3D Printing Medical Device Market Analysis and Insights:

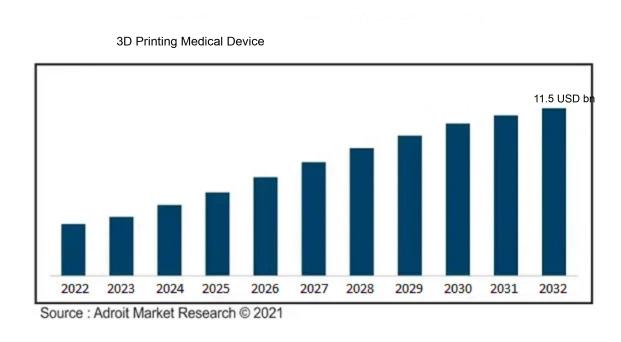

The market for 3D Printing Medical Devices was estimated to be worth USD 2.9 billion in 2023, and from 2024 to 2032, it is anticipated to grow at a CAGR of 17.5%, with an expected value of USD 11.5 billion in 2032.

The expansion of the 3D printing medical device sector is primarily influenced by advancements in technology, a rising interest in personalized medicine, and partnerships between healthcare entities and additive manufacturing companies. Breakthroughs in bioprinting methods have paved the way for the development of tailored solutions, including prosthetics and implants, which significantly improve patient outcomes. The increasing rates of chronic illnesses create a demand for more effective and individualized treatment strategies, further driving the market's growth. Furthermore, the inherent cost-efficiency and shortened production timelines of 3D printing attract healthcare organizations seeking to enhance their resource management. An improvement in regulatory frameworks and guidelines concerning 3D printed devices is easing the path for new entrants into the market. In addition, an emphasis on minimally invasive surgical techniques is elevating the need for customized tools and devices, thereby strengthening the industry's growth and establishing 3D printing as an essential element in contemporary medical practices.

3D Printing Medical Device Market Definition

The process of 3D printing in the medical field involves leveraging additive manufacturing techniques to produce personalized medical tools, implants, and prosthetics that cater to the specific requirements of each patient. This cutting-edge methodology facilitates meticulous design and production, thereby boosting treatment efficacy and enhancing patient recovery results.

The role of 3D printing in the field of medical devices is crucial, as it enables the creation of bespoke and highly precise prototypes and implants that are specifically designed to fit the unique anatomies of individual patients. This innovative technology accelerates the development process, significantly cutting down both production time and costs while maintaining exceptional accuracy. The ability to customize medical devices greatly enhances treatment efficacy, especially in fields such as orthopedics, dentistry, and reconstructive surgery, where tailor-made items like prosthetics and surgical guides lead to improved patient results. Additionally, 3D printing makes it possible to produce intricate designs that traditional manufacturing methods may not be able to replicate, thereby broadening the horizon for medical device innovation and promoting progress in regenerative medicine and bioprinting for tissue engineering purposes.

3D Printing Medical Device Market Segmental Analysis:

Insights On Product

3D Bio-printers

The 3D Bio-printers category is expected to dominate the Global 3D Printing Medical Device Market due to their significant application in the bioprinting of tissues and organs, which is revolutionizing regenerative medicine. The rising prevalence of chronic diseases and the growing need for organ transplants have driven innovation in this field. With advancements in bioink materials and printing techniques, 3D Bio-printers offer unparalleled customization for patient-specific solutions, enhancing the efficacy of medical treatments. Additionally, the increasing collaboration between biotechnology firms and healthcare providers to improve bioprinting technology supports their leading position in this market.

3D Printers

3D Printers play an essential role in the medical device landscape, providing tools for producing customized implants, prosthetics, and surgical instruments. As the technology becomes more cost-effective and accessible, hospitals and clinics are increasingly adopting 3D printing capabilities to enhance operational efficiency and reduce production lead times. The rising interest from dental practices in producing orthodontic devices also contributes to the growth of this category. This trend will likely continue as more professionals recognize the extensive possibilities of 3D Printers in mastering personalized healthcare solutions.

Material

The Material category encompasses the diverse range of substances required for 3D printing applications in the medical field, including plastics, metals, and bio-compatible materials. As the demand for high-quality, functional, and safe medical devices increases, the need for innovative materials that meet stringent regulatory standards also grows. Research is ongoing to develop materials that exhibit desirable properties such as strength, flexibility, and biocompatibility. The understanding that the success of 3D printing largely depends on the materials used will keep this relevant in supporting advancements in medical devices.

