3D Printed Composites Market Analysis and Insights:

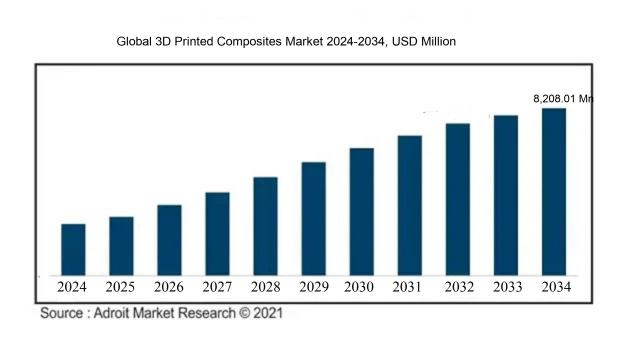

In 2024, the worldwide market for 3D printed composites was valued at USD 325.12 million. By 2025, it had grown to USD 449.20 million, and by 2034, it is projected to reach over USD 8,208.01 million, with a compound annual growth rate (CAGR) of 39.05%.

The market for 3D printed composites is significantly propelled by breakthroughs in additive manufacturing technologies that enhance both performance and adaptability of materials. An escalating need across sectors such as aerospace, automotive, and healthcare for lightweight yet strong components contributes to this market's growth. The capability to produce intricate geometries and tailor-made designs efficiently appeals to manufacturers eager to improve material utilization and minimize wastage. Furthermore, a ened emphasis on sustainability, coupled with a transition towards environmentally friendly materials in production, increases the demand for composite materials suitable for 3D printing. Innovations in material science that result in enhanced mechanical characteristics and thermal stability further contribute to the expansion of this market. Additionally, the emergence of Industry 4.0 and the adoption of smart manufacturing practices underscore the necessity of incorporating 3D printing into production workflows, serving as a vital element that shapes market trends as companies aim for ened efficiency and competitiveness in manufacturing settings.

3D Printed Composites Market Definition

3D printed composites are materials formed from the combination of two or more different elements through additive manufacturing processes, leading to superior mechanical characteristics and capabilities. Typically, these composites integrate polymers with reinforcement materials like fibers or nanoparticles, which enhance their strength, durability, and overall performance across a range of applications.

Composites produced through 3D printing are highly valuable across multiple sectors because of their distinctive attributes, including reduced weight, strength, and adaptability. These materials facilitate the fabrication of intricate shapes that conventional manufacturing methods struggle to produce, leading to improved design efficiency and minimized material waste. In industries like aerospace, automotive, and healthcare, 3D printed composites not only improve performance but also decrease expenses and production times. Furthermore, the capability to customize material characteristics during the printing process paves the way for innovation, contributing to technological advancements and expanding their uses from prototyping to the production of end components.

3D Printed Composites Market Segmental Analysis:

Insights On Composite Type

Carbon Fiber Composites

Carbon fiber composites are expected to dominate the Global 3D Printed Composites Market due to their superior mechanical properties, including high strength-to-weight ratio, rigidity, and thermal stability. These characteristics make them particularly appealing for applications in aerospace, automotive, and high-performance sporting goods, where performance and weight savings are critical. The increasing demand for lightweight materials in these sectors is pushing manufacturers to adopt carbon fiber composites for 3D printing, leading to innovations in production techniques that enhance their usability and effectiveness. As a result, this category is likely to capture the largest market share and drive the growth of the overall composites market.

Glass Fiber Composites

Glass fiber composites are known for their good tensile strength and are widely used due to their cost-effectiveness. They provide decent performance characteristics while being more affordable than carbon fiber composites. Their versatility allows for applications across various industries such as construction, automotive, and marine. The ability to produce large structures with glass fiber composites through 3D printing boosts their appeal in sectors looking to balance performance and cost. Increased investments in R&D can further enhance their capabilities, making them a popular choice in the composites market.

Graphene Composites

Graphene composites represent an advanced material option with remarkable electrical and thermal conductivity, as well as outstanding mechanical strength. Although they are still in the early stages of commercial application in the 3D printing sector, their potential is immense for high-tech industries, including electronics and advanced engineering. The challenge lies in production costs and scalability, but ongoing research is expected to lead to innovations that could unlock broader applications. As the technology matures and becomes more accessible, graphene composites could gain traction in specialized markets, though they may remain niche for now.

