While 3D printing can offer advantages in terms of design flexibility and customization in tooling applications, it may not be suitable for high-volume production and certain demanding requirements. Traditional tooling methods, such as injection molding, still remain the preferred choice for many industries. Hence, the demand for 3D printing plastics in tooling applications is expected to be substantial but not dominant in the market.

Insights On Key End-Use

Automotive

The Automotive is expected to dominate the Global 3D Printing Plastics Market. The automotive industry has been increasingly adopting 3D printing technology for various applications such as prototyping, tooling, and even production s. The ability to customize and manufacture complex geometries with 3D printing has led to improved design possibilities and reduced lead times in the automotive sector. Additionally, 3D printing offers lightweight and durable plastic components that can contribute to fuel efficiency. With the growing demand for electric vehicles and advancements in autonomous driving technologies, the automotive sector is likely to drive the adoption of 3D printing plastics.

Aerospace & Defense

The Aerospace & Defense is expected to play a significant role in the Global 3D Printing Plastics Market. The aerospace industry has been utilizing 3D printing for manufacturing lightweight components with complex designs, which can lead to improved fuel efficiency and reduced production costs. Furthermore, 3D printing enables the production of s on-demand and facilitates rapid prototyping, allowing for faster iteration and design improvements. In the defense sector, 3D printing plastics are applied in the production of unmanned aerial vehicles (UAVs) and military equipment. The continuous advancements in additive manufacturing technology are expected to further drive the adoption of 3D printing plastics in the aerospace and defense industry.

Healthcare

The Healthcare is anticipated to have a significant presence in the Global 3D Printing Plastics Market. 3D printing has revolutionized the healthcare industry by enabling the production of patient-specific medical devices, prosthetics, and anatomical models. The ability to create personalized and custom-fit implants or prostheses using 3D printed plastics improves patient outcomes and enhances overall healthcare efficiency. Moreover, 3D printing allows for the fabrication of complex geometries and intricate structures, which are often challenging to manufacture using traditional methods. As the demand for customized medical solutions continues to grow, the adoption of 3D printing plastics is expected to increase within the healthcare sector.

Consumer Goods

The Consumer Goods is likely to have a notable presence in the Global 3D Printing Plastics Market. With 3D printing, consumers can now create their own customized products and prototypes, ranging from fashion accessories to household items. The ability to produce unique designs on-demand and the freedom from mass production constraints have made 3D printing plastics an attractive option for consumer goods manufacturers. Additionally, 3D printing allows for greater design flexibility and the incorporation of intricate details, resulting in aesthetically appealing and functional consumer products. These factors are expected to drive the adoption of 3D printing plastics in the consumer goods industry.

Others

The Other encompasses various industries such as electronics, architecture, and education, among others. While these industries may see significant adoption of 3D printing plastics in specific applications, they are not expected to dominate the global market. For instance, electronics manufacturers may utilize 3D printing for rapid prototyping of casings or components, while architects may utilize the technology for producing scaled models. However, their overall impact on the Global 3D Printing Plastics Market is likely to be smaller compared to the dominating s mentioned above.

Insights on Regional Analysis:

Asia Pacific

Asia Pacific is expected to dominate the Global 3D Printing Plastics market. This region has been experiencing significant growth in the adoption of 3D printing technology across various industries such as automotive, healthcare, and electronics. The presence of major players in countries like China, Japan, and South Korea has also contributed to the dominance of the Asia Pacific region in the market. Furthermore, the region has a large manufacturing base and a favorable regulatory environment, which has further fueled the growth of the 3D printing plastics market. With a growing focus on advanced manufacturing and the rising demand for customized products in the region, Asia Pacific is poised to remain the dominant market for 3D printing plastics.

North America

North America has been one of the key regions driving the growth of the global 3D printing plastics market. The region is home to several advanced manufacturing industries, including aerospace, automotive, and healthcare, which are major users of 3D printed plastic components. Moreover, the presence of prominent players and extensive research and development activities in the region has boosted the adoption of 3D printing plastics. However, compared to the Asia Pacific region, the growth in North America's 3D printing plastics market might be relatively slower due to market saturation and intense competition.

Europe

Europe has also been witnessing significant growth in the adoption of 3D printing plastics. The region has a well-established manufacturing sector and a strong focus on innovation and technological advancements. Countries such as Germany, the UK, and France are leading the market in Europe, with the presence of major players and a high demand for 3D printed plastic products in various industries. However, while Europe shows potential for growth in the 3D printing plastics market, it may not dominate the global market due to the intense competition from other regions such as Asia Pacific.

Latin America

Latin America is gradually emerging as a promising market for 3D printing plastics. The region has witnessed a growing interest in 3D printing technology, icularly in countries like Brazil and Mexico. The automotive and healthcare sectors in Latin America are showing increasing adoption of 3D printed plastic components. However, the market is still in its early stages, and the growth potential is yet to be fully realized. Therefore, it is unlikely that Latin America will dominate the global 3D printing plastics market in the near future.