Software & Services

The Software & Services sector is crucial in facilitating the operation, design, and optimization of 3D printing processes for medical applications. With the complexity of designing intricate medical devices, effective software solutions that enable precise modeling, simulation, and production management are in high demand. Additionally, as healthcare providers seek to streamline their operations and improve patient outcomes, services that encompass training, maintenance, and consultation on 3D printing technologies add significant value to the overall process. This is particularly true in overcoming regulatory challenges and enhancing workflow efficiencies.

Insights On Technology

Laser Beam Melting

Laser Beam Melting (LBM) is anticipated to dominate the Global 3D Printing Medical Device Market due to its ability to produce highly complex geometries, intricate structures, and precision components that are critical for medical applications. This technology is particularly effective in creating metal implants and prosthetics, which require high strength and biocompatibility. The ongoing advancements in laser technology enhance the speed and accuracy of the fabrication process, addressing the growing demand for customized medical devices tailored to individual patients. Moreover, LBM is favored for its capacity to recycle materials, making it a sustainable choice in the healthcare sector.

Photo Polymerization

Photo Polymerization, also known as resin-based 3D printing, is a widely recognized technique that offers high-resolution and detailed prints. This technology is mainly utilized in creating dental devices, surgical guides, and anatomical models. Its capability to produce intricate designs makes it favorable for prototyping and low-volume production runs, especially in dental applications. While not as prevalent as LBM for metal applications, its efficiency in creating precise and customized prototypes places it as an important technology in the overall medical device market.

Three-dimensional Printing

Three-dimensional Printing (3DP) encompasses a variety of printing techniques that typically use polymer materials to create models, prototypes, and functional devices. While it provides flexibility in design and is suitable for producing devices such as hearing aids and soft tissue applications, the resolution and material properties can vary significantly depending on the specific 3D printing method employed. Despite this, the versatility and lower initial costs associated with 3DP technologies make it appealing, particularly for rapid prototyping in medical device development.

Electron Beam Melting

Electron Beam Melting (EBM) is prominently used for the fabrication of aerospace and orthopedic implants due to its ability to deliver significant mechanical properties and ensure material integrity. It utilizes a high-energy electron beam to melt and fuse metal powder, allowing for the creation of complex geometries that are essential in medical applications. Although it competes closely with Laser Beam Melting, EBM is more suitable for high melting point materials such as titanium alloys. Its slower build speed, however, can limit its widespread application compared to faster technologies.

Droplet Deposition

Droplet Deposition encompasses various techniques designed primarily for bio-printing applications, such as tissue engineering and drug delivery systems. This method stands out due to its ability to build complex tissue structures layer by layer using living cells and biomaterials. However, it faces challenges in resolution and precision when compared to LBM and other advanced techniques. Despite these limitations, Droplet Deposition holds the potential for significant advancements in personalized medicine and regenerative therapies, making it an essential part of the broader 3D printing ecosystem within the healthcare landscape.

Insights On Key Application

Standard Prosthetics & Implants

The Standard Prosthetics & Implants category is anticipated to lead in the Global 3D Printing Medical Device Market. This dominance can be attributed to the rapid customization of prosthetic devices, which aligns with increasing patient demand for tailored solutions that enhance comfort and functionality. The ability to leverage 3D printing technology allows for precision fitting and reduces production times, making these devices more accessible. Additionally, the growth of the aging population and rising incidences of trauma and congenital conditions create a substantial market for prosthetic innovations, further solidifying its leading position in the market.

Surgical Guides

Surgical Guides represent an important niche in the 3D printing medical device landscape, providing enhanced precision in surgical procedures. They facilitate better alignment and positioning for implants or other interventions, which significantly improves surgical outcomes. The increasing adoption of minimally invasive techniques drives the demand for customized guides that are tailored to individual patient anatomies. As surgeons embrace advanced technologies to enhance accuracy in procedures such as dental implants and orthopedic surgeries, the relevance of surgical guides continues to grow in the market.