Aramid Fiber Composites

Aramid fiber composites are recognized for their high impact resistance and tensile strength, making them suitable for demanding applications such as protective clothing and ballistic reinforcement. Their lightweight nature and durability are also advantageous in aerospace and automotive industries. While aramid fibers possess exceptional performance characteristics, the market penetration for 3D printing applications has been slower due to cost and processing challenges. As manufacturers find more efficient ways to work with aramid fibers, their adoption in the composites market may increase, although they currently have a smaller presence compared to carbon fiber composites.

Insights On End-User

Aerospace & Defense

The Aerospace & Defense sector is expected to dominate the Global 3D Printed Composites Market due to its increasing demand for lightweight materials that can withstand extreme conditions. The aerospace industry relies heavily on advanced materials to enhance fuel efficiency and reduce overall aircraft weight, leading to significant cost savings. 3D printed composites offer the ability to create complex geometries that traditional manufacturing processes cannot achieve, thereby optimizing performance. Additionally, defense applications require custom, high-strength components that can be produced rapidly and affordably, supporting the growing trend of on-demand manufacturing. As a result, investment and R&D in this sector are robust, propelling it to the forefront of market growth.

Healthcare

The Healthcare sector is leveraging 3D printed composites for a range of applications, particularly within prosthetics and medical devices. Innovations in bespoke implant technology and surgical planning are driving the need for customized, biocompatible materials that 3D printing can provide. With the rise of personalized medicine, the ability to create patient-specific solutions has become essential, further validating the role of composite materials in enhancing patient outcomes. Additionally, regulatory approvals are becoming more streamlined, encouraging manufacturers to explore these advanced materials, though it may lag behind aerospace in terms of overall market share.

Automotive

The Automotive industry is increasingly investing in 3D printed composites to enhance vehicle performance and innovation. With a strong focus on lightweight materials to improve fuel efficiency and reduce emissions, composites are becoming a pivotal element in automotive design and manufacturing. Emerging trends in electric and autonomous vehicles further drive this shift, as manufacturers seek ways to minimize weight while maintaining structural integrity and safety. However, the integration of these advanced materials is still in its developmental stages within automotive applications, with competitive pressures prompting a gradual adoption alongside established manufacturing processes.

Others

In the "Others" category, various sectors such as sporting goods, consumer electronics, and construction are beginning to see the benefits of utilizing 3D printed composites. While these applications are not as large-scale as aerospace or healthcare, they represent an innovative approach to creating customized products and solutions. Industries are exploring the use of composites for improved design flexibility and enhanced performance characteristics. However, market traction is limited due to traditional manufacturing preferences and lower adoption rates compared to the dominant sectors. This potential for growth exists but is overshadowed by the significant advancements in more prominent industries.

Insights On Technology Type

Material Extrusion Technology

Material Extrusion Technology is expected to dominate the Global 3D Printed Composites Market. This is primarily due to its versatility, cost-effectiveness, and accessibility for both industrial and consumer applications. The technology allows for a wide range of materials, including various plastics and composites, to be processed and utilized in 3D printing. Its ability to produce large-scale components at relatively low investment and operational costs makes it particularly appealing for manufacturers looking to innovate in their production processes. The growing demand for customized and complex geometries in various industries such as aerospace, automotive, and consumer goods further propels this technology ahead of its competitors.

Fusion Bed Infusion

Fusion Bed Infusion is an emerging technology that focuses on the layering of materials, leading to unique mechanical properties in the final composites. Although it is not currently leading the market, its potential for producing high-strength parts with excellent thermal and chemical resistance is gaining traction. Industries that require durable and lightweight materials, such as aerospace and automotive, are beginning to explore this technology. As manufacturers push the envelope for enhanced material performance, Fusion Bed Infusion may carve out a significant niche in specialized applications in the future.

Stereolithography (SLA)

Stereolithography (SLA) is a well-established technology known for its high-resolution printing capabilities, making it particularly advantageous for applications requiring intricate detail and smooth finish. While it excels in the production of prototypes and small batches, its limitations in scalability and material availability restrict its widespread usage in high-volume applications compared to other methods like Material Extrusion Technology. Nevertheless, SLA remains relevant in fields such as healthcare and consumer product design, where precision is paramount, ensuring a steady demand for its use.

Selective Laser Sintering (SLS)

Selective Laser Sintering (SLS) is a process that uses lasers to fuse powdered materials, typically plastics or metals, into solid structures. Although it is strong in terms of material versatility and design capability, SLS technology hasn't gained the same market dominance as Material Extrusion Technology. Its generally higher operational costs and slower production speeds can inhibit its adoption for mass-market applications. However, SLS is highly valued in industries requiring robust functionality and custom applications, particularly in aerospace and complex geometries, ensuring its presence in specialized sectors.