Middle East & Africa

The Middle East and Africa region are also witnessing growth in the adoption of 3D printing plastics, albeit at a slower pace compared to other regions. The market in this region is driven by sectors such as healthcare, automotive, and construction. However, the limited awareness and availability of advanced 3D printing technologies, along with the challenges related to infrastructure and skilled labor, might hinder the region's dominance in the global 3D printing plastics market. While the market potential is there, it will require further investment and development to catch up with other regions.

Company Profiles:

Prominent figures in the international 3D Printing Plastics sector are pivotal in the creation and production of top-tier 3D printing plastic materials and technologies. Their efforts cater to the rising needs of industries like aerospace, automotive, healthcare, and consumer goods. These individuals are instrumental in fostering innovation and advancing the global acceptance of 3D printing technology. Prominent contributors in the realm of 3D Printing Plastics Market encompass Stratasys Ltd., 3D Systems Corporation, The ExOne Company, EOS GmbH Electro Optical Systems, Materialise NV, SLM Solutions Group AG, EnvisionTEC Inc., Arcam AB, voxeljet AG, and Protolabs.

COVID-19 Impact and Market Status:

The Global 3D Printing Plastics market has faced notable impact from the Covid-19 pandemic, with supply chain interruptions and decreased demand stemming from economic instability. Despite these challenges, the market is anticipated to rebound and expand in the forthcoming years. The outbreak of COVID-19 has presented a dual impact on the 3D printing plastics sector. The global supply chains have encountered significant disturbances, leading to issues in sourcing essential raw materials and components necessary for 3D printing operations.

Consequently, this has caused delays in production and temporary shutdowns of 3D printing facilities. Conversely, the pandemic has brought forth fresh prospects for the 3D printing plastics industry. The demand for personal protective equipment (PPE) like face shields and masks has risen sharply, prompting the utilization of 3D printing technology to fulfill this urgent requirement. Furthermore, the crisis has emphasized the advantages of localized manufacturing, driving an increased interest in the adoption of 3D printing methods to diminish reliance on imports and bolster supply chain robustness. In essence, although the 3D printing plastics market has encountered immediate hurdles due to the pandemic, it has also uncovered novel pathways for expansion and progress.

Latest Trends and Innovation:

- In May 2020, BASF announced its acquisition of Sculpteo, a French on-demand 3D printing service provider, to strengthen its position in the 3D printing plastics market.

- In September 2020, 3D Systems introduced Figure 4® RUBBER-65A, a new 3D printing material designed for the production of high-speed elastomeric s, expanding its portfolio in the 3D printing plastics sector.

- In December 2020, Arkema acquired 3DXTech, a US-based 3D printing materials company, to enhance its offering of advanced 3D printing materials and provide solutions for various industries.

- In January 2021, Evonik announced the launch of VESTAMID® HTplus, a high-temperature resistant polymer material for the 3D printing market, expanding its product range of 3D printing plastics.

- In April 2021, HP Inc. unveiled its new HP Jet Fusion 5200 Series 3D printing solution, aimed at industrial-scale manufacturing with improved productivity and cost efficiency using 3D printing plastics.

- In May 2021, DSM announced its collaboration with Toyota Motorsport GmbH to develop high-performance 3D printed s for the automotive industry, further advancing the use of 3D printing plastics in automotive applications.

- In July 2021, Stratasys nered with Google Arts & Culture to bring 3D printing technology to museums and cultural institutions, enabling them to create replicas of artifacts using various 3D printing plastics.

- In September 2021, Covestro launched a new portfolio of 3D printing materials under the brand name Addigy®, including high-performance filaments made from polycarbonate and other innovative polymers for a wide range of applications.

Significant Growth Factors:

The expansion drivers of the 3D printing plastics industry comprise the rising usage in diverse sectors, technological progress, and the desire for personalized and intricate designs. The market for 3D printing plastics is witnessing remarkable growth driven by various significant factors. The expanding utilization of additive manufacturing technology across a diverse range of industries such as automotive, aerospace, healthcare, and consumer goods is propelling the need for 3D printing plastics. The cost-effective and efficient production capabilities of 3D printing for intricate and customized designs have led to its widespread acceptance. Progress in material science has given rise to the creation of high-performance and functional 3D printing plastics such as ABS, PLA, PETG, and nylon, which offer attributes like strength, durability, flexibility, and heat resistance, thus broadening the applications of 3D printing. Moreover, the increasing emphasis on sustainability and environmentally friendly manufacturing practices has elevated the demand for bio-based and recycled 3D printing plastics as viable alternatives to traditional petroleum-based plastics. Furthermore, the escalating investments in research and development endeavors by major industry players to improve material properties and compatibility with various 3D printing technologies have further catalyzed market expansion. Additionally, the surging adoption of 3D printing in healthcare for creating patient-specific medical devices, surgical tools, and organ printing has also driven the need for specialized medical-grade 3D printing plastics. In essence, the 3D printing plastics market is poised for significant growth due to the widespread integration of additive manufacturing, advancements in material science, increasing focus on sustainability, and expanding application domains.