Surgical Instruments

Surgical Instruments produced through 3D printing are gaining traction due to their ability to be customized for specific surgeries and patient needs. The use of this technology allows for lower manufacturing costs and quicker production times, reducing operating room delays. Furthermore, the trend towards surgical instrument sterilization and lightweight materials can be effectively achieved using 3D printing, making these instruments more appealing. As healthcare facilities prioritize innovation alongside efficiency, tailored surgical instruments are becoming an essential tool in the operating room.

Tissue-engineered Products

Tissue-engineered Products are making significant strides in the 3D printing sector, offering groundbreaking solutions for regenerative medicine. This area is vital for developing scaffolds that can promote cellular growth and tissue repair. As advancements are made in bioprinting technology, the ability to create complex tissues that mimic natural biological structures becomes feasible, opening Doors to novel treatments. Demand in this is expected to rise thanks to various applications in reconstructive surgery and wound healing, making tissue-engineered products essential in the healthcare future.

Hearing Aids

Hearing Aids are seeing a shift towards personalized solutions through 3D printing technology. With the capacity for crafting custom-fit devices that cater precisely to an individual's ear shape and hearing loss degree, this market is poised for growth. Patients increasingly prefer discreet and comfortable solutions, which 3D printing can provide more effectively than traditional methods. As the global population ages, the demand for innovative hearing solutions is projected to rise, making hearing aids a critical area for advancements in the 3D printing medical device market.

External Wearable Devices

External Wearable Devices designed using 3D printing are becoming increasingly popular for health monitoring and rehabilitation. The customization capabilities of 3D printing allow for devices that fit users comfortably while being trend-setting. These devices, including smart health trackers and rehabilitation equipment, promote user engagement and are effective in collecting health data. The growing trend of personalized medicine and fitness awareness signifies a rising market for such wearables. As technologies mature, demand for externally worn health devices will continue to expand, driving their growth in the 3D printing medical sector.

Insights On End User

Hospitals

Hospitals are expected to dominate the Global 3D Printing Medical Device Market due to their critical role in healthcare delivery and patient care. They are increasingly investing in advanced technologies, including 3D printing, to enhance surgical precision, produce custom implants, and improve patient outcomes. Hospitals require tailored devices, making 3D printing an ideal solution for creating patient-specific models and tools. The rising preference for personalized medicine, along with the increasing prevalence of chronic diseases requiring complex interventions, drives the demand for innovative medical solutions in hospital settings. Additionally, hospitals are integrating 3D printing technologies into their processes for education and training, further solidifying their leading position within the market.

Academic Institutes

Academic institutes play a vital role in advancing research and education in the field of medical devices, including 3D printing. They focus on developing innovative technologies and exploring novel applications that can improve healthcare delivery. With collaborations between academia and industry, these institutions contribute to the growth of knowledge and expertise in 3D printing techniques, which can be translated into practical applications in medicine. They often act as incubators for new ideas and products, fostering innovation that can eventually benefit the healthcare sector.

Contract Research Organizations

Contract Research Organizations (CROs) are increasingly utilizing 3D printing technologies to streamline research and development processes for medical devices. They provide vital support to pharmaceutical and biotechnology companies by managing clinical trials and accelerating the time-to-market for innovative products. CROs benefit from 3D printing capabilities by developing custom models for testing and analysis, improving accuracy in preclinical studies. As the demand for efficient and rapid product development grows, CROs are expected to leverage 3D printing to remain competitive and meet the evolving needs of their clients.

Pharma & Biotech Companies

Pharma & Biotech companies are significant players in the 3D Printing Medical Device Market, leveraging this technology to enhance drug delivery systems and create personalized medication. Through 3D printing, these companies can produce tailored formulations and devices that cater to specific patient needs, thereby improving treatment efficacy. Moreover, the integration of 3D printing into their R&D processes allows for rapid prototyping and testing of new drug formulations and delivery mechanisms. This customization is crucial for advancing personalized medicine, making pharma and biotech companies a noteworthy part of the overall market dynamics.

Global 3D Printing Medical Device Market Regional Insights:

North America

North America is expected to dominate the Global 3D Printing Medical Device Market due to a combination of advanced technological infrastructure, significant investment in healthcare innovations, and the presence of leading companies in 3D printing technologies. The region's strong focus on research and development, coupled with high healthcare spending, facilitates the adoption of 3D printing applications in various medical sectors, including prosthetics, implants, and surgical instruments. Furthermore, collaboration between healthcare institutions and technology firms fosters an ecosystem conducive to growth, ultimately positioning North America at the forefront of the 3D printing medical device landscape.