Others

The 'Others' category encompasses various less common technologies, including Binder Jetting and Direct Energy Deposition, each offering unique advantages. While these methods may not dominate the market compared to Material Extrusion Technology, they serve specific use cases where traditional technologies may fall short. For instance, Binder Jetting is appealing for producing large-scale parts at a faster rate, while Direct Energy Deposition is useful for repair applications in aerospace. As industries seek tailored solutions, these alternative technologies may experience incremental growth, contributing to a diverse ecosystem in the 3D printed composites market.

Global 3D Printed Composites Market Regional Insights:

North America

North America is poised to dominate the Global 3D Printed Composites market, mainly driven by advanced technological infrastructure, significant investment in research and development, and a strong presence of key market players. The aerospace and automotive industries in the region are increasingly adopting 3D printed composites to leverage lighter and more durable materials, enhancing performance and reducing production costs. Moreover, the growing emphasis on sustainability and lightweight materials is expected to propel market growth. The presence of prominent companies and numerous collaborations for innovative solutions further cements North America's dominant position.

Latin America

Latin America is gradually entering the 3D Printed Composites market, driven by increased interest from manufacturing sectors, notably automotive and consumer goods. However, it still lags behind in terms of technological adoption and investment compared to North America and Europe. Government initiatives and local startups are beginning to explore applications in construction and healthcare, promoting awareness and driving modest growth. As infrastructure develops, there is potential for more significant advancements in the adoption of 3D printed composites in the future.

Asia Pacific

Asia Pacific presents a rapidly growing market for 3D Printed Composites, primarily led by countries like China, Japan, and South Korea. Significant investments in technology and manufacturing capabilities are noted, especially within the automotive and aerospace sectors. The region's focus on innovation and cost-effective production processes makes it an attractive hub for 3D printing technology. Moreover, collaborations between local universities and industries are fostering research and development, contributing to a robust growth trajectory, although it may take time to reach North America's level of dominance.

Europe

Europe is an important region in the Global 3D Printed Composites market, featuring a strong emphasis on sustainable practices and innovative material development. Various industries, particularly aerospace and healthcare, are leveraging 3D printed composites to achieve enhanced material properties while maintaining compliance with stringent regulations. The presence of established companies and research institutions contributes to advancements in technology. However, the level of market maturity combined with competitive dynamics means Europe is likely to maintain a significant share rather than overthrow North America's leading status.

Middle East & Africa

The Middle East & Africa region show potential for future growth in the 3D Printed Composites market, driven by diversification efforts, particularly in the United Arab Emirates and South Africa. Government investments in technology and infrastructure, along with initiatives promoting advanced manufacturing, create a conducive environment for adoption. However, the market is still in nascent stages, and significant barriers such as limited access to advanced technologies and skilled labor need to be addressed for substantial growth to occur. The region may become a more prominent player in the long term as these barriers are overcome.

3D Printed Composites Competitive Landscape:

Prominent participants in the worldwide market for 3D printed composites prioritize the development of cutting-edge materials and technologies aimed at improving manufacturing methods. Simultaneously, they are cultivating collaborations to broaden their market presence and utility across multiple sectors. Their targeted investments in research and development facilitate the advancement of lightweight, high-performance composites designed for a wide range of applications.

The primary companies operating in the market for 3D printed composites comprise Stratasys Ltd., 3D Systems Corporation, Materialise NV, Dassault Systèmes SE, EOS GmbH, HP Inc., NTT Data Corporation, Renishaw plc, Carbon, Inc., BASF SE, Ultimaker B.V., Sabic, Mitsubishi Chemical Corporation, Arkema S.A., and Markforged, Inc.

Global 3D Printed Composites COVID-19 Impact and Market Status:

The Covid-19 pandemic greatly impacted the Global 3D Printed Composites sector by leading to supply chain disruptions and a short-term reduction in production processes. At the same time, it spurred an increased need for cutting-edge manufacturing solutions and materials across multiple industries.

The COVID-19 pandemic had a profound effect on the market for 3D printed composites, revealing both obstacles and avenues for growth. Initially, manufacturing capabilities were compromised due to supply chain disruptions brought about by factory shutdowns and various restrictions, resulting in project delays and a short-term decline in demand across multiple sectors. Conversely, the crisis expedited the adoption of additive manufacturing as companies sought agile production solutions to accommodate evolving market dynamics. The ened focus on sustainability also drove a greater interest in bio-based and environmentally friendly composite materials for 3D printing applications. As manufacturers shifted towards local sourcing and on-demand production models, signs of market recovery began to emerge, supported by rising investments in cutting-edge technologies and materials that are expected to propel growth in the post-pandemic landscape. In summary, while the pandemic presented considerable challenges, it also catalyzed a significant transformation towards more robust and adaptable manufacturing practices within the 3D printed composites sector.