Restraining Factors:

The restricted selection of suitable materials and the elevated expenses linked to them pose substantial limitations in the market for plastics used in 3D printing. The 3D printing plastics industry is currently witnessing a significant upsurge in growth attributed to its diverse range of applications across various sectors. Nevertheless, certain inhibiting factors are hampering the further progression of this market. The primary challenge is the substantial cost linked to 3D printing plastics, posing a major obstacle for small and medium-sized enterprises in terms of affordability. Furthermore, the limited selection of materials accessible for 3D printing constrains the adaptability of the technology. Another influential aspect is the absence of standardized regulations governing 3D printing, inducing uncertainty and hindering the uptake of this innovative technology. Moreover, the potential environmental repercussions of 3D printing plastics, including the utilization of non-biodegradable materials and waste generation, necessitate attention to ensure sustainable practices in the long term. Despite these obstacles, there is an optimistic outlook for the 3D printing plastics market. Ongoing research and development endeavors aimed at enhancing material choices and cost reduction are anticipated to propel market expansion. Additionally, nerships between industry stakeholders and regulatory entities could pave the way for the establishment of standardized regulations, ensuring a more stable and enabling business environment. With continuous technological advancements and growing awareness of sustainable methodologies, the future prospects for the 3D printing plastics industry appear promising.

Key Segments of the 3D Printing Plastics Market

Plastics Type Overview

• Photopolymers

• ABS (Acrylonitrile Butadiene Styrene)

• PLA (Polylactic Acid)

• Polyamide

• PETG (Polyethylene Terephthalate Glycol)

• Others

Form Overview

• Filament

• Powder

• Liquid

Application Overview

• Prototyping

• Manufacturing

• Tooling

End-Use Overview

• Aerospace & Defense

• Automotive

• Healthcare

• Consumer Goods

• Others

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America

Frequently Asked Questions (FAQ) :

Need for district energy systems is predicted to rise in response to rising global environmental consciousness and greater demand for energy-efficient solutions. Due to rising demand for residential and commercial projects globally, the building and construction application category is expected to rise at a significant CAGR from 2020 to 2028. Population growth and urbanization are likely to fuel segmental growth.

Asia-Pacific controls the world's largest 3D printing plastics market. China is the leader in 3D printing plastics manufacturing because to rising production and consumption of insulated items, and important leaders are getting funding from China and India. Because of significant business expansions and construction in developing countries, the Asia-Pacific region is expected to grow at the quickest rate between 2020 and 2027. China is driving the growth of the Asia-Pacific market due to the extensive usage of 3D printing plastics and substantial sales of chemicals and petroleum products. The United States dominates North America because to its vast production of oil and petroleum products, but Germany dominates the European market owing to its replacement of old pipes in chemical facilities with rigid foam. The bulk of chemical manufacturing facilities are over 50 years old, needing pipe replacement every 10 to 20 years, depending on demand, restricting the expansion of the German 3D printing plastics industry.

Type Segment

Based on form, the 3D printing plastics market was dominated by the filament segment in 2017. With its widespread use in general and industrial applications, the filament sector is expected to dominate the market. In terms of the growth of laser sintering technology, the powder category is predicted to have the largest CAGR throughout the projection period. The 3D printing plastics market has been divided into end-use industries such as aerospace and military, healthcare, automotive, electrical and electronics, and others. The healthcare category led the 3D printing plastics market in 2017, and it is predicted to grow at the fastest CAGR from 2018 to 2023, owing to rising demand from medical devices & equipment and orthopedic & dental implants.

Application Segment

The prototype segment led the 3D printing plastics market in 2017, and this trend is projected to continue throughout the forecast period. During the projection period, the manufacturing segment is predicted to have the greatest CAGR.

The Asia Pacific 3D printing plastics market is expected to grow at the fastest rate between 2018 and 2023. Because of the large presence of the aerospace & military and healthcare industries, which are the key end users of 3D printing plastics, North America and Europe are expected to remain the leading markets for 3D printing plastics.

North America led the 3D printing plastics market in 2019, accounting for more than 40% of worldwide sales. The area is made up of established markets and is distinguished by a technologically advanced 3D printing sector, which contributes considerably to the worldwide market. One of the primary market limitations is environmental concerns over the usage of plastics. 3D Systems Corporation (US), Stratasys Ltd. (US), Arkema SA (France), BASF SE (Germany), Evonik Industries AG (Germany), SABIC (Saudi Arabia), HP Inc. (US), DowDuPont Inc. (US), Royal DSM N.V. (Netherlands), EOS GmbH Electro Optical Systems (Germany), Clariant International Ltd. (Switzerland), CRP Group (US), Envisiont ( (US). These multinational businesses, who have a well-established distribution network and industry experience, are increasing their R&D investments. They also have strong technical and market development capabilities, which enable them to upgrade their existing products for new applications.

.png)