Latin America

Latin America presents a developing landscape for the 3D Printing Medical Device market, primarily driven by increasing healthcare demands and the gradual adoption of advanced technologies. While the region is not expected to dominate, initiatives to improve healthcare accessibility and affordability are fostering growth. Advancements in local manufacturing capabilities and investments from international companies in the region provide the potential for increased penetration of 3D printed medical devices, particularly in underserved areas.

Asia Pacific

The Asia Pacific region is experiencing significant growth in the 3D Printing Medical Device Market, driven by rapid technological advancements and increasing healthcare investments. Countries like China and Japan are at the forefront, with strong government support for innovation and a burgeoning demand for customized medical solutions. However, challenges related to regulatory frameworks and infrastructure can temper the pace of growth, preventing it from overtaking North America in the near term.

Europe

Europe stands as a key player in the Global 3D Printing Medical Device Market, propelled by stringent regulations promoting advanced manufacturing techniques. The region boasts a robust healthcare ecosystem that encourages research and collaborative innovation, with several countries investing heavily in healthcare technologies. However, while Europe has a strong presence, it competes closely with North America, limiting its dominance due to varying market dynamics.

Middle East & Africa

The Middle East & Africa region remains in the early stages of developing its 3D Printing Medical Device Market. Although there is notable interest in healthcare improvements and technological advances, market penetration is hindered by economic constraints and limited access to resources. Efforts to enhance healthcare systems and attract foreign investments are emerging, but the region is far from being a dominant player compared to North America and other regions.

3D Printing Medical Device Competitive Landscape:

Leading figures in the worldwide market for 3D-printed medical devices, including producers, technology innovators, and healthcare organizations, are pivotal in fostering innovation and advancing production efficiencies. Their collaborative efforts focus on creating tailored solutions that enhance patient care while minimizing production expenses within the healthcare industry.

Prominent contenders within the medical device sector of 3D printing encompass Stratasys Ltd., 3D Systems Corporation, Materialise NV, Siemens Healthineers, Stryker Corporation, GE Additive, EOS GmbH, Medtronic Plc, HP Inc., EnvisionTEC (now integrated into Desktop Metal), Arcam AB (a subsidiary of GE Additive), Aspect Biosystems, Formlabs, Nexxt Spine, and RMIT University.

Global 3D Printing Medical Device COVID-19 Impact and Market Status:

The Covid-19 crisis greatly expedited the integration of 3D printing technology within the medical device sector, underscoring its ability to swiftly produce and tailor solutions in light of pressing healthcare needs.

The COVID-19 pandemic has profoundly affected the market for 3D-printed medical devices, accelerating both innovation and widespread acceptance. The urgent requirement for swift prototyping and the manufacturing of essential medical apparatus—such as ventilators, personal protective equipment (PPE), and specialized devices—positioned 3D printing as an essential technological response. Hospitals and manufacturers harnessed this capability to tackle shortages and adapt promptly to fluctuating needs. Additionally, the crisis prompted increased funding in research and development for 3D printing, leading to improvements in biocompatible materials and printing methodologies. While there were initial disruptions in supply networks, the pandemic underscored the benefits of localized production and tailored solutions, resulting in a significant shift towards more resilient manufacturing strategies. Consequently, the market for 3D-printed medical devices is projected to continue its growth trajectory, fueled by persistent healthcare challenges, a greater emphasis on personalized solutions, and advancements in manufacturing techniques in the post-pandemic landscape.

Latest Trends and Innovation in The Global 3D Printing Medical Device Market:

- In July 2023, Stryker Corporation acquired Vexim, a company specializing in spinal surgery products. This acquisition aimed to enhance Stryker’s position in the orthopedic market with innovative 3D-printed solutions.

- In January 2023, Materialise established a partnership with Johnson & Johnson to develop personalized 3D-printed surgical guides for orthopedic procedures. This collaboration aimed to leverage Materialise's expertise in 3D printing to enhance surgical precision.

- In August 2022, 3D Systems announced the acquisition of Cimatron, aimed at expanding its capabilities in software solutions for additive manufacturing, particularly in the medical device sector. This move intends to integrate advanced software for better design and production processes.

- In June 2022, Siemens Healthineers launched its "Digital Ecosystem" that includes features for additive manufacturing aimed at optimizing the production of customized medical devices, facilitating more efficient workflows.