Latest Trends and Innovation in The Global 3D Printed Composites Market:

- In December 2021, Stratasys announced the acquisition of MakerBot, a leader in desktop 3D printing, in an effort to strengthen its position in the educational and consumer market for 3D printing technologies.

- In September 2022, 3D Systems launched a new composite materials portfolio, which includes Carbon Fiber Filament, aimed at improving the performance characteristics of components produced via additive manufacturing, enhancing durability and lightweight properties.

- In April 2023, Markforged introduced the FX20, a high-performance 3D printer designed for composite parts, which features an integrated carbon fiber and polymer filament system, enabling the production of industrial-grade components with superior strength-to-weight ratios.

- In July 2023, BASF and 3D Systems announced a partnership to develop new advanced materials, including composite filaments that incorporate sustainable materials, aiming to meet the growing demand for eco-friendly 3D printing solutions.

- In August 2023, Desktop Metal acquired Adaptive3D, a leader in the development of polymer materials for additive manufacturing, focusing on expanding its range of 3D printed composite solutions for various industrial applications.

- In October 2023, SLM Solutions showcased a new metal-composite hybrid technology at the Formnext trade show, which combines metal and composite materials for 3D printing, enhancing the capabilities to produce lightweight yet strong parts for aerospace and automotive industries.

3D Printed Composites Market Growth Factors:

The expansion of the market for 3D printed composites is fueled by innovations in manufacturing processes, a rising need for lightweight materials in various sectors, and the ability of additive manufacturing to produce customized solutions.

The market for 3D printed composites is witnessing remarkable expansion, fueled by several pivotal elements. Foremost among these is the rising demand for lightweight yet robust materials in various sectors, including aerospace, automotive, and healthcare, which is accelerating the uptake of 3D printing technologies. This innovation facilitates the fabrication of intricate geometries that optimize performance while minimizing weight. Moreover, continuous enhancements in 3D printing methods, such as the introduction of novel composite materials and advanced printing processes, are broadening application fields and enhancing their utility in manufacturing.

Another significant driver of growth is the increasing preference for customization, as additive manufacturing fosters ened design adaptability to meet specific customer requirements. Additionally, the growing emphasis on sustainability and the reduction of material waste in production processes is leading companies to embrace 3D printing technologies that maximize the effectiveness of composite materials. Support from governmental bodies and research organizations is also essential, promoting research and development initiatives and collaborative projects in this domain. Finally, the escalating adoption of digital manufacturing and Industry 4.0 strategies among businesses is promoting the application of intelligent manufacturing techniques, further stimulating market development. Together, these dynamics are creating a promising future for the 3D printed composites sector in the years ahead.

3D Printed Composites Market Restaining Factors:

The expansion of the market for 3D printed composites faces obstacles due to elevated production expenses and a restricted range of available materials.

The 3D printed composites market encounters various challenges that could impede its expansion and widespread use. One of the primary issues is the elevated costs of advanced composite materials, which can restrict access for smaller manufacturers and create financial barriers to adopting 3D printing technologies. Furthermore, the intricate nature of the printing process often demands specialized expertise, leading to a significant learning curve for newcomers.

Concerns over the mechanical strength and longevity of 3D printed composites, especially when compared to their traditional counterparts, can also dissuade potential clients, particularly in critical sectors such as aerospace and automotive, where performance is paramount. Additionally, regulatory hurdles represent substantial obstacles, as acquiring the necessary certifications for novel materials and processes can prove to be both time-intensive and financially burdensome.

Lastly, the competition posed by traditional manufacturing methods may inhibit the innovation and market integration of 3D printing solutions. Nevertheless, the sector holds promise for growth, propelled by ongoing technological advancements, ened investments in research and development, and an increasing recognition of the advantages offered by 3D printed composites. As the industry progresses, it is expected that these challenges will be mitigated, fostering a more sustainable and efficient future for 3D printed composites.

Key Segments of the 3D Printed Composites Market

By Composite Type

• Carbon Fiber Composites

• Glass Fiber Composites

• Graphene

• Aramid Fiber Composites

By End-User

• Aerospace & Defense

• Healthcare

• Automotive

• Others

By Technology Type

• Fusion Bed Infusion

• Stereolithography (SLA)

• Material Extrusion Technology

• Selective Laser Sintering (SLS)

• Others

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America