- In October 2021, Stratasys partnered with Medtronic to co-develop 3D printing applications for medical devices, focusing on enhancing prototyping capabilities and faster development of patient-specific solutions.

- In March 2021, EOS GmbH introduced its latest metal 3D printing technology specifically designed for fabrication of complex medical devices, aligned with industry standards for biocompatibility and regulatory compliance in the healthcare sector.

- In February 2021, Formlabs launched a new line of biocompatible resins for its 3D printers, aimed specifically at the dental market but adaptable for various medical applications, thereby addressing the growing demand for customized dental devices.

- In April 2020, Organovo announced the successful development of human liver tissues printed using 3D bioprinting technologies, showcasing advancements in creating functional organs for research and potential therapeutic applications.

- In November 2019, GE Healthcare unveiled its partnership with several health systems to utilize 3D printing in creating patient-specific models for pre-surgical planning, enhancing outcomes in complex surgical cases.

3D Printing Medical Device Market Growth Factors:

The expansion of the medical device sector for 3D printing is fueled by technological innovations, a growing need for personalized solutions, and an increasing demand for patient-tailored products.

The market for 3D-printed medical devices is witnessing remarkable expansion due to several pivotal influences. Primarily, the soaring interest in personalized medicine is a major driver of this trend, as 3D printing technology enables the development of customized implants, prosthetics, and various devices that fit the unique anatomical needs of each patient. Furthermore, technological innovations, particularly in bioprinting and advancements in materials science, are paving the way for the creation of more intricate and functional medical devices, thereby broadening their clinical usage.

Additionally, the growing incidence of chronic diseases alongside an aging demographic underscores the demand for pioneering medical solutions, further fueling market growth. Supportive regulatory frameworks and initiatives designed to facilitate the adoption of 3D printing within the healthcare sector are crucial, as they expedite approval processes and attract investments. The emergence of cost-efficient manufacturing methods, which enable swift prototyping and reduced production times, also appeals to healthcare providers aiming to lower costs while enhancing patient care.

Finally, increased collaboration between tech companies and healthcare entities fosters the exchange of knowledge and expedites the introduction of new 3D printing applications. In summary, these interconnected factors create a dynamic environment that is driving the evolution of the 3D Printing Medical Device Market, establishing its role as a significant transformative element in the healthcare industry.

3D Printing Medical Device Market Restaining Factors:

The primary obstacles hindering the growth of the 3D printing medical device sector encompass regulatory hurdles, elevated manufacturing expenses, and constraints related to available materials.

One of the primary hurdles is the necessity for regulatory adherence, as these devices need to satisfy strict safety and effectiveness criteria imposed by regulatory bodies like the FDA in the United States and the EMA in Europe, which can result in delays before they can be introduced to the market. Furthermore, the financial burden associated with cutting-edge 3D printing technologies and materials can restrict access, particularly impacting smaller enterprises. Issues linked to intellectual property rights add another layer of complexity, leading companies to be cautious about investing significantly in innovations that might be readily duplicated. Additionally, the workforce lacks sufficient expertise, as not all medical professionals are trained in 3D printing techniques, which can hinder widespread adoption. The limited range of materials available and the difficulties associated with efficient scaling of production also pose significant obstacles to fully harnessing the capabilities of this emerging technology. Nonetheless, continuous advancements in technology, rising investments in research and development, and an increasing acceptance of personalized medicine are setting the stage for a more dynamic market for 3D printed medical devices. This evolution holds promise for innovative breakthroughs and enhancements in patient care in the years to come.

Key Segments of the 3D Printing Medical Device Market

By Product

- 3D Printers

- 3D Bio-printers

- Material

- Software & Services

By Technology

- Laser Beam Melting

- Photo Polymerization

- Three-dimensional Printing

- Electron Beam Melting

- Droplet Deposition

By Application

- Surgical Guides

- Surgical Instruments

- Standard Prosthetics & Implants

- Tissue-engineered Products

- Hearing Aids

- External Wearable Devices

By End User

- Hospitals

- Academic Institutes

- Contract Research Organizations

- Pharma & Biotech Companies

Regional Overview

North America

- US

- Canada

- Mexico

Europe

- Germany

- France

- U.K

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

Middle East and Africa

- Saudi Arabia

- UAE

- Rest of Middle East and Